Staff Reporter

Allison Q3 Profit Surges 26.6% on Vocational Truck Demand

[Stay on top of transportation news: Get TTNews in your inbox.]

Allison Transmission’s profit in the third quarter jumped 26.6% on the back of appetite for Class 8 vocational trucks in North America, with executives saying demand shows no sign of weakening.

Indianapolis-based automatic transmission specialist Allison posted net income of $200 million, or $2.27 per diluted share, in the most recent quarter compared with $158 million, $1.76, in the year-earlier period.

Allison’s sales in the three months that ended Sept. 30 totaled a record $824 million, up 12% compared with $736 million in the 2023 period, powered by a 22% rise in North America On-Highway sales to $457 million from $376 million.

The increase in North American On-Highway sales principally was driven by strength in demand for Class 8 vocational vehicles and medium-duty trucks, and price increases on certain products, the company said in a release Oct. 29.

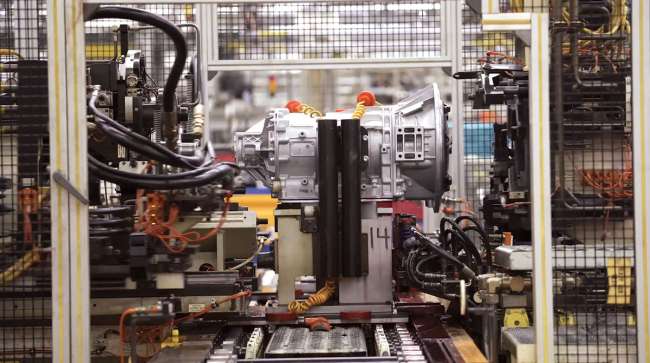

“Allison continues to see robust demand for our on-highway products, particularly our 3000 Series and 4000 Series fully automatic transmissions due to unprecedented Class 8 vocational vehicle demand stemming from sustained infrastructure spending in North America,” CEO David Graziosi said during the company’s quarterly earnings call.

“In order to meet this elevated demand throughout the year, we have made investments in our supply chain and operations to not only manage capacity, but also improve manufacturing throughput,” he told analysts.

Demand for the company’s products from the vocational sector is unlikely to slow down any time soon, executives said during the call.

Graziosi

“We have not heard anything from a market perspective, whether that be end users or [original equipment manufacturers] sensing any level of pullback on overall demand. As we’ve talked about on prior calls, you had a level of suppressed production because of COVID for a number of reasons,” said the company’s top executive.

“At the same time, you’ve had this enormous injection of capital into the market, driving demand for vocational products. So, whether that be infrastructure spending, other investment initiatives and incentives, they are out there and driving demand. So, we are, again, seeing nothing at this point that would tell us that this is a near-term end in sight,” Graziosi said.

“I think, quite frankly, at least from the public comments of vehicle OEMs, I think they’ve indicated across the board very strong demand well into 2025. On the back end of 2025, you also have this issue of, as you know, [Environmental Protection Agency] emissions changes for 2027 and what that potentially does as well in terms of just taking normal demand and accelerating some of that,” he added.

Demand is humming along so well, Allison increased its full-year earnings guidance for the second consecutive quarter.

Allison now expects net income in a range of $675 million to $725 million and sales in a range of $3.135 billion to $3.215 billion. At the start of the year, Allison said it expected net income in a range of $635 million to $685 million and sales in a range of $3.050 billion to $3.150 billion.

Looking forward, 2025 could be even better as the company expects to increase its prices as the vocational boom continues.

“About 60% of revenue in North America On-Highway [long-term agreements} are coming due and we’re in the middle of negotiating these currently. As we’ve talked about in the past, we continue to deliver a significant amount of value to the end market. Our fully [automatic transmissions] allow the commercial vehicles to operate more efficiently,” Chief Financial Officer Frederick Bohley told analysts.

“We’re delivering a significant amount of value. There is very, very strong demand for our product. And we’ll continue the negotiations and anticipate most of them concluding probably toward the latter half of Q4,” he added.

The key variable holding back the vocational sector is bottlenecks at upfitters and bodybuilders, according to the executives.

Bohley

“Everybody in that vocational space is constrained at this point, component suppliers, bodybuilders, but the demand is clearly there with … absolutely no signs of slowing down,” said Bohley.

Analysts are optimistic about the company and certain of its North American markets too, they said in comments during the call and research notes.

“[Allison’s] end markets are healthy, but not in oversold conditions; demand seems strong for North American vocational Class 8 heavy trucks and medium-duty trucks into next year,” Melius Research founding partner Rob Wertheimer said in an Oct. 29 note.

“Allison hasn’t yet had the sort of price increase that drove OEM margins across [the machinery sector] to record highs; its brand power is strong, competitive threats low, and management team aggressive,” Wertheimer added. “We expect estimates will rise through next year.”

Want more news? Listen to today's daily briefing below or go here for more info: