In 2024, the world is standing at an energy and sustainability inflection point.

As the world moves towards a more sustainable, renewable future, the stability and viability of diesel fuel is a burning question on the minds of leaders in major sectors such as transportation and agriculture. Despite advances in clean energy such as EVs or alternative fuels, diesel is still the lifeblood of multiple industries, and its availability can have major impacts on specific industries and the economy.

Current and historical diesel prices | Comdata, T-Chek averages | Latest fuel news

Understanding the ‘how’ and ‘why’ of global oil market trends, persistent supply chain challenges, economic conditions, and government regulations will all be crucial to determining if there will be a diesel shortage in 2024.

Let’s dig in more and learn more about the diesel fuel market in 2024.

Is There a Diesel Shortage in 2024?

At the core of global diesel markets is supply and demand and the perfect storm may be shaping up for 2024.

According to the EIA, as of January 26, distillate inventories in the United States stood at just 131 million barrels, representing a deficit of 10 million barrels (a decrease of 7% or 0.54 standard deviations) compared to the preceding ten-year seasonal average. The deficit has contracted from 19 million barrels (a decrease of 16% or -1.44 standard deviations) since mid-November. These reductions in average supply are especially significant given the projected shift in economic output.

Diesel and other distillate fuel oils serve as the backbone of the industrial economy, especially in the manufacturing, freight transport, and construction sectors. As a result, they are among the most responsive fuels to fluctuations in the business cycle of sectors like manufacturing.

2022 and 2023 marked a shallow cyclical downturn for manufacturers in the United States, but this cycle is set to change in 2024 as manufacturers begin to ramp up production of goods. Combine this increase in production with expected rate cuts from the U.S. Federal Reserve and the European Central Bank, and the cyclical cycle will see a major boost as we move into 2024.

Early reports this year indicated that inventories of diesel, heating oil, and gas oil fell below the 10-year seasonal average across North America, Europe, and Singapore. This trend has initiated upward pressure on immediate fuel prices in these regions and drew the attention of bearish investors in the early part of 2024. Thanks to economic growth, the United States Energy Information Administration expects annual U.S. average diesel consumption to grow modestly, by 1.3%, or about 50,000 b/d, in 2024.

The SKS Doyles crude oil tanker moves along the Suez Canal towards Ismailia in Suez, Egypt. During the Middle East conflict, some tankers avoided entering a vital Red Sea conduit because of attacks on ships. (Bloomberg News)

Despite this apparent reduction in supply, the EIA indicates additional refinery capabilities in the United States, and international production increases in countries like Kuwait will adequately increase global gasoline and diesel production to head off any drastic reductions in supply. Accordingly, the IEA reports that thanks to record-setting refinery output from the U.S., Brazil, Guyana, and Canada, world oil supply is forecast to rise by 1.5 mb/d to a new high of 103.5 mb/d.

Diesel markets are highly challenged by geopolitical tensions in regions like the Middle East, which accounts for one-third of the world’s seaborne oil. U.S. and UK airstrikes targeting Houthi positions in Yemen, in response to attacks on tankers in the Red Sea by the Iran-backed group, have sparked concerns about a potential escalation of the conflict. Such escalation could exacerbate disruptions to the flow of oil through critical trade chokepoints.

In summary, despite global challenges and a shifting economy, the supply of diesel fuel is expected to keep pace with demand and avoid any dramatic increases in fuel prices. However, issues like worsening geopolitical tensions, disruptions at refineries, or any number of other issues could completely change this forecast.

