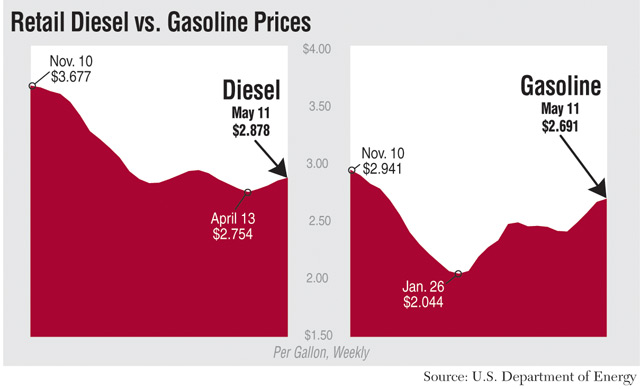

Diesel Average Rises 2.4¢ to $2.878; Price Has Climbed 12.4¢ in Past Month

This story appears in the May 18 print edition of Transport Topics.

Diesel’s national average price rose for the fourth straight week, climbing 2.4 cents to $2.878 a gallon, the Department of Energy reported May 11.

The price of trucking’s main fuel has risen 12.4 cents in the past month but is $1.07 less than its level in the comparable week a year ago, according to DOE figures.

Gasoline also rose for a fourth week, gaining 2.7 cents to $2.691, DOE said after its weekly survey of filling stations.

The motor fuel, which has jumped 28.3 cents in the past month, is selling for just under $1 less than during the corresponding week last year.

Oil held above $60 a barrel on the New York Mercantile Exchange last week, matching its level from the start of the month when it reached its highest point since early December.

DOE last week bumped its forecast for 2015 diesel prices by 2 cents to $2.88 a gallon and said it will rise to $3.12 next year, 12 cents below its previous forecast.

Trucking’s main fuel will average in the $2.80s and $2.90s through early 2016 before crossing the $3 mark in March, DOE’s Energy Information Administration said in its monthly short-term energy outlook, released May 12.

EIA analyst Sean Hill said the recent higher prices for both diesel and gasoline largely have resulted from gains in both U.S.-traded West Texas Intermediate and globally traded Brent crude oil.

“There’s still a lot of diesel out there, and we’re coming off the winter, so prices are pretty stable,” he told Transport Topics. “Higher diesel prices have been a factor of the overall higher crude prices.”

Distillate inventories, which include diesel, have been strong and are in the middle of the five-year U.S. average, with levels particularly high in the Midwest, he said.

“We’re catching up to the [crude price] increases of the last month, but we don’t see it increasing much further,” Hill told TT. “Refiners are using as much crude as they can to churn out diesel and gasoline, and both of those inventory levels are extremely high, as well.”

EIA Administrator Adam Siemin-ski said that “fewer rigs drilling for crude will take a bite out of U.S.

oil production growth this year and in 2016.”

In a statement issued after the outlook’s release, Sieminski added, “U.S. oil production this year is still on track to be the highest in more than four decades.”

EIA raised its 2015 oil-price outlook by almost $2 to $54.26 a barrel but lowered its 2016 forecast to $65.50 from last month’s $70 per-barrel projection.

Gasoline will average $2.68 this month and gradually will fall about 20 cents by September and by 40 cents by the end of the year, to about $2.30, the outlook said.

Last year, diesel averaged $3.83 and gasoline averaged $3.36 per gallon.

Prices of both fuels remained the highest in the country on the West Coast and in California last week, with diesel pushing past the $3 mark on the West Coast, excluding California, according to DOE figures.

At $3.25, California’s diesel price was 37 cents higher than the national average, while the state’s $3.73 gasoline price was more than $1 higher than the motor fuel’s national average.

An official with one Washington state carrier said last week that diesel averaged $3.04 near the Port of Tacoma in the first two weeks of May.

And an executive with a Midwest-based national flatbed carrier that uses owner-operators in its 200-truck fleet said its fuel-purchase card offers discounts to drivers buying fuel on the road.

Some of the discounts are for as much as 18 cents a gallon, said Karen Micklic, senior vice president with Packard Transport in Channahon, Illinois.

“Our operators are sometimes seeing savings of $55 to $100 on a fuel purchase,” she said. “Some months, they save up to $25,000, collectively — that’s a significant savings.”

On May 12, Packard announced it renewed its membership in the U.S. Environmental Protection Agency’s SmartWay Transport Partnership, which it joined in 2008.

The flatbed carrier said its “fleet of independent contractors is committed to efficient and effective freight strategies.”

“Every dollar saved is more profit to them,” Micklic said. “Using the discounts, being cost-efficient with their operations and keeping their equipment well maintained, they’re going to maximize their fuel mileage per gallon.”