Trucking Stocks Slip in First Half of 2015 as Investors Worry About Economy, Rates

Investors’ fears that the economy will weaken and curtail carriers’ pricing power are pushing down trucking share prices at a time when the broader stock market hovered near record levels before last week’s pullback, analysts said.

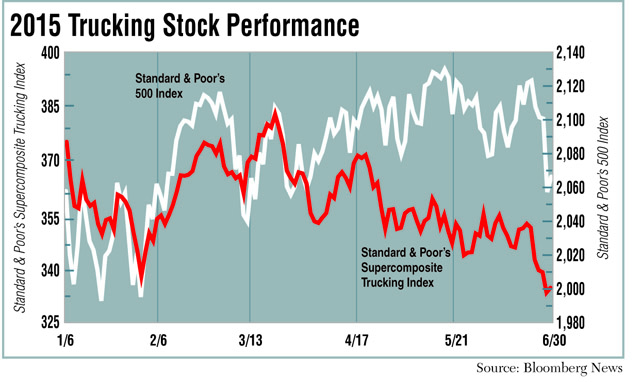

As the calendar turns to the second half of 2015, trucking shares measured by Standard & Poor’s Supercomposite Trucking Index fell 10.9% through June 30 while the benchmark S&P 500 inched up 0.4%.

Shares fell overall last week after a breakdown in talks between Greece and its creditors led to default on a $1.8 billion International Monetary Fund loan. Investors feared default could create turmoil in global financial markets.

Throughout the first half, the pattern of weaker trucking stock performance held, never topping the broader market index. The trucking index was stuck in negative territory for all but six days and fell 10% or more on three days.

“The stocks are falling because of fears the economy is going to drop off,” Jason Seidl, a Cowen & Co. analyst, told Transport Topics in late June. “Everyone is worried that pricing has been so good for so long that if the rate of economic growth drops significantly we will see a drop in pricing.”

A drop-off in pricing at the same time that freight volumes are moderating is a “double hit” for fleets, Seidl said.

Trucking share prices typically rise before the overall market accelerates and then tend to trail off before the broader index declines at the end of a recovery, Seidl said.

While the main index of publicly traded truckers stumbled, rail stocks fell much farther, declining 18% since 2015 trading began on Jan. 2. The decline followed a drop-off of total rail shipments, which included declines of carload freight such as coal and increases in truck-rail cargo to record levels during May.

Not every stock declined in the trucking sector. Roadrunner Transportation Systems’ shares rose more than 12% during the first half after the company’s less-than-truckload unit performance improved. Roadrunner ranks No. 21 on the Transport Topics Top 100 list of U.S. and Canadian for-hire carriers.

The worst declines were elsewhere in the LTL sector, including a 41% drop at No. 5 YRC Worldwide Inc., 29% at No. 25 Saia Inc. and 31% at LTL and logistics company ArcBest Corp., No. 13.

Seidl said the LTL fleets’ shares suffered more because they have more exposure to the industrial sector of the economy that has been hurt by the strengthening U.S. dollar.

LTL operators have greater fixed costs that can hold back profit growth when freight markets weaken.

Shares of UPS Inc. and FedEx Corp., the two largest companies on the TT for-hire list, also dropped. FedEx fell 1.2%, while UPS dropped 12%. Neither package company is in the S&P Trucking Index.

“The [trucking] stock market isn’t quite as robust,” said John Larkin, an analyst at Stifel, Nicolaus & Co., as extremely tight 2014 demand has eased.

“Shippers this year haven’t had as much trouble finding capacity,” he said. With more capacity available, it’s become more difficult for fleets to maintain higher rates and profits, he added, noting that’s one of the reasons why the truckload stocks have trailed off.

“The rates are a little bit below the increases they got last year,” Larkin said, moving up 3% to 5% instead of as much as 8% in 2014.

BB&T Capital Markets analyst Thom Albrecht said “investors fear a return to the lethargic volume and pricing and environment of 2012-2013” in a market where signs of growth are scarce.

The loosening of capacity has hurt LTL carriers that captured some truckload freight last year when equipment was scarce in that sector, Albrecht agreed. In 2015, truckload carriers have been able to seat more tractors and buy equipment.

Robert W. Baird analyst Benjamin Hartford and Seidl projected that trucking stock prices will stay in the current range for several reasons.

While modest freight demand improvement this month could provide stability, Hartford said, fleets face pricing challenges because rate increases accelerated in the second half of 2014. But investors remain concerned that a decelerating economy is a constraint.

“Recent [trucking] underperformance against a more seasonally stable June should serve as a floor for the group,” Hartford wrote in a report. “We believe 2016 and 2017 can be healthy, with higher rates that improve profits as regulatory changes squeeze capacity.”

While asset-based carriers’ profits lagged, some asset-light companies moved higher.

“The market buzz has been in that sector,” Seidl said, as companies such as XPO Logistics (up 11%) and Echo Global Logistics (up 15%) moved up. Both companies announced acquisitions during the first half. However, largest broker C.H. Robinson Worldwide fell 16%.