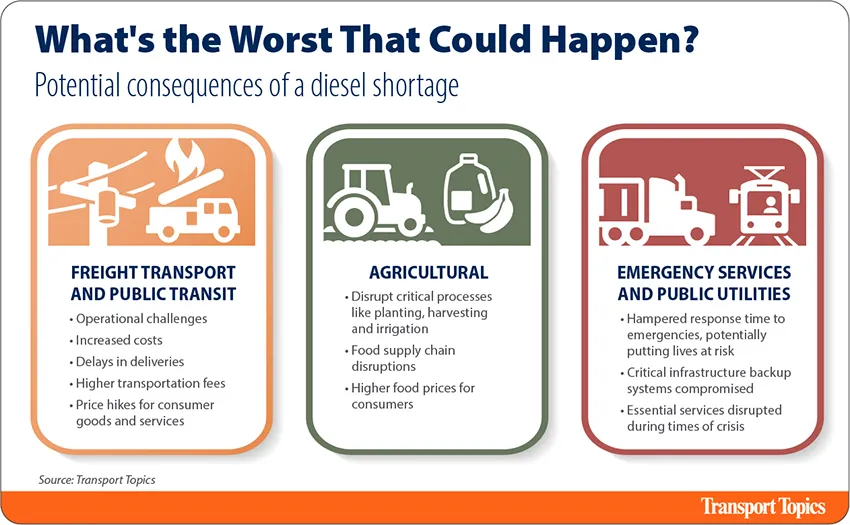

What Are the Potential Consequences of a Diesel Shortage?

Dealing with a diesel shortage could trigger a range of potential issues across several sectors that are instrumental to global resource production and maintaining safe, thriving communities.

In transportation, industries heavily reliant on diesel fuel, such as freight transport and public transit, may face operational challenges and increased costs. The shortage could lead to delays in deliveries or higher transportation fees, and ultimately result in price hikes for consumer goods and services.

Trucks fill up at diesel pumps at night. (Bim/Getty Images)

Agricultural activities, including farming and food production, heavily depend on diesel-powered machinery for operations such as planting, harvesting and irrigation. A shortage in diesel fuel could disrupt these critical processes, impacting crop yields and potentially leading to food supply chain disruptions and higher food prices for consumers.

In addition to transportation and agriculture, a diesel shortage could also affect emergency services and public utilities.

Emergency response vehicles, such as ambulances and fire trucks, rely on diesel fuel for their operations. A shortage could hamper their ability to respond promptly to emergencies, potentially putting lives at risk. Similarly, diesel generators are often used as backup power sources for hospitals, data centers, and other critical infrastructure during power outages. A shortage of diesel fuel could compromise the reliability of these backup systems, leading to disruptions in essential services and infrastructure, particularly during times of crisis or natural disasters.

Overall, a diesel shortage could have far-reaching implications, affecting both daily life and critical societal functions.

What Are Possible Solutions to Mitigate a Shortage?

Mitigating a diesel fuel shortage requires a globally focused strategy that includes a well-honed balance between supply and demand, the wide adoption of alternative fuel options, the conversation of primary resources, and a continual march toward technological advancements.

Supply and Demand Changes

During the pandemic, diesel prices surged primarily due to a combination of supply chain disruptions and fluctuating demand. Reduced production and refining capacity, along with shifts in consumer and commercial transportation needs, led to tighter supply and higher overall prices. Although we have made strides since the pandemic, these issues are still lingering, causing the cost of diesel to remain high.

At the core of the supply discussion is OPEC+, a coalition consisting of the Organization of the Petroleum Exporting Countries and 10 collaborating nations. Reduction in output by OPEC+ in the last year has allowed non-OPEC countries to boost production and better maintain prices.

A pump jack operates in an oil field in Midland, Texas. (Tony Gutierrez/Associated Press)

Approximately half of the world's petroleum and other liquid fuels produced last year originated from OPEC+. Since late 2016, these countries have coordinated their crude oil production with OPEC. In response to declining global oil demand and plummeting crude oil prices, OPEC+ has revised its production targets downward over the past year.

For 2024, the EIA forecast indicates that OPEC+ crude oil production is anticipated to average 36.4 million barrels per day (b/d) in 2024 and 37.2 million b/d in 2025, both figures falling short of the pre-pandemic five-year average of 40.2 million b/d recorded from 2015 to 2019. Notably, these estimations exclude Angola, which departed from OPEC in January 2024.

On the demand side, the world must continually march toward reducing reliance on fossil fuels. While it may be impractical to eliminate fossil fuels in short order, global shifts towards boosting fuel efficiency across both light and heavy-duty vehicles have also helped advance global clean air goals and led to substantial reductions in greenhouse gas emissions.

