Nafta Freight Falls 3.4% in 2016; Trucks Remain Dominant Mode

This story appears in the March 13 print edition of Transport Topics.

The volume of North American Free Trade Agreement commerce dipped by 3.4% last year compared with 2015, and with that decline, trucks hauled less freight across the U.S. borders with Canada and Mexico — although the value of the trade still topped $1 trillion, and trucks transported a strong majority of the goods.

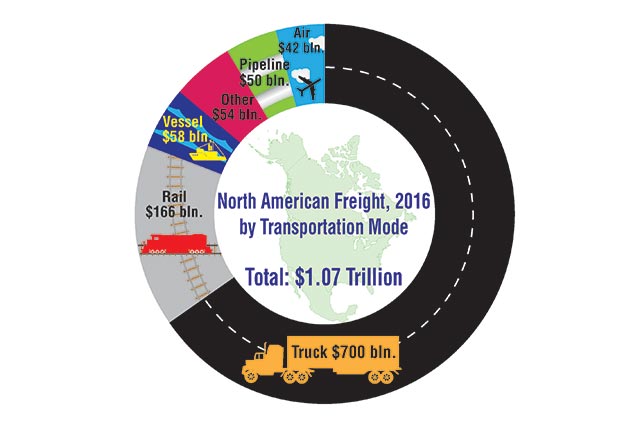

The total value of cross-border freight carried on all modes — trucks, pipelines, vessels and aircraft — declined to $1.07 trillion from $1.11 trillion in 2015, according to data from the U.S. Bureau of Transportation Statistics.

Trucks carried 65.5% of the freight: $362 billion worth of imports, or 63.3% of the total imported, and $338 billion worth of exports, or 68%.

The decline in cross-border truck freight is consistent with what happened for domestic shipping, American Trucking Associations Chief Economist Bob Costello said.

“What we saw in 2016 was like a freight recession. Freight very much underperformed the macroeconomy,” he said.

Costello said Nafta-related shipping plays a highly significant role in U.S. trucking.

“There is no doubt this trade creates at least thousands, and even tens of thousands of U.S. trucking jobs,” he said.

The report March 2 from BTS, an office within the Department of Transportation, also examined the types of goods moved and the breakdowns between Canada and Mexico.

The United States ran trade deficits with both nations in 2016. The Canadian deficit narrowed while the balance with Mexico widened.

The total value of U.S.-Canada freight fell by 5.4% to $544 billion in 2016 compared with the previous year. Trucks carried 60.1% of the freight moving to and from Canada. Railroads picked up the No. 2 spot with 16.2%.

Light vehicles, mainly cars and parts for them, dominated U.S.- Canadian trade, in general, and for the portion moved by trucks, specifically.

Total U.S.-Canadian vehicle-and-parts trade was worth $106.1 billion last year, and trucks moved 56.4% of it.

“Cross-border freight can be anything from chemicals to frozen french fries,” said Martin Rojas, a senior adviser on the Americas to the International Road Transport Union.

“It’s usually freight you’d like because the margins are good and the revenue is growing. These are high-value goods,” Rojas said.

Truckload dry vans make up a majority of the equipment used in cross-border trade, Costello and Rojas said, but they also mentioned refrigerated vans, less-than- truckload and even some tank trucks as participants.

The value of U.S.-Mexican freight, exports and imports, dipped 1.1% to $525.1 billion. Trucks carried 71% of the value of the freight to and from Mexico, followed by rail at 14.7%.

The top commodity transported between the United States and Mexico in 2016 was electrical machinery at $102.6 billion, and trucks hauled 91.6% of the value. The next-highest commodity category was vehicles and parts with $43.7 billion in freight moved by rail.

Costello said North American cross-border trade is part of sophisticated supply chains developed over many years. Manufacturers consider both border regions as uninterrupted production areas. Unfinished intermediate goods make a lot of the border crossings.

A part or component made in Mexico or Canada often crosses into the United States and then gets assembled into a larger system before crossing the border several more times and being sold as a finished product.

“Nafta supply chains are so interwoven,” Costello said. “There’s a lot of back-and-forth with products to both Mexico and Canada.”

Rojas said Canadian trucks often will travel far into the United States, but that is unusual in Nafta transport. More common, he said, is for carriers to have subsidiaries in other nations or develop partnerships with other carriers.

U.S. carriers, he said, often are disinclined to cross a border because the wait times involved conflict with hours-of-service demands.