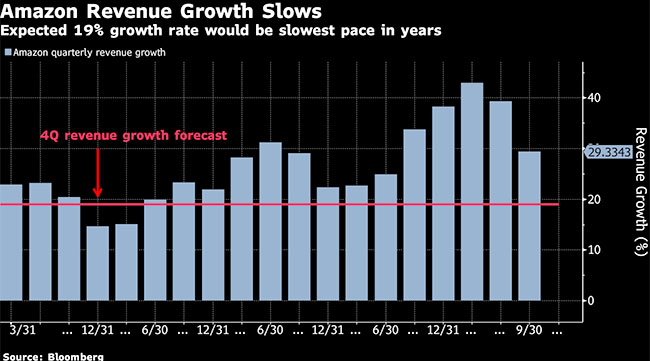

Amazon Likely to Post Slowest Revenue Growth Since 2015

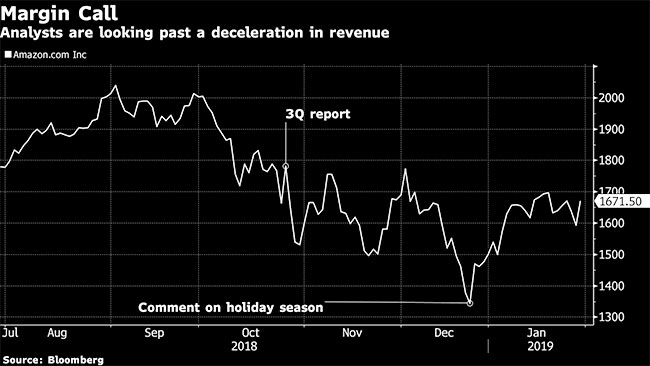

Amazon.com reports fourth-quarter results after the market closes Jan. 31, with analysts braced for a relatively weak read on revenue growth, and focusing instead on the benefits cloud-computing and advertising have had on its margins. (Update, Jan. 31: Amazon sales, profit top estimates as retail, advertising soar)

The e-commerce company is expected to deliver a sales increase of about 19% in its holiday quarter, the slowest pace since the start of 2015, according to Bloomberg data. Profit growth also is expected to decelerate, though net earnings still are seen more than doubling.

In particular focus are the company’s margins, which analysts expect to expand by 8.4%, an improvement that is due in large part to the explosive growth of Amazon Web Services.

Wall Street is calculating AWS revenue of nearly $7.3 billion, based on the average of seven analyst estimates compiled by Bloomberg. That represents growth of more than 42%. In the third quarter, AWS accounted for 11.8% of Amazon’s total revenue.

Canaccord Genuity analyst Michael Graham downplayed the deceleration in overall revenue growth, saying it was due to the company “lapping the first full-quarter contribution from Whole Foods” and a change in the amortization schedule of Amazon Prime subscriptions.

“Despite this dynamic, we believe underlying business trends remain strong,” he wrote in a preview note. “Longer term, we believe Amazon’s rapidly growing scale of investment is strengthening its competitive barriers, and we continue to see the company as having the most robust and durable growth outlook.”

Goldman Sachs analyst Heath Terry wrote that despite concerns over growth and the health of the consumer, “We believe share gains at Amazon [both retail and AWS] and the number of opportunities for investment present more than enough runway for consolidated growth to remain above investors’ key 20% benchmark.”

Amazon gave a disappointing forecast for the holiday quarter in October, although it alleviated some of these concerns when it subsequently touted a record-breaking holiday season. The stock, long one of the top-performing internet names, is up more than 20% from a December low, although it remains down nearly 20% from record levels hit in September.

Beyond the numbers, this quarter also could contain a personal element as founder and CEO Jeff Bezos recently announced that he and his wife, MacKenzie, were divorcing, raising potential questions about whether the settlement will impact his control of the company.