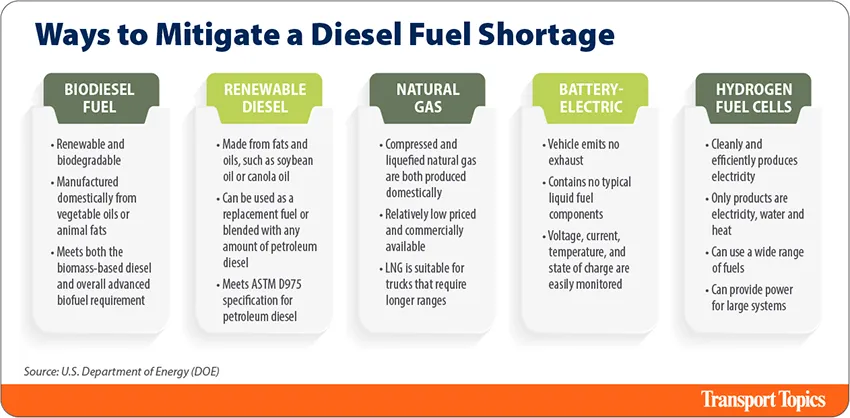

Alternative Fuel Options

One of the most dynamic and compelling opportunities to mitigate a diesel shortage is removing the reliance on fossil fuels entirely by moving to alternative fuels.

In the third quarter of 2023, electric vehicles and hybrids accounted for 18% of U.S. light-duty vehicle sales, while they represented 33% of light-duty vehicle sales in China, according to data from Bloomberg Intelligence. This trend suggests a notable shift toward greener transportation options in both major markets. Analysts across the globe anticipate that the ongoing adoption of EVs and hybrid vehicles will contribute to a reduction in motor gasoline consumption as consumers increasingly embrace these environmentally friendly alternatives.

Moving a passenger vehicle is one thing, but moving trucks, boats and airplanes with alternative fuels is another massive challenge for shippers and carriers in the transportation industry. Currently, the most popular forms of alternative fuels for large-scale transportation are biodiesel and renewable diesel, natural gas, battery-electric and hydrogen fuel cells.

U.S. Department of Energy

Biodiesel and renewable diesel stand out as leading alternative energies embraced in commercial transportation because these sustainable options reduce reliance on traditional fossil fuels. It’s important to keep in mind that a recent study from the Traffic Injury Research Foundation indicates a link between fuel efficiency and overall safety.

Hydrotreating, a common process in oil refineries, yields a product almost indistinguishable from conventional diesel fuel, further highlighting the viability of renewable options in the transportation sector.

At most fueling stations, various biodiesel, and biofuel blends, such as E10, B5, and B2, which mix conventional fuels with bio-based components, are available. In specific regions like Minnesota, B20, a blend containing 20% biodiesel, becomes mandatory during the summer months, highlighting the commitment to renewable energy sources.

Will We Have Diesel in 50 Years?

Few things in the world have universal acceptance, but without question, experts agree that the world will eventually run out of fossil fuels.

Recent cultural shifts and consumer sentiment show that the world is moving toward reducing its dependence on fossil fuels, including diesel. Yet, despite the press and focus placed on fundamental game-changers such as Tesla, our world still primarily relies on fossil fuels to do everything from driving the kids to school to moving freight across the globe. Alternative fuel sources like biodiesel are compelling but lack the scale required to make a significant impact in the short term.

A Tesla electric vehicle charging station in Topeka, Kan. (Orlin Wagner/Associated Press)

Long-term, things look much different, as biofuel options, including alternative jet fuel (AJF) or biojet, are gaining traction across the globe.

In January 2023, the production capacity of renewable diesel and other biofuels in the United States achieved a milestone, reaching 3 billion gallons per year. This significant capacity surpassed the production capacity of U.S. biodiesel for the first time, marking a notable shift in the renewable fuel landscape. The growth in U.S. renewable diesel capacity is primarily propelled by escalating targets set by state and federal renewable fuel programs.

On top of targets, the renewal of biomass-based diesel tax credits has played a pivotal role in incentivizing investments and fostering the expansion of renewable diesel production facilities across the nation. As sustainability initiatives gain momentum and environmental concerns drive policy changes, the renewable diesel sector is poised for continued growth and innovation in the coming years.

