Staff Reporter

Diesel Price Increase Eases

[Stay on top of transportation news: Get TTNews in your inbox.]

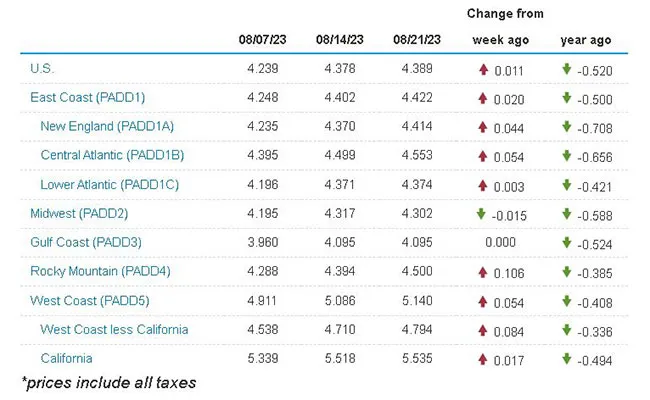

The national average diesel price posted a modest gain after four consecutive double-digit jumps, rising 1.1 cents a gallon to $4.389 a gallon, according to Energy Information Administration data released Aug. 21.

Diesel’s average price rose in eight of the 10 regions in EIA’s weekly survey, dipped 1.5 cents a gallon in the Midwest and was unchanged along the Gulf Coast. The biggest increase was 10.6 cents in the Rocky Mountain region; the smallest gain was three-tenths of a cent in the Lower Atlantic.

The average on-highway price for a gallon of diesel soared 57.2 cents over the previous four weeks.

Diesel’s average price is 52 cents less than at this time in 2022, in contrast to the end of the first half of 2023, when it was more than $1.90 below the cost of trucking’s main fuel 12 months earlier.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Gasoline, meanwhile, has lagged diesel’s strength of late. The wholesale diesel price rose more than 22% between the start of the second half of 2023 and Aug. 18, while its gasoline counterpart rose just over 7%, Tom Kloza, global head of energy analysis at price reporting agency OPIS, noted in a tweet.

Energy Reflation Scorecard:

June 30 Today %Move

WTI $70.64/bbl $81.25/bbl +15%

ULSD $2.448/gal $2.991/gal +22.2%

RBOB $2.634/gal $2.929/gal + 7.2%

Jet Fuel $2.265/gal $3.105/gal +37% — Tom Kloza (@TomKloza) August 18, 2023

The on-highway gasoline price rose 1.8 cents a gallon to a national average of $3.868 a gallon, almost on a par (down by 1.2 cents) from what it was a year ago, EIA data show.

This week’s slowdown in retail diesel’s upswing is a pattern likely to continue in the near future, with wholesale prices retreating before steadying in recent days, according to analysts.

“During the next couple of weeks, we’ll do the cha-cha-cha,” Kloza told Transport Topics in an Aug. 22 interview, with prices moving only slightly higher and slightly lower.

After that and through the winter, however, analysts foresee wholesale and retail diesel prices climbing because of a confluence of bullish factors, with at least one predicting a vertiginous spike.

Thompson

A key factor is that two of the remaining refineries on the Atlantic coast of North America are set to shut in the coming weeks for maintenance, David Thompson, an executive vice president at Washington-based brokerage Powerhouse, said in a phone interview.

Irving Oil’s 320,000-barrels-per-day Saint John refinery in New Brunswick is set to be offline for several weeks. The refinery ships much of its diesel output to New York Harbor, the delivery point for the benchmark futures contract.

Also, sources said Delta Airlines unit Monroe Energy is set to carry out once every five years maintenance on the 185,000-barrels-per-day Trainer refinery near Philadelphia in the coming weeks.

The maintenance on the pair of refineries is set to coincide for at least four and possibly six weeks, timing that historically would not have had a great impact in what is the low-demand shoulder season on the East Coast.

But refineries operated by Philadelphia Energy Solutions and Sunoco in the Mid-Atlantic are now shuttered. Also, a facility in Dartmouth, Nova Scotia, was shut by ExxonMobil, while the Come-by-Chance refinery in Newfoundland switched to production of renewable fuels in 2020.

Also, what had until now been a quiet Atlantic hurricane season is heating up.

Tropical Storm Harold came ashore in Texas Aug. 22 before being downgraded to a depression, two days after three tropical cyclones formed in the Atlantic basin within a 24-hour period. Since records began in 1851, such a spurt of cyclone formation had only been seen twice previously, according to meteorologist Michael Lowry.

Flynn

“We have had a relatively quiet hurricane season so far, but now we’re getting into the high point of the season, and the tropical storm map from the National Hurricane Center is again looking like somebody spilled some coffee on it,” warned Price Futures Group oil trader Phil Flynn.

The Gulf of Mexico has replaced the Gulf of Hormuz as the world’s choke point for crude oil, Kloza told TT. Also, the Gulf Coast region is home to 47% of U.S. refining capacity, so shutdowns because of storms eat into diesel supplies quickly. “It’s not good news for a lot of your readers; they’d be well advised to take note,” said Kloza.

At the same time, Saudi Arabian oil production cuts are trimming the amount of diesel American refineries typically produce, analysts say. U.S. refineries’ consumption of Canadian shale oil is growing as light, sweet crude supplies are harder to come by, and such a diet produces less diesel.

A hurricane plus refinery outages plus the upcoming harvest season is likely to lead to a “very uncomfortable situation, with a short squeeze taking place,” said Kloza. The potential for another spike not unlike that of 2022 due to the Russian invasion of Ukraine is growing, he said.

It may be even worse. “From October 2023 to March 2024, we could see the highest diesel margins on record. A major hurricane that shuts down U.S. Gulf Coast refineries could turn a terrible situation into a catastrophe. Retail diesel fuel consumers in certain areas could pay more than $10 per gallon,” said Philip Verleger, principal at economic consultancy PKVerleger.

Want more news? Listen to today's daily briefing below or go here for more info: