Share

Up Front

Soft market conditions in 2023 placed financial strain on many of the largest trucking companies in North America.

Trucking companies have been surviving on lower rates while awaiting a freight market recovery.

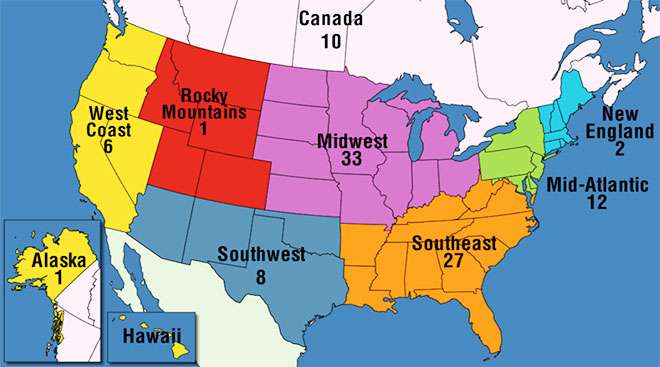

Find out where the Top 100 For-Hire carriers are located by region; click links to view details about the company.

Rankings

| Rank This Year | Rank Last Year | Company | Revenue (000) | Net Income (000) | Employees | Tractors* | Trailers |

|---|---|---|---|---|---|---|---|

| 1 | 1 | 90,958,000 | 6,708,000 | 500,000 | 19,267 | 84,956 | |

| 2 | 2 | 87,514,000 | 4,395,000 | 529,000 | 38,697 | 138,230 | |

| 3 | 3 | 12,829,665 | 728,287 | 35,000 | 23,000 | 47,400 | |

| 4 | 4 | 9,090,567 est |

504,877 | 25,123 | 7,504 | 34,599 | |

| 5 | 5 | 7,744,000 | 189,000 | 38,000 | 9,500 | 33,500 | |

| 6 | 9 | 7,660,000 est |

- | 47,500 | 69,000 | 40,800 | |

| 7 | 7 | 7,141,766 | 217,149 | 34,300 | 24,788 | 96,347 | |

| 8 | 10 | 5,866,152 | 1,239,502 | 23,386 | 10,791 | 46,414 | |

| 9 | 8 | 5,498,900 | 238,500 | 17,300 | 10,600 | 47,300 | |

| 10 | 6 | 5,303,322 | 264,394 | 1,468 | 9,809 | 18,017 | |

| 11 | 14 | 5,073,000 | - | 22,803 | 10,033 | 41,368 | |

| 12 | 12 | 4,427,443 | 142,164 | 15,000 | 4,411 | 24,323 | |

| 13 | 15 | 4,300,000 | - | 21,173 | 7,287 | 21,979 | |

| 14 | 11 | 4,202,585 | 167,528 | 5,950 | 5,200 | 4,300 | |

| 15 | 16 | 3,500,000 | - | 17,300 | 4,850 | 13,700 | |

| 16 | 17 | 3,283,499 | 112,382 | 13,809 | 8,035 | 30,810 | |

| 17 | 18 | 3,070,000 est |

- | 8,284 | 20,468 | ||

| 18 | 21 | 2,881,433 | 354,857 | 14,000 | 6,500 | 22,100 | |

| 19 | 20 | 2,653,000 | 296,000 | 14,000 | 552 | 1,073 | |

| 20 | 19 | 2,520,027 | 368,654 | 4,535 | 8,112 | 15,735 | |

| 21 | 22 | 2,406,635 | - | 10,000 | 7,550 | 12,600 | |

| 22 | 23 | 2,040,000 | - | 630 | 7,500 | ||

| 23 | 34 | 1,706,219 | - | 5,000 | 3,782 | 10,302 | |

| 24 | 32 | 1,686,340 | - | 8,592 | 2,924 | 8,426 | |

| 25 | 26 | 1,668,000 est |

- | 6,224 | 4,778 | ||

| 25 | 29 | 1,668,000 est |

- | 9,309 | 5,255 | 15,774 | |

| 27 | 25 | 1,662,139 | 92,901 | 9,311 | 4,206 | 4,892 | |

| 28 | 33 | 1,569,780 est |

- | 3,600 | 3,950 | 6,400 | |

| 29 | 39 | 1,529,000 | - | 8,258 | 1,537 | 9,854 | |

| 30 | 35 | 1,525,716 est |

- | 1,234 | |||

| 31 | 30 | 1,511,300 | - | 2,379 | 2,443 | 6,891 | |

