Senior Reporter

Class 8 Sales Decline 12.6%

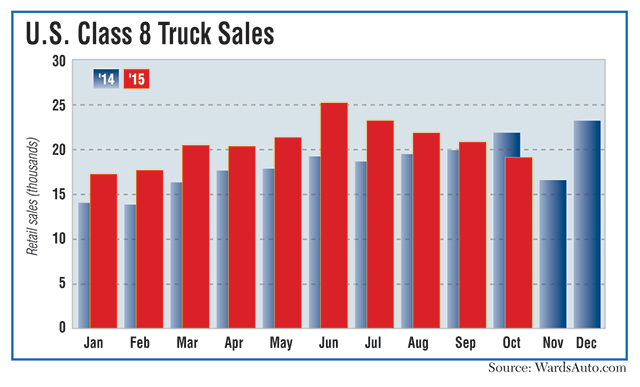

U.S. retail sales of Class 8 trucks declined on a year-over-year basis in October for the first time in 26 months as a softer economy sent mixed signals to the industry.

Last month’s sales total fell to 19,252 trucks, down 12.6% from 22,032 in October 2014, WardsAuto.com reported.

All major brands posted lower sales except Daimler Trucks North America’s niche nameplate Western Star.

Also, last month’s sales total was third-lowest of the year and down 8.2% from September’s 20,972.

“The sky is not falling,” David Leiker, an analyst with Robert W. Baird & Co., wrote in an investor’s note regarding Class 8 production. He pointed to the Institute for Supply Management’s most recent New Orders Index in October that registered 52.9%, an increase of 2.8 percentage points from the reading of 50.1% in September. He also cited strong auto sales and increasing housing starts as signs of underlying strength.

Year-to-date sales remained ahead of last year’s pace with 208,793 heavy trucks sold, up 15.8% from 180,317 in the 2014 period.

Markus Pfeifer, DTNA’s director of marketing operations, saw signs of reassurance in October’s numbers.

He said October has proved to be a “stable” month for DTNA, also the parent company of market-leading Freightliner Trucks.

Freightliner sales slipped 1.5% year-over-year to 8,033 trucks. Year-to-date sales, however, they have jumped 22.8% to 79,306, giving the brand 38% of the Class 8 market.

John Walsh, Mack Trucks’ vice president of marketing, told Transport Topics, “October’s Class 8 industry sales were impacted as the U.S. economy faced weaker manufacturing levels and lower freight volumes as the result of high inventory levels.”

Walsh said there were other factors at work, too, “including sluggish economic growth elsewhere in the world and continued weakness in oil and gas investments.”

Year-over-year sales at Mack, a unit of the Volvo Group, dropped by 19%, or 287 trucks, to 1,220. Year-to-date sales rose 5.8% to 16,005, for 7.7% market share.

Kenny Vieth, president of ACT Research, said his firm’s latest for-hire trucking index was aligned with other reports showing softer freight conditions. The index had “the lowest reading since December 2012 and the first negative October reading since the inception of our survey in 2009,” Vieth said in a statement.

Forty-five percent of the fleets in the survey reported a decrease in freight in October, a time when freight should be increasing ahead of the holiday season, according to the report.

Jonathan Starks, an analyst with the research firm FTR, said in a release, “If slow growth in the economy continues, the next significant change in market conditions isn’t expected until fleets start implementing the coming regulations [mandating electronic logging devices]. That is likely to occur in -the second half of 2016.”

Magnus Koeck, vice president of marketing for Volvo Trucks North America, said, “The U.S. economy is navigating through a soft interval.”

Year-over-year, Volvo’s sales declined 2.6%, or 61 trucks, to 2,317 units. Year-to-date sales have increased 16.7% to 25,344 units, representing 12.1% market share.

Jeff Sass, senior vice president of sales and marketing at Navistar International Corp., cited signs of a turnaround at the truck maker.

“[Our] dealer-led sales in Class 8 are up nearly 20% year over year, and we’re pleased that customers continue to grow the share of International trucks in their fleets, setting the foundation for a strong 2016 build season,” Sass said.

International’s October sales fell 38.7% to 2,155 trucks while year-to-date sales slipped 6.7% to 25,254, giving it 12.1% market share.

Baird’s Leiker said he expected 2016 Class 8 production to be about 300,000 units, down 5% to 10% from his earlier estimate, “but still well above analyst and investor consensus near 280,000,” he said. “Even with no change in current order rates, we believe expectations for next year are too low.”

Michael Baudendistel, an analyst with Stifel Nicolaus & Co., said he believed International’s “product is higher quality than many buyers in the market believe. . . . But it will take longer for International to repair its reputation with the smaller purchasers, which make up the majority of the market.”

Paccar Inc.’s two brands, Kenworth Truck Co. and Peterbilt Motors Co., did not comment.

Kenworth saw October sales decline 4.3% to 2,918. Year-to-date sales have climbed 26.6% to 31,476 trucks for 15.1% market share.

Peterbilt’s sales dropped 38.7% last month to 2,155 units. Year-to-date sales are up 13.6% at 27,445 units, or 13.1% of market share.

Western Star sold 392 trucks in October, up 12.3% from a year earlier. Year-to-date it has sold 3,896, a 43.8% gain, giving it 1.9% market share.