So, will we have diesel in 50 years? Time will tell.

Cost of Diesel: Worldwide Variations

According to commodity markets, the average price of diesel, worldwide (February 2024), is hovering around $1.86 per liter. That month, it topped $4.00 per gallon in the U.S. As mentioned above, this price is expected to stay relatively stable throughout 2024 and 2025 due to increases in supply, augmented by a minor increase in demand as the worldwide economy shifts into a higher gear. Around the globe, several unique variables are contributing to seismic shifts in diesel pricing. Europe is in a particularly unique position due to the ongoing Russia-Ukraine conflict.

A Marathon station in Bradenton, Fla., in early February 2024. Marathon's refinery in Garyville, La., is one of the largest and most important refineries in the U.S. (Gene J. Puskar/Associated Press)

Following the European Union’s prohibition on the import or use of Russian diesel within the bloc, countries began depending on imports from Asia and the U.S. Analysts caution that refinery maintenance in the U.S. will exacerbate supply shortages across the Atlantic and contribute to additional price increases.

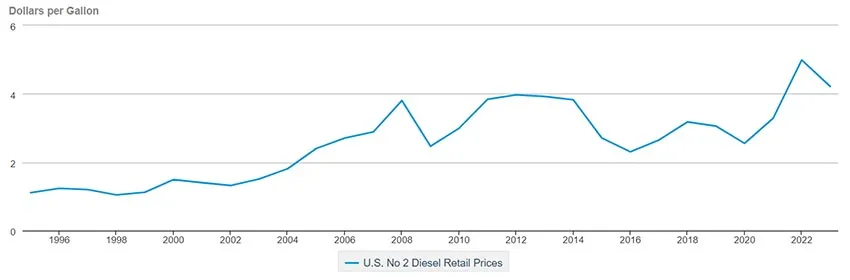

When analyzing the cost of diesel in the United States over the past 30 years, EIA analysis shows 2022 and 2023 as the highest years for diesel retail cost at $4.989, and $4.214, respectively.

U.S. No. 2 Diesel Retail Prices

Data Source: U.S. Energy Information Administration

The Future of Diesel Fuel

Experts across the world accept that fossil fuel-derived diesel fuel is not a sustainable method of transportation for the long haul. However, this fact does not solve issues that are prevalent in today’s transportation markets. These issues, mind you, will likely stick around for at least another decade, as the world continues its march toward scalable, sustainable, and renewable resources.

While the world economy transitions away from reliance on diesel fuel, environmental regulations, and technological advancements are poised to help minimize impact.

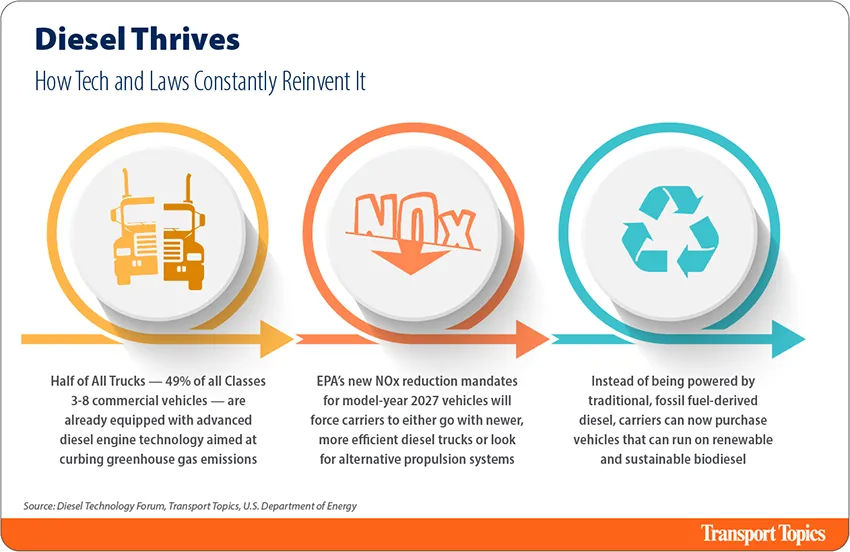

A recent study revealed that 49% of all Classes 3-8 commercial vehicles, equivalent to nearly 5.5 million trucks, are already equipped with advanced diesel engine technology aimed at curbing greenhouse gas emissions. This widespread adoption underscores the industry's commitment to sustainability and highlights the significant role that advanced diesel engine technology plays in reducing environmental impact across the commercial vehicle sector.