| 32 | 38 | 1,342,000 | - | 6,500 | 5,538 | 13,170 | |

| 33 | 40 | 859,429 | - | 2,940 | 2,200 | 150 | |

| 34 | 36 | 1,282,000 | - | 616 | 3,900 | ||

| 35 | 44 | 1,261,000 est |

- | 2,953 | 11,877 | ||

| 36 | 58 | 1,207,458 | 14,775 | 6,320 | 5,512 | 16,833 | |

| 37 | 41 | 1,193,400 est |

- | 2,519 | 1,088 | 3,348 | |

| 38 | 42 | 1,131,455 | 70,373 | 4,213 | 3,349 | 5,653 | |

| 39 | 43 | 1,127,348 | - | 1,215 | 3,499 | 3,345 | |

| 40 | 46 | 1,103,573 | 55,229 | 4,904 | 2,458 | 4,808 | |

| 41 | 27 | 1,096,958 | 167,351 | 4,014 | 989 | 6,637 | |

| 42 | 28 | 1,089,000 est |

- | 6,500 | 3,996 | 5,544 | |

| 43 | 48 | 1,057,251 | - | 3,050 | 4,300 | ||

| 44 | 50 | 1,054,000 est |

- | 5,300 | 3,550 | 9,200 | |

| 45 | 56 | 1,035,000 est |

- | 5,800 | 2,261 | 5,223 | |

| 46 | 49 | 1,003,153 | - | 4,486 | 2,600 | 9,400 | |

| 47 | 37 | 989,259 | 101,259 | 4,621 | 2,354 | 6,549 | |

| 48 | 55 | 962,180 est |

- | 5,583 | 3,500 | 5,000 | |

| 49 | 60 | 944,742 | - | 5,424 | 1,654 | 4,145 | |

| 50 | 53 | 904,600 | 2,000 | 637 | 1,679 | 3,754 | |

| 51 | 57 | 903,312 est |

- | 3,000 | 2,035 | 5,782 | |

| 52 | 54 | 886,000 | - | 783 | 1,020 | 1,508 | |

| 53 | 62 | 814,000 | 118,900 | 3,650 | 2,400 | 4,100 | |

| 54 | 61 | 810,807 | 18,416 | 2,530 | 2,200 | 8,567 | |

| 55 | 45 | 808,000 est |

- | 2,624 | 3,152 | 5,250 | |

| 56 | 67 | 795,000 | - | 3,200 | 2,500 | 2,345 | |

| 57 | 66 | 774,000 | - | 4,120 | 1,763 | 2,924 | |

| 58 | 758,000 est |

- | |||||

| 59 | 65 | 744,000 est |

- | 3,500 | 2,519 | 3,402 | |

| 60 | 64 | 736,236 est |

- | 1,837 | 1,797 | 1,915 | |

| 61 | 76 | 676,000 est |

- | 3,681 | 4,429 | ||

| 62 | 59 | 674,500 | - | 3,500 | 2,897 | 4,608 | |

| 63 | 68 | 670,079 | - | 2,325 | 2,392 | 7,666 | |

| 64 | 69 | 664,000 | - | 2,262 | 1,899 | 3,425 | |

| 65 | 70 | 647,000 est |

- | 266 | 2,093 | 2,093 | |

| 66 | 609,000 est |

- | 3,700 | 3,076 | 11,683 | ||

| 67 | 71 | 574,668 est |

- | 3,400 | 2,200 | 5,000 | |

| 68 | 73 | 574,000 est |

- | 2,933 | 2,166 | 5,820 | |

| 69 | 83 | 556,975 | - | 1,585 | 1,480 | 3,134 | |

| 70 | 74 | 547,128 est |

- | 2,000 | 2,000 | ||

| 71 | 75 | 531,522 est |

- | 2,000 | 1,286 | 1,284 | |

| 72 | 78 | 468,180 est |

- | 450 | 1,500 | ||

| 73 | 72 | 446,000 est |

- | 2,000 | 1,600 | 5,600 | |

| 74 | 63 | 443,000 est |

- | 2,043 | 6,300 | ||

| 75 | 85 | 425,089 | - | 619 | 1,199 | 2,011 | |

