Agriculture Industry Talks With Trump Team on Immigration

[Stay on top of transportation news: Get TTNews in your inbox.]

The U.S. agriculture industry has started talks with Donald Trump’s transition team in a bid to advocate for the food business as the president-elect pledges tariffs and mass deportations.

Groups including the National Grain and Feed Association, which represents agriculture powerhouses such as Archer-Daniels-Midland Co. and Cargill Inc., and the International Fresh Produce Association, were among those involved in the discussions, according to people familiar with the matter. The National Council of Agricultural Employers also has a meeting on the books.

ADM ranks No. 74 on the Transport Topics Top 100 list of the largest private fleet operators in North America, and No. 9 on the agriculture sector list. Cargill ranks No. 18 on the agriculture list.

The groups are prioritizing topics such as Trump’s promised tariffs, which could upend trade with key commodity buyers like China and Mexico, as well as immigration, with U.S. agriculture becoming more reliant on foreign labor. Some industry advocates are lobbying for the expansion of a visa program for temporary workers, and others want China to stick to crop purchases pledged during the “Phase One” trade deal negotiated by Trump in his previous term, said the people who asked not to be named citing private talks.

While many farmers make up key blocs of Trump’s supporters, his policies sometimes run counter to the agriculture industry’s economic interests. Take soybeans, for example. The commodity became the poster child of Trump’s first-term trade war with China. Retaliatory tariffs from the Asian nation dried up demand for U.S. cargoes, with American shipments to the world’s top buyer of the commodity tumbling 79% in the first two years of the administration. That hurt farmers to the tune of $11 billion.

At the same time, some industry leaders are also worried about Trump’s plans for mass deportations. If the president-elect follows through with his plan to send millions of undocumented workers out of the country, it would have repercussions across the farming world, exacerbating a decades-long labor-shortage problem. The situation could be especially acute for growers of fresh produce including tomatoes and lettuce.

“The American people re-elected President Trump by a resounding margin giving him a mandate to implement the promises he made on the campaign trail, like deporting migrant criminals and restoring our economic greatness. He will deliver,” Karoline Leavitt, a spokeswoman for the Trump-Vance transition team, said in an emailed statement. “In his first term, President Trump instituted tariffs against China that created jobs, spurred investment, and resulted in no inflation.”

Farm labor has been an ongoing issue for the ag industry. @FarmBureau President @ZippyDuvall says he’ll be pushing lawmakers on Capitol Hill next year to revise the H-2A Visa program. @INFarmBureau https://t.co/NbuAPZUKp8 — Hoosier Ag Today (@hoosieragtoday) December 11, 2024

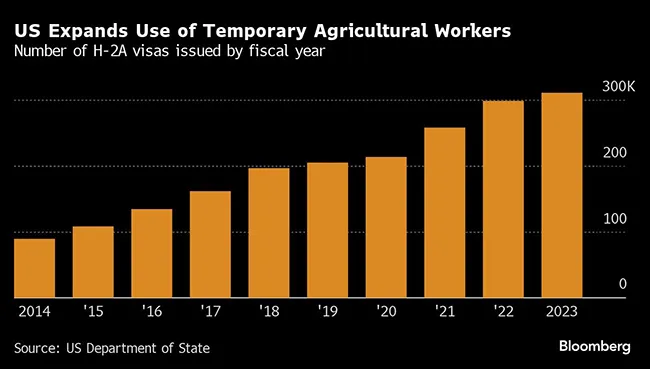

Many migrants enter the U.S. through the federal H-2A visa program, which has allowed the numbers of documented temporary workers to surge in the past decade. Even then, the Department of Agriculture estimates that nearly half of hired crop farmworkers lack legal immigration status.

The International Fresh Produce Association, which represents companies including berry producer Driscoll’s and tomato supplier NatureSweet, is lobbying to have the H-2A visa program expanded within the first six months of the administration, the people said.

“H-2A use has become more widespread, turning the program into an essential solution for meeting producers’ labor needs,” the IFPA said in a statement to Bloomberg News. “IFPA will continue to push to roll back unnecessary regulations put in place by the Biden administration, and work with Congress and the Trump administration to modernize this important tool for American farmers.”

The National Council of Agricultural Employers also wants the program to be expanded, according to President Michael Marsh. In addition, the group is pushing for a lower minimum wage rate as higher costs have prompted American farmers to exit the business or move food production to Mexico and Canada, he said.

Lori Heino-Royer of Waabi discusses the latest developments, breakthroughs and key industry partnerships in autonomous trucking. Tune in above or by going to RoadSigns.ttnews.com.

The number of H-2A visas issued surged nearly 60% in the 2023 fiscal year from five years earlier. Growth in the program is “one of the clearest indicators of the scarcity of farm labor,” according to the USDA. Employers who hire through the program are required to show they were unable to find enough domestic workers.

Trump’s popularity with agricultural communities has stood the test of time even as tariffs on China left soybeans piling up on U.S. farms. After all, the former president threw $28 billion in aid at growers to cushion the blow of his trade war. Rural support likely means Trump won’t hold back on another round of tariffs, forcing the industry to get creative.

One possible solution being touted by industry groups is convincing China to stick to the $50 billion a year in agricultural purchases the nation pledged during the “Phase One” trade deal, while also having the Asian country approve crop traits that would give U.S. suppliers better access to the Chinese market, according to one of the people.

Want more news? Listen to today's daily briefing above or go here for more info

The push comes at a time when China, the world’s largest commodities importer, is increasingly turning to Brazil for its crop supplies, reducing its dependence on the U.S.

Railroad-inspection delays at the border with Mexico and the European Union’s Deforestation Regulation are also among topics of interest for the industry, the person said.

“There are real opportunities to work with the incoming administration to achieve positive trade-related outcomes for the feed and grain industry,” Mike Seyfert, NGFA’s president, said in a statement to Bloomberg.

Written by Ilena Peng, Gerson Freitas Jr. and Isis Almeida