Senior Reporter

May Truck Sales Fall 19.5%

This story appears in the June 20 print edition of Transport Topics.

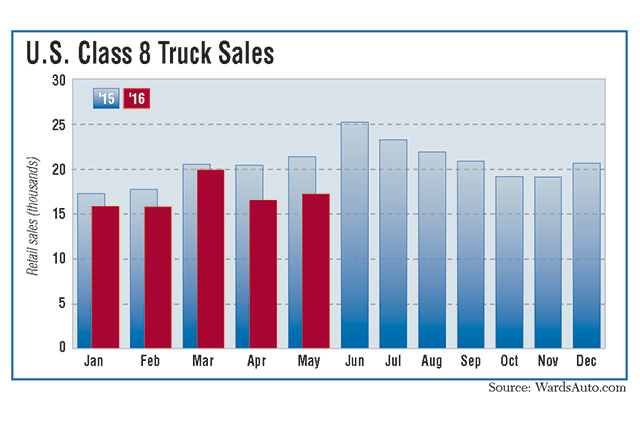

U.S. retail sales of Class 8 trucks in May dropped 19.5% as the downturn rolled on for a sixth consecutive month and still has not hit bottom, analysts said.

Sales fell to 17,312 units compared with 21,501 a year earlier, WardsAuto.com reported. May was the latest month in a year-over-year slide that began in December 2015 — after increases in 26 of the previous 27 months.

“Maybe the story is about what we already know,” Steve Tam, vice president, commercial vehicle sector at ACT Research Co., told Transport Topics, referring to the glut of inventory and other factors that are stifling sales growth.

Year-to-date, Class 8 sales fell 12.3% to 85,804 compared with 97,819 in the 2015 period.

The 248,804 sales in 2015 marked the third-highest total since 2000, according to Ward’s.

Tam said ACT recently lowered its North American Class 8 production forecast for 2016 to 236,000 units, a decrease of 500. It also adjusted its outlook for 2017 to 214,300 from 245,100 and for 2018 to 260,700 from 274,700.

“We are starting to see less momentum than we had previously seen,” he said. “So this ends up being a multiyear downturn as opposed to just a one-year trough. We are all sitting around waiting for freight to start flowing in a positive fashion again, and that is just not happening.”

In May, Freightliner continued as the market leader, although it saw double-digit declines, as did all other truck manufacturers except Western Star.

Freightliner’s sales fell 15% to 7,012 trucks, earning it a 40.5% market share. Western Star sold 463, a gain of 72, for a 2.7% share. Freightliner and Western Star are units of Daimler Trucks North America.

“You have come from a banner peak year in 2015 and come off it faster than people anticipated. My contention was it was never as good as it seemed,” said Don Ake, vice president of commercial vehicles at research firm FTR. “The big question is now 2017. There is concern in the marketplace that things have not stabilized.”

Ake said excess Class 8 inventory is in the range of 15,000 to 20,000 trucks, “and they are not moving out.”

He said the glut has spread to original equipment manufacturers in addition to their dealers.

“What I have heard is that you’ve got elevated inventories at the OEM level, too,” Ake said. “They just overbuilt. The big fleets were telling them to crank up.

“The big fleets were overoptimistic, too. They over ordered. The OEMs overbuilt, and so now inventories remain very bloated.”

Asked if that was across all OEMs, he said, “Gut feel would say yes. Obviously, some companies have more excess than others.”

International Trucks, a unit of Navistar International Corp., saw sales drop 27.4% year-over-year to 1,743 units, good for a 10.1% market share.

Bill Kozek, president of trucks and parts for Navistar, said during a quarterly earnings call in June the company’s orders are up 2 percentage points year-over-year.

“So that’s reason to anticipate share growth in the second half,” Kozek said. “We’re down 1% in retail year-over-year in the heavy segment, and that’s predominantly due to some of our larger over-the-road and leasing customers not buying the amounts or the volumes that we had forecast for 2016.”

Volvo Trucks North America saw sales drop the most, plunging 36.6% to 1,775 units, good for a 10.3% share of the market.

“While we still anticipate a solid overall Class 8 market in 2016,” lower freight volumes, weaker manufacturing and high inventories across the economy “reduced demand in longhaul, a core segment for Volvo Trucks,” said Magnus Koeck, vice president for marketing.

Sales at Mack Trucks dropped 15% to 1,376, good for a 7.9% market share.

“Excess inventories throughout the economy [are] resulting in a drag on Class 8 retail sales,” said John Walsh, Mack vice president of global marketing. “The construction sector remains a relative bright spot, which is good news for Mack,” citing the Granite model.

VTNA and Mack are units of Volvo Group.

At Kenworth Truck Co. sales fell 17.6% to 2,587, good for a 14.9% market share. Sales at Peterbilt Motors Co. were 2,347, down 18.9%, earning it a 13.6% share.

Kenworth and Peterbilt are units of Paccar Inc.

Michael Baudendistel, an analyst with Stifel, Nicolaus & Co., wrote in a note to investors this month, “We believe a pre-buy ahead of the 2021 Environmental Protection Agency [greenhouse-gas] regulations could lead to strong demand for trucks in 2019-2020.”

Other truck manufacturers were unavailable for comment.