| 76 | 79 | 423,433 est |

- | 2,173 | 1,645 | 2,763 | |

| 77 | 80 | 415,120 est |

- | 260 | 550 | 650 | |

| 78 | 88 | 410,000 est |

- | 1,250 | 352 | 2,042 | |

| 79 | 81 | 403,002 est |

- | 1,485 | 576 | 1,147 | |

| 80 | 84 | 390,150 est |

- | 900 | 2,000 | ||

| 81 | 87 | 374,000 est |

- | 400 | 158 | 575 | |

| 82 | 357,000 | - | 600 | 640 | 1,300 | ||

| 83 | 82 | 349,442 | - | 1,754 | 1,596 | 2,420 | |

| 84 | 92 | 332,000 | - | 1,150 | 1,005 | 1,900 | |

| 85 | 91 | 331,258 est |

- | 930 | 616 | 1,000 | |

| 86 | 330,000 | - | 1,404 | 687 | 1,423 | ||

| 87 | 86 | 323,556 | 187,260 | 1,225 | 615 | 1,805 | |

| 88 | 94 | 320,000 est |

- | 1,700 | 800 | 2,400 | |

| 89 | 93 | 312,933 est |

- | 509 | 757 | 3,400 | |

| 90 | 95 | 305,694 est |

- | 1,500 | 4,000 | ||

| 91 | 96 | 301,222 est |

- | 1,300 | 1,200 | 4,600 | |

| 92 | 97 | 290,822 est |

- | 1,200 | 1,897 | 2,068 | |

| 93 | 98 | 264,906 | - | 1,095 | 750 | 3,340 | |

| 94 | 253,000 est |

- | 1,600 | 600 | |||

| 95 | 248,467 | - | 1,350 | 849 | 623 | ||

| 96 | 100 | 232,529 est |

- | 588 | 653 | 1,250 | |

| 97 | 207,000 | - | 1,090 | 850 | 2,200 | ||

| 98 | 204,698 | 6,141 | 1,288 | 1,150 | 2,696 | ||

| 99 | 198,166 | -1,324 | 1,315 | 702 | 1,620 | ||

| 100 | 182,415 | 13,426 | 1,800 | 119 | 295 |

Top For-Hire Carriers on this list are common and contract freight carriers operating in the United States, Canada and Mexico. Companies are ranked on the basis of annual revenue. To be included in the Top 100 or any of the sectors, please send contact information to tteditor@ttnews.com. We will contact you via phone or e-mail to get information about your company prior to publication of the next Top 100 list.

* Tractor count includes company-owned, lease-to-own and owner-operator tractors.

#2 FedEx Corp. revenue and net income is for the 12-month period ended Feb. 29, 2024.

#4 TFI’s revenue is adjusted to reflect its acquisition of Daseke Inc. in April 2024.

#6 Ryder’s revenue is adjusted to reflect its acquisition of Cardinal Logistics in February 2024.

#33 IMC Logistics revenue data was provided by the company to replace the previously published estimate that determined its ranking on the Top 100 list.

#47 Mullen Group revenue and income converted to U.S. dollars based on average 2023 exchange rate.

#48 10 Roads Express revenue estimate is based on data provided by Culhane Meadows.

