Managing Editor, Features and Multimedia

New Truck Registrations Rise; US Heavy-Duty Fleet Expands

This story appears in the Aug. 31 print edition of Transport Topics.

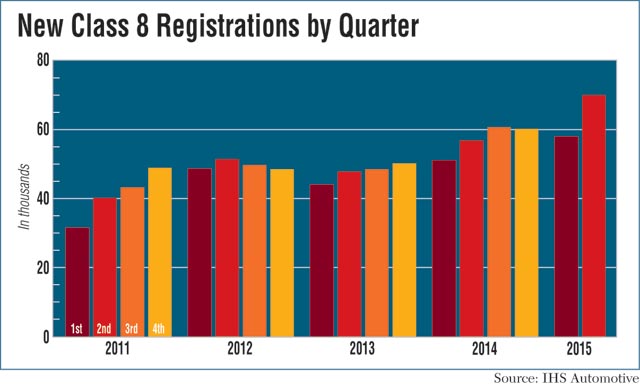

This story appears in the Aug. 31 print edition of Transport Topics. A hot second quarter pushed U.S. registrations of new, heavy-duty trucks during the first half of this year 20% above last year’s pace, providing another sign that fleets remain confident about freight demand to come, IHS Automotive reported.

The 129,720 Class 8 trucks registered from January through June were well ahead of the 107,910 recorded in the same period in 2014, putting the new-truck market on track for its best year since the 2006 “pre-buy,” when sales soared to records ahead of the 2007 change in federal emissions standards. Large fleets led much of the activity.

The first-half growth helped expand the total roster of Class 8 trucks registered in the nation to 3.89 million, the highest level on record and up 4.7% from a year earlier, IHS said in its latest Polk division report on commercial vehicles.

“We’ve still got a pretty good economy,” said Gary Meteer Sr., director of global commercial vehicle products at IHS. “Demand for goods is high, so somebody’s got to carry those goods and move them from point A to point B.”

In the second quarter alone, new registrations climbed to 69,928 trucks, up from 56,838 a year earlier and 59,792 in the first quarter. The second-quarter growth was supported by the highest total on record for the month of June, Meteer said.

Large fleets have been driving the new-equipment market for the past few years, and that trend continued in the first half of 2015, he said.

Fleets operating more than 500 trucks accounted for 49.3% of all new registrations in the first six months, up from a 47.8% share in the same timeframe last year, the IHS data showed.

Total commercial vehicle registrations also expanded in the first half but at a slower rate than the heavy-duty segment.

Registrations of all new commercial vehicles in Classes 3-8, rose to 350,837 units through June, up 12% from a year earlier, IHS said.

The U.S. Class 8 fleet now has grown for 12 straight quarters.

One trucking company that has rapidly expanded its fleet is W.W. Transport Inc., a food-service bulk carrier based in West Burlington, Iowa.

Over the past six years, the company has grown to about 400 trucks from 250, said Stan Addis, director of safety.

“We’ve been adding a lot of trucks,” he said.

That expansion has been a natural response to new business growth rather than an active push on the carrier’s part to grow its fleet, Addis said.

W.W. Transport, which hauls commodities such as bulk flour, also remains optimistic about freight demand.

“People are going to eat, no matter what,” Addis said.

The IHS registration figures provide an approximation of total trucks in operation but also count some vehicles that are registered and not currently in use, including some that are awaiting sale into the used market.

Although some carriers are adding to fleet size, Meteer said he still sees replacement demand as the main driver of the Class 8 market because buyers continue to push their used trucks into the aftermarket for resale rather than retaining them.

“The used-truck business is still really healthy, and that means that these companies aren’t hanging on to them,” he said. “They’re putting them back in the market because that’s the trade cycle they’re following.”

Registration changes for used Class 8 trucks did decline 6% in the first half of 2015 to 140,906 units, from 149,978 a year earlier, but Meteer said the used market could be poised for a big third quarter as the equipment traded in during recent months reaches new owners.

In the second quarter, used-vehicle transactions fell to 68,793 trucks from 80,359 a year earlier and from 72,113 in the first quarter.

While registrations and retail sales of Class 8 sales have grown this year, order activity has slowed.

ACT Research reported that North American Class 8 orders declined on a year-over-year basis for a fifth straight month in July, but the firm attributed that decline primarily to the lack of remaining build slots available this year.

In an Aug. 18 note to investors, J.P. Morgan analyst Ann Duignan said those relatively full backlogs and some weaker economic indicators “have weighed on [new Class 8] orders in recent months.”

However, she said manufacturers’ extended backlogs suggest that truck production levels will remain elevated through the rest of 2015.

Duignan added that lower fuel prices have been a boon to the freight business as a whole but have hurt volumes in the oil and gas sector at the same time.

“Offsetting these catalysts, we are watching freight rates carefully for any sign of a decline in fleet profitability,” she added.