Other changes include major advancements in requirements for diesel trucks for 2027.

The Environmental Protection Agency introduced new NOx (nitrogen oxide) reduction mandates in 2022, set to take effect effectively in 2026 with the model-year 2027 heavy-duty trucks. At this “fork in the road,” carriers are forced to either go with newer, more efficient diesel trucks or look for alternative propulsion systems such as battery-electric, fuel cell, or hybrid technology.

As the transportation industry moves toward the future, diesel trucks will not be eliminated, but rather shift in definition. Instead of being powered by traditional, fossil fuel-derived diesel, carriers can now purchase vehicles that can run on renewable biodiesel. Not only is the fuel itself sustainable, but it can be engineered to burn cleaner, further reducing greenhouse gas emissions in the long term.

As with all forms of renewable energy, infrastructure viability will be the single most important factor in the widespread adoption of renewable or more sustainable transportation/mobility systems.

What Will Happen to Diesel in 2024?

At its core, the world is at an energy and sustainability inflection point, driving increased scrutiny and evaluation of diesel's role in the evolving landscape. For 2024, the outlook for diesel is multifaceted, influenced by a complex interplay of global trends, economic factors, regulatory mandates, and technological advancements

With concerns surrounding sustainability and environmental impact gaining prominence, diesel's stability and viability are being questioned, particularly in major sectors like transportation and agriculture. While electric vehicles and alternative fuels are gaining traction, diesel remains integral to various industries and its availability significantly impacts economic sectors and the broader economy.

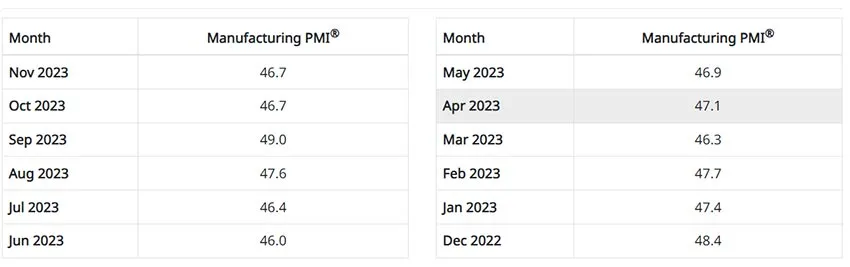

The Institute for Supply Management's Manufacturing Purchasing Managers Index (PMI) rose to 49.0 in September of 2023, indicating a potential turnaround in U.S. manufacturing activity. Given this uptick, the possibility of increased diesel demand and subsequent price inflation presents a notable concern that must be addressed because the relationship between manufacturing growth and industrial energy consumption, particularly diesel usage, is well-established over time.

Source: Institute for Supply Chain Management

Diesel serves as a significant fuel source for various industrial processes, and a resurgence in manufacturing typically leads to heightened demand for such energy resources. The concern over diesel demand and price inflation is exacerbated by concerns over future supply. Even a modest uptick in demand could prompt rapid price escalation, potentially contributing to broader inflationary pressures. Such inflationary trends could undermine the sustainability of the economic recovery and pose challenges for businesses and consumers alike.

While the ISM Manufacturing PMI remains below the 50.0 expansion threshold, the upward trajectory suggests a potential shift toward growth. Proactive measures may be necessary to mitigate inflationary risks and ensure a stable and sustainable economic recovery.

Given this information, policymakers, industry stakeholders, and economists should remain vigilant in assessing the impact of manufacturing growth on energy consumption and prices.

Strategies to enhance energy efficiency, diversify energy sources, and manage supply chains effectively may help mitigate the potential adverse effects of increased diesel demand on inflation and economic stability.