Some Shippers Implement Longer Payment Policies

Some shippers are taking longer to pay freight bills, forcing carriers and brokerage firms to accept either discounts on invoices paid within a shorter payment cycle or to absorb additional expenses associated with extending credit to customers.

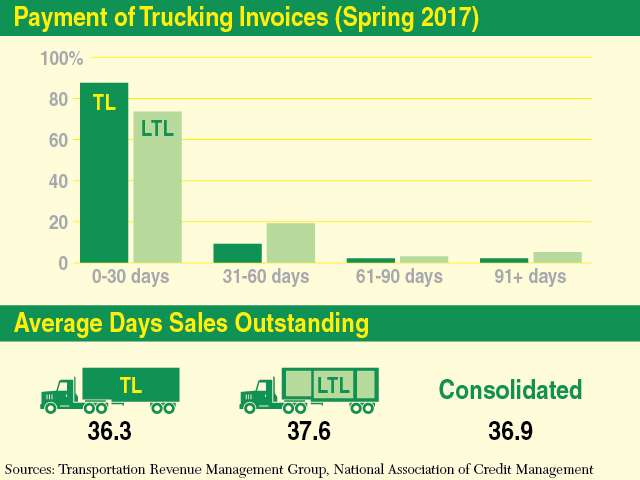

One trucking company owner said he was asked by a Fortune 50 company to wait 120 days, more than three times the average of 36.9 days, based on a survey of freight carriers and third-party logistics companies conducted by the Transportation Revenue Management Group of the National Association of Credit Management.

While the latest survey actually shows a slight reduction in average days for sales outstanding compared with a year ago, Robbin Windham, credit manager for BNSF Logistics in Springdale, Ark., and a spokeswoman for TRMG, said there is growing evidence that shippers are looking to put off payments to freight carriers as a way to conserve cash.

“It’s the tip of the iceberg,” said one executive for a dry van truckload carrier who asked not to be identified. “This will be very detrimental to the trucking industry if we allow this to happen.”

Earlier this year, Procter & Gamble announced a change in payment terms from 75 days to 120 days and joined a small but growing number of shippers that have implemented longer payment policies.

One of the first was Kellogg Co., which implemented a 120-day payment policy in 2014. Other companies with extended payment programs in place include Mondelez International, Anheuser-Busch InBev, Church & Dwight, Kraft-Heinz and Mars Inc.

P&G, in an e-mail sent to representatives of at least 80 freight carriers and logistics firms, said the new policy would be effective for contracts entered into after April 15. The Cincinnati-based company is one of the world’s largest producers of consumer products and ships everything from laundry detergent and diapers to shampoo, deodorants and paper towels. The company generates 44% of its annual revenue of $65.3 billion in the United States and Canada.

A representative of P&G declined to discuss the change in its payment policy, but in its statement to carriers — a copy of which was obtained by Transport Topics — carriers were encouraged to enroll in a supply chain financing program.

Under such programs, shippers hand over invoices to a commercial bank or finance company that in turn negotiates payment terms with carriers. A carrier seeking to collect $1,000, for instance, may be asked to accept $950 in 30 days while the bank collects the full amount later from the shipper.

The process is similar to one that carriers sometimes use, called accounts receivable financing, or factoring, in which a carrier turns over collections to a third party, which “advances” a portion of the full invoice amount to the carrier immediately and then bills the shipper for the full amount.

In both cases, finance companies make money on the difference between what the shipper pays and the amount the carrier receives in advance.

Several trucking executives interviewed by Transport Topics said they are seeing more requests for longer payment terms, especially from larger shippers, and many are pushing back against the trend.

Mike Regan, an industry consultant who helps shippers and carriers collaborate, said shippers run the risk of losing capacity because of a reduction in the number of carriers willing to haul freight or incurring higher freight rates as carriers seek to recover the cost of carrying unpaid invoices.

“Shippers can’t have it both ways,” Regan said. “If you want me to finance you, it will be reflected in your rates — pretty easy to calculate.”

One truckload carrier executive, who also asked not to be identified, said his company has responded to requests for payment extensions by raising rates as much as 10 cents a mile and by walking away from some freight.

“I feel there is a lot of collusion against the smaller guys,” the executive told TT.

Although longer payment terms are common in Europe and other places around the world, such as Brazil, trucking executives said it would have disastrous consequences in the United States.

“We pay drivers weekly. We buy fuel twice a week. And we make monthly payments on our trucks,” one exasperated carrier executive said. “We’re not [expletive] Europe.”

Todd Ehrlich, managing member of BAM Worldwide, a finance company based in Atlanta, said he hasn’t seen a big change in payment practices by shippers and, in fact, many freight brokers are expediting payments to carriers and using that as a competitive advantage in the market.

“If you let payments slide, it can all come crashing down very quickly,” Erhlich said. “If you don’t pay carriers promptly, it makes each additional load harder to get. The faster you pay, the faster carriers say yes to loads.”

In a market where capacity is plentiful, Ehrlich said, it’s not uncommon for shippers to seek more lenient payment terms from carriers. He advises carriers to counter shipper requests for more time to pay with a request of their own for more business.

Winston Aston, CEO of TransCredit Inc., a company that has tracked payment trends since 1999, said payment practices vary widely with ocean freight shippers typically paying in 60 to 90 days and the majority of truckload shippers paying in 30 days or less.

Among truckload shippers, Aston said, the trend of payments actually has improved over the past year or so, with shippers paying on average in 39 days, based on a survey of nearly 400,000 truckload shippers in April. That is down from 43 days in September 2016 and only slightly higher than the 37 days recorded in April 2014.

TransCredit also assigns a credit score to shippers based on several factors, including how quickly they pay and the cumulative amount of outstanding invoices. Those scores also have improved over the past year, climbing from 69 in September 2016 to 78 in April, the latest survey period, based on a scale of 1 to 100 with 100 being the highest credit quality.

Jeff Rogers, CEO of Universal Logistics Holdings, said he’s OK with some shippers taking longer to pay so long as the payments are consistent and there is no change in credit risk. “We are doing the same thing with our vendors,” he noted.

For finance companies, a longer payment cycle could be an opportunity to do more business.

Aston said he has seen dramatic growth in the use of “spot factoring,” in which truckers turn over invoices for individual loads in return for immediate payment rather than negotiate with a factoring company to assume collection for a large number of invoices. The cost of spot factoring can be as much as 10% of the invoice amount because it usually does not involve credit checks and is considered riskier than more formal factoring arrangements.

Steve Hausman, CEO of Triumph Business Capital, said the number of firms providing factoring services has grown from 30 to more than 150 over the past decade. And while the number of providers appears to have stabilized, Hausman figures the market could be heating up in response to longer payment practices by some shippers.

Currently, Hausman said, less than 10% of brokers use factoring services, but “that number is growing.”

Staff Reporter Ari Ashe contributed to this story.