#28 PS Logistics, #30 OnTrac Inc., #37 Lynden, #51 Quality Carriers, #60 United Road Services, #67 Trimac Transportation, #70 Heniff, #71 Jack Cooper Holdings, #72 ContainerPort Group, #76 Maverick USA, #77 Beemac Trucking, #79 Dependable Supply Chain Services, #80 Koch Cos., #89 Artur Express, #90 Western Flyer Express, #91 New Legend, #92 Transervice Logistics and #96 National Carriers revenues are estimated by Transport Topics based on prior-year data and industry revenue trends.

#17 R+L Carriers, #25 CRST, #35 Central Transport International, #58 Manitoulin Group of Cos., #61 TMC Transportation, #65 Mercer Transportation, #66 FirstFleet and #68 Roehl Transport revenues are estimated by SJ Consulting Group.

#25 Averitt Express, #42 C.R. England, #45 Dayton Freight Lines, #55 Hirschbach Motor Lines, #59 Canada Cartage, #73 Mesilla Valley Transportation, #74 USA Truck, #78 Roadrunner Freight, #81 Daylight Transport, #88 Oak Harbor Freight Lines and #94 Ward Transport & Logistics revenue estimates are based on data provided by SJ Consulting Group.

Extras

The regional LTL carrier has adapted and expanded through a full century of economic cycles and industry changes.

The trucking industry remains mired in sustained overcapacity relative to freight demand even as it has slowly shed workers.

After being displaced by war in his native Sudan, Lual Akoon’s path took him to Middle America – and trucking.

If your company appears on the list, you have a few ways to announce it. Visit our logo library to get ready-made graphics.

For-hire carriers across segments saw revenues slide and margins tighten, but some fared better than others.

Learn more about how companies are selected for Transport Topics' Top 100 largest for-hire carriers list.

For-Hire News

Proficient Q4 Revenue Slumps 15.9% on Weaker Margins

Proficient — the No. 4-ranked auto transporter — expects industry dynamics to improve in 2025, including through a reduction in carrier capacity due to the travails of Jack Cooper Holdings.

Auto Hauler Jack Cooper to Shut Down After Losing Ford, GM

The dominoes started to topple when automaker Ford decided in January to end its relationship with Jack Cooper, bringing the curtain down on an approximately 40-year relationship.

Mullen Group Posts 0.1% Revenue Gain

Mullen Group experienced a slight increase in revenue year over year but a dip in earnings during the fourth quarter of 2024, the company reported Feb. 13.

Knight-Swift, A. Duie Pyle, TFI Buy Ex-Yellow Terminals

The three carriers bought a total of seven former Yellow terminals in private deals from the bankrupt LTL carrier’s administrators as each sought to bolster its LTL operations.

Ryder Reports Growth From Strong Operations During Q4

“We are pleased to report that this quarter is the first quarter in the last eight with year-over-year comparable earnings growth," CEO Robert Sanchez said during a call with investors.

Heartland Express Targets Major Operating Ratio Improvement

The Iowa-based company posted a loss in the fourth quarter of 2024 as the ongoing integration of two acquisitions alongside the industrywide freight recession weighed heavily on its OR.

Werner Posts Q4 Declines in Profit, Revenue

Werner Enterprises reported year-over-year income and revenue declines during the fourth quarter of 2024.

Hub Group Q4 Profit Falls Despite Intermodal Volume Growth

Fourth-quarter and full-year profit and revenue at Hub Group fell as lower revenue per load outweighed increased intermodal volume amid an ongoing weak freight market, the company said.

Universal Logistics Reports 19% Gain in Q4 Revenue

Universal Logistics Holdings experienced a 19% year-over-year increase in revenue but a slight dip in net income for the fourth quarter of 2024, the company reported Feb. 6.

Transportation M&A Gains Momentum in Late 2024

The transportation sector saw merger and acquisition activity gain momentum as market conditions stabilized in the second half of 2024, according to experts.