Bloomberg News

Biden Makes $11 Billion Push to Beat China at Chip Research

[Stay on top of transportation news: Get TTNews in your inbox.]

The Biden administration’s efforts to revitalize the chip industry have mostly focused on doling out multibillion-dollar grants for domestic factories. But there’s a less-discussed side to the push: turning cutting-edge semiconductor research into a more enticing field for Americans.

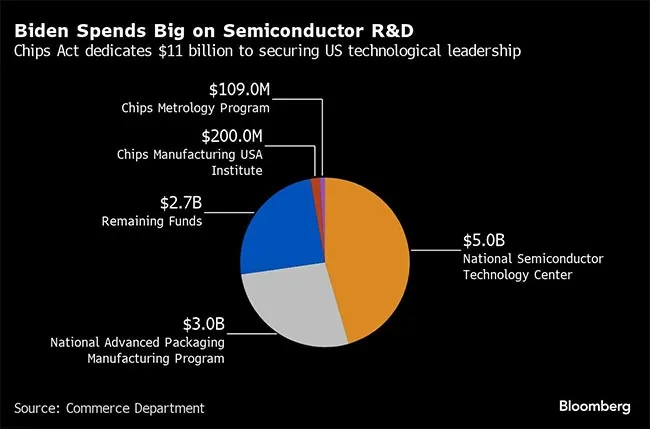

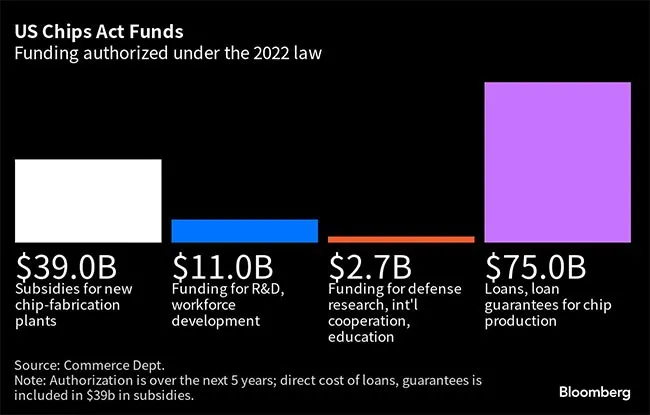

As part of the 2022 CHIPS and Science Act, the Commerce Department is spending $11 billion to boost U.S. leadership in research and development. The hope is to create the next generation of critical electronic components, and beat Beijing in the battle for advanced technology. That will involve everything from developing better measurement techniques for microelectronic materials to new strategies for what’s known as chip packaging — fitting the components together for use.

Officials have allocated nearly 85% of the CHIPS Act manufacturing incentives, including a $6.1 billion grant to Micron Technology Inc. set to be unveiled April 25. But they’re just beginning to open applications for R&D funding that some experts say could prove more critical in the long term.

Key to the effort is attracting a tech workforce that might otherwise choose to pursue artificial intelligence software or some other more fashionable area. But the endeavor has sparked questions over whether it has enough funding — or the right approach — to make that happen.

“We need to find out ways to make it easier for people to get into chip design in this country, rather than developing yet another app or yet another piece of AI software,” said Deirdre Hanford, who leads the new government-backed National Semiconductor Technology Center, or NSTC. The administration, she said, is “trying to build the economy and generate innovation.”

Money from the CHIPS Act helped fund the NSTC and a program focused on advanced packaging. The roots of this R&D push predate the pandemic, and it’s separate from $39 billion in production incentives for companies like Intel Corp. and Taiwan Semiconductor Manufacturing Co.

Those grants are just the first step toward keeping America’s chip economy healthy, said Daniel Berger, associate director of Commerce’s packaging effort. “The R&D program, which I’m part of, is to sustain it, keep it here,” he said.

The department has already funded some initial projects focused on metrology, or the science of measurement. Officials plan to create a piloting facility to transition new packaging technologies to large-scale production, plus programs for workforce development.

But key industry and academic groups are warning that the agency risks undermining its own goals. New guidance would allow the federal government to take over patents developed with the help of taxpayer dollars — and license those inventions to another entity. That’s a controversial approach.

This so-called march-in framework, unveiled in December, was born out of an effort to lower drug prices. But it affects all federally funded R&D, said Joe Allen, executive director of the Bayh-Dole Coalition, named for the 1980 law that lets organizations own, patent and sell products created with public R&D money.

The draft policy will “undermine interest” in CHIPS Act R&D programs, wrote the National Association of Manufacturers, “at a time when China has prioritized becoming a leader in the products and technologies of the future.” The National Venture Capital Association said that “VCs are questioning their involvement and investment in programs produced from your marquee legislation.”

Those sentiments were echoed by the Technology Councils of North America, Duke University and the innovation foundation at Ohio State University — the flagship school nearby a massive proposed Intel factory.

A representative for the Commerce Department said it has seen “significant interest from industry and academia in securing CHIPS program funding and delivering on the goals of the CHIPS program, including adhering to public-funding requirements.”

The department originally intended to supplement its $11 billion investment with a separate program for commercial R&D, leveraging money from $39 billion in manufacturing subsidies.

But those plans are on ice after the Pentagon pulled out of an agreement to spend $2.5 billion on military chips. Congress directed the Commerce Department to cover that funding shortfall itself. That led to a weekslong scramble, according to people familiar with the matter, as officials tried to reapportion the pool of incentive money.

They ultimately chose to scrap the commercial R&D program, citing “recent direction from Congress in the latest appropriations law” — and the fact that CHIPS Act funding is already insufficient to cover overwhelming demand.

Want more news? Listen to today's daily briefing above or go here for more info

That has led to some fallout in the chip industry. Applied Materials Inc., the largest U.S. maker of semiconductor equipment, is reconsidering a planned $4 billion R&D investment in Silicon Valley, the San Francisco Chronicle reported. The company said in a statement that it encourages the Biden administration and Congress to find a path forward to fund commercial R&D with the CHIPS Act.

“Without robust support for commercial R&D, we risk our global leadership and ability to outpace our foreign competitors in the semiconductor industry,” California Gov. Gavin Newsom and Sen. Alex Padilla (D-Calif.) said in a statement. The $11 billion R&D fund “cannot replace direct commercial investments.”