Retail Truck Sales Jump 25% in March

By Seth Clevenger, Staff Reporter

By Seth Clevenger, Staff Reporter This story appears in the April 20 print edition of Transport Topics.

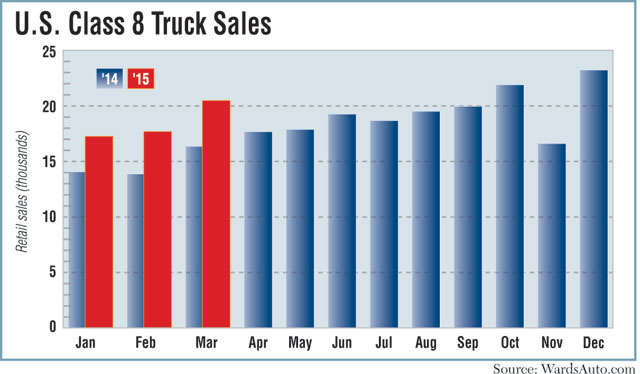

Heavy-duty truck sales continued to grow at a rapid clip in March, jumping 25% from the same month last year, WardsAuto.com reported.

U.S. retail sales of Class 8 trucks totaled 20,625 last month, marking the fourth time in seven months that sales surpassed 20,000 units.

The industry has reached that level only one other time since the 2006 “pre-buy,” when truck operators bought in huge numbers to avoid new emissions controls introduced on the following year’s models.

For the first quarter, buyers purchased 55,809 trucks, a 25% gain from the same period a year earlier.

The March total, which compared with 16,452 a year ago, also rose 16% from the 17,811 trucks sold in February.

Despite continued growth in Class 8 sales, incoming orders for future production declined in March for the first time in 26 months, according to ACT Research. However, an industry analyst said that slowdown likely reflects a dwindling number of open build slots, rather than cooling demand for sales.

The reduced availability of 2015 production slots likely will mean that new orders will “appear weak” in the next several months before truck makers establish 2016 pricing, said Michael Baudendistel of Stifel, Nicolaus & Co.

Fleets’ continued willingness to invest in new equipment boils down to greater confidence in freight demand and the state of the economy, said Kyle Treadway, president of Kenworth Sales Co., a truck dealership with a number of locations in the western United States.

“We’ve been hearing, almost across the board, a confidence that we haven’t heard in many years,” he said. “The resurgence in the economy has been waking folks up, and they’re more confident that it’s getting some traction now.”

The growth has taken hold across the trucking industry, including longhaul, bulk commodities, construction and vocational operations, with the only clear exception being the oil and gas sector, given the low price of crude oil, said Treadway, who is a past chairman of American Truck Dealers.

“Many fleets across the industry are seeing improved freight levels and freight rates,” said Bill Kozek, president of Navistar Inc.’s truck and parts business. “The fuel-efficiency advantages of new Class 8 trucks . . . continue to be a key factor that drives fleets to invest in new technology.”

Magnus Koeck, vice president of marketing and brand management for Volvo Trucks, said the “robust” March sales industrywide “reflect solid U.S. economic indicators and a combination of factors specific to the trucking industry, including continued pent-up demand, strong profitability for fleets and higher maintenance and fuel costs for older trucks.”

All seven major North American heavy-duty truck brands posted sales gains in March, Ward’s figures showed.

Daimler Trucks North America sold 6,776 Freightliner Class 8 trucks in March, a 28% increase from a year earlier. The Freightliner brand led the industry with 32.9% of the total market, up from 32.2% in March 2014.

Sales of DTNA’s Western Star brand more than doubled to 407 trucks from 162 a year ago, boosting its market share to 2%.

Kelley Platt, who recently succeeded Michael Jackson as general manager of Western Star Trucks, noted that the brand’s first-quarter sales have climbed 61% year-over-year.

“I am thrilled at the present momentum in the industry for our complete product line including the new Western Star 5700XE,” she said.

Navistar posted a 14% sales gain to 3,073 units, but monthly market share for its International brand trucks fell to 14.9%, compared with 16.4% a year earlier.

Kozek said Navistar continues to see 2015 as a “strong year,” adding that the company has “the right plans in place to deliver industry-leading uptime for our customers and capitalize on the increased industry volume.”

Volvo’s sales rose 15% last month to 2,874 trucks from a year earlier. The brand’s market share, however, slipped to 13.9% from 15.2%.

“Customer preference for our fuel-efficient truck models, integrated powertrains and comprehensive approach to uptime contributed to strong March sales for Volvo,” Koeck said.

Mack, also part of Volvo Group, sold 1,753 vehicles, a 30% jump from a year earlier. That increase boosted Mack’s market share to 8.5% from 8.2%.

John Walsh, vice president of marketing at Mack Trucks, said the company’s sales growth demonstrates “strong demand” for its integrated products, designed to enhance vehicle reliability and fuel efficiency.

Kenworth Truck Co.’s sales climbed 27% to 2,949 units, accounting for 14.3% of the market, an uptick from 14.2% in March 2014.

Sales at Peterbilt Motors Co. surged 32% to 2,792 trucks, representing 13.5% of the market, up from 12.9%.

Kenworth and Peterbilt, both part of Paccar Inc., did not comment by press time.