Tonnage Down 2.8% in February From Year Ago

This story appears in the March 27 print edition of Transport Topics.

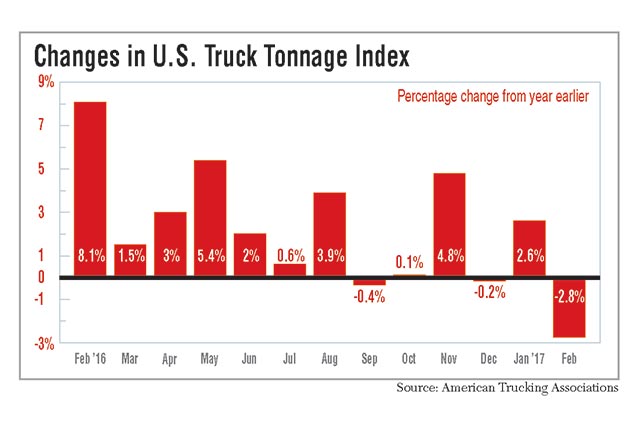

Truck tonnage dropped 2.8% in February year-over-year, reversing January’s positive momentum, but American Trucking Associations’ chief economist maintains that freight activity remained strong considering February 2016 was a record-setting month.

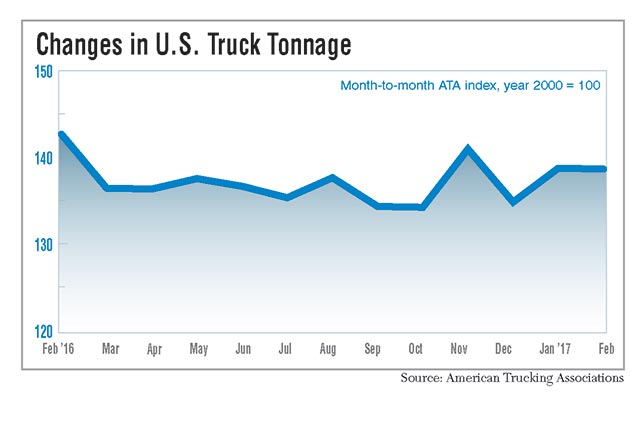

Sequentially, ATA’s tonnage index fell 0.1% to 138.7 in February from 138.9 in January — a month that recorded a 2.9% improvement over December. The all-time high in February 2016 was 142.7.

“February’s numbers, especially the year-over-year drop, might surprise some as several other economic indicators were positive in February,” ATA Chief Economist Bob Costello said. “However, I’m not worried about the decline from February last year as it was really due to very difficult comparisons more than anything else. February 2016 was abnormally strong.”

The not seasonally adjusted index, which represents the change in tonnage actually hauled by fleets, was 125.5 in February, a 4.6% decline from the previous month. The index uses a base level of 100 for freight activity in the year 2000.

The DAT North American Freight Index was 332 in February, up from 224 a year ago. But it was down from 380 in January. DAT also uses a base level of 100 for freight activity in the year 2000.

While ATA’s index was at an all-time high in February 2016, the DAT index was at a low point.

The difference between the two indexes is the ATA figure is weighted toward contract freight while DAT measures spot market freight often hauled by small carriers with fewer than 20 trucks. Spot markets are leading indicators to the contract market.

Flatbed spot market rates were up 8.1% in February versus the prior year. Dry van spot market rates were 7.9% higher, and linehaul rates were up 2.2%. However, refrigerated rates were down 0.1% year-over-year. All the rates include fuel surcharges.

DAT industry analyst Mark Montague blamed the lower refrigerated rates on a drought in California and credited the higher flatbed rates on more oil and gas drilling. The Baker Hughes count, a business barometer for that industry, reported 789 active rigs in the United States as of March 17, up from 476 a year ago.

“The spot market contracted in ’15 going into ’16, and we really didn’t hit the bottom until last April or May. The spot market fell so much below contracts that some shippers got very attractive rates from [third-party logistics companies], and brokers and [shippers] began to shift away from contract moves,” Montague said.

Stifel, Nicolaus & Co. industry analyst John Larkin told Transport Topics that 2017 has been mediocre for trucking, but strength in the flatbed, open-deck, heavy-haul, specialized market is a positive.

“This is somewhat encouraging as the flatbed group often leads the rest of the industry into a broader recovery,” he said. “We would also point out that the foot-dragging in Congress is holding up the series of stimulative, pro-business elements of the Trump administration’s agenda. Our sense is that businesses are still being a bit cautious with respect to hiring and capital investments until they see more definitive evidence that the Trump agenda will, in fact, be at least partially implemented.”

The Cass Freight Index of shipments increased 1.9% year-over-year and 7% sequentially. Expenditures rose 3.2% year-over-year and 5.1% from January. Cass uses information from bill payments through its St. Louis bank primarily based on trucking but also including rail, air and barge freight.

“We have been questioning, ‘How fast will the recovery from here be?’ However, the overall freight recession, which began in March 2015, appears to be over and, more importantly, freight seems to be gaining momentum,” according to the report, written by Donald Broughton, an analyst with Avondale Partners.

“We should also remind readers of a fundamental rule of marketplaces: Volume leads growth. Repeatedly, we have watched in a host of different markets that volume goes up before pricing starts to improve, and volume goes down before pricing starts to weaken.”

In other economic news, the Institute for Supply Management reported the February purchasing managers’ index rose to 57.7% from 56% in January. The index measures new orders, inventory levels, production, supplier deliveries and employment. The U.S. Census said retail sales inched up 0.1% in February and that the total inventory-to-sales ratio remained at 1.35 in January, the latest month of available data. New home construction rose at a seasonally adjusted annual rate of 1.29 million in February, up 3% sequentially and 6.2% year-over-year.

“Looking ahead, signs remain mostly positive for truck tonnage, including lower inventory levels, better manufacturing activity, solid housing starts, good consumer spending, as well as an increase in the oil rig count — all of which are drivers of freight volumes,” Costello said.