Senior Reporter

April Class 8 Sales Decline 18.9%

This story appears in the May 16 print edition of Transport Topics.

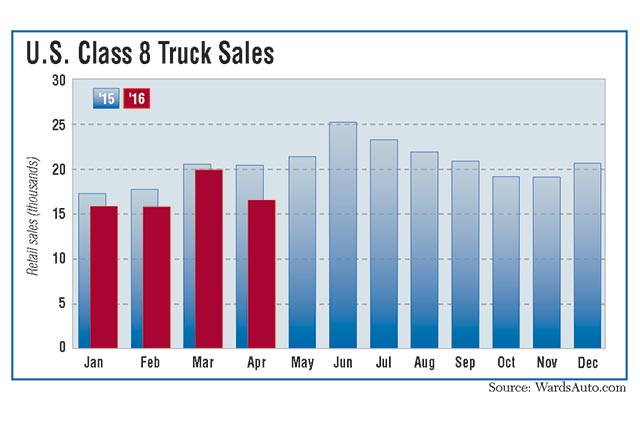

U.S. retail sales of new Class 8 trucks fell 18.9% in April from a year earlier, WardsAuto.com reported. Analysts said the figures reflect a shift in traditional seasonal buying patterns rather than plummeting demand.

April sales totaled 16,633, the lowest for the month since 2013, when sales were 15,646. Through the first four months of 2016, sales are 68,492, down 10.3% compared with a year earlier, Ward’s said.

The market “has not appeared to bottom out yet, which is bad news,” Don Ake, vice president of commercial vehicles at research firm FTR, told Transport Topics. “This is how this industry works. It overheats, then it has to cool. This reduction has gone in steps; it’s not like it has fallen [completely] off.”

Steve Tam, vice president of ACT Research’s commercial sector, told TT he had to “play the seasonal card” to explain April’s sales.

“We basically had a mini-pull forward … in March. So the exuberant strength in March pulled away from April. It’s just kind of a timing issue, really, more than anything. We just moved the demand around a little bit.”

Tam noted some large lease and rental fleets are putting up “reasonable numbers” of trucks into their fleets ahead of the summer season, but large for-hire fleets generally are not active buyers this time of year.

ACT’s forecast for the U.S. retail Class 8 sales market is 207,000 units, down about 18% from last year’s 248,359, which was the fourth-best year on record.

Tam noted replacement sales typically account for about 190,000 units, so ACT’s forecast has “a little bit of fleet growth baked in there.”

Only Western Star, the niche brand of Daimler Trucks North America, posted higher numbers year-over-year in April. Sales jumped 28.5%, or by 107 trucks, to 483 for a 2.9% market share.

Freightliner Trucks, also a DTNA brand, remained the overall leader with sales of 6,358 trucks, a decline of 4.9% from a year earlier but good for a 38.2% market share.

The remaining truck makers saw declines of at least 20% compared with a year earlier.

International Trucks, a unit of Navistar International Corp., saw sales fall 26.7% to 1,893 units but secured an 11.4% market share.

Volvo Trucks North America saw sales tumble 32.6% to 1,828 and a market share of 11%. Sales at Mack Trucks plunged 31.7% to 1,194 and a market share of 7.2%. VTNA and Mack are units of Volvo Group.

“April’s decline in Class 8 industry retail sales are indicative of too many trucks continuing to chase too little freight, as inventories remain high throughout the economy, and many heavy-duty truck customers look to right-size their fleets,” said John Walsh, Mack’s vice president of global marketing.

Even “relatively good levels of activity in construction” could not offset Mack’s year-over-year declines, given the weak freight environment, he said.

However, Mack was “certainly encouraged by the fact that we’re one of few OEMs to grow market share this year,” he said

Its year-to-date share stands at 8.1% compared with 7.5% in 2015. Freightliner and Western Star’s market shares grew as well, by 4.4 percentage points and 0.6 percentage point, respectively.

At Kenworth Truck Co., sales fell 25.7% to 2,538 units, earning it a 15.3% market share. Peterbilt Motors Co. saw sales decline 21.8% to 2,332 trucks, good for a 14% market share. Kenworth and Peterbilt are units of Paccar Inc.

Neil Frohnapple, an analyst at Longbow Research, surveyed Paccar’s dealers April 20 and included the findings in an investor note this month.

“Contacts reduced their 2016 Class 8 sales outlook to a 20% decline compared with their prior forecast range of 15% to 20% due to weaker than expected new-truck orders received thus far in the year,” Frohnapple wrote.

There was some good news: Fewer dealers told him they had excessive new-truck inventory compared with Frohnapple’s previous survey. The dealers said Paccar incentives boosted sales.

Also in April, persistent freight, resale and capacity issues in play during recent months drove down North American Class 8 orders to below 14,000, analysts said.

In separate reports, ACT said preliminary data showed there were 13,700 orders, down 39% year-over-year despite increasingly easy comparisons and down 16% month-over-month, ACT said. FTR pegged orders at 13,500.

April orders posted the lowest total since July 2012, when orders were 13,655.