BP Breaks From Peers to Unleash Cash Bet on Oil Staying High

BP is gearing up to leave European competitors in the dust, at least when it comes to spending the oil industry’s enormous cash pile.

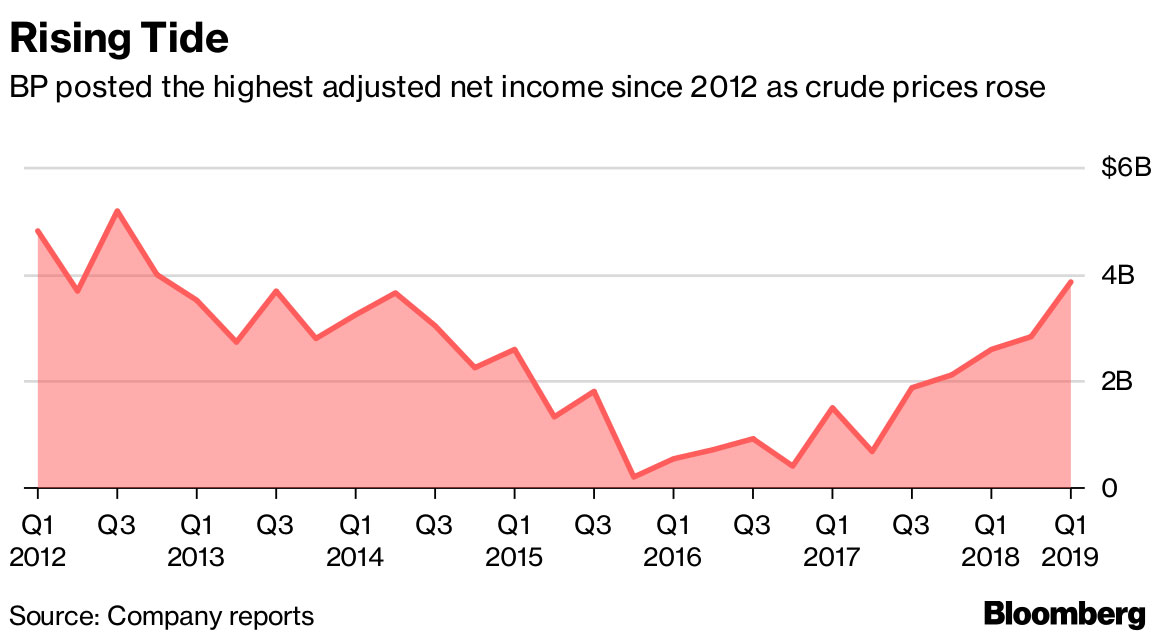

While Total SA and Equinor ASA signaled last week they still are keeping a tight rein on spending, BP showed Oct, 30 it is prepared to take some risks. After smashing earnings estimates in the third quarter, the U.K. oil major reversed a plan to issue new equity to fund a $10.5 billion acquisition, saying it will do it all in cash instead.

The turnaround follows a 14% surge in benchmark crude prices this year to more than $75 a barrel, which has swelled cash reserves among producers and boosted confidence after the worst market slump in a generation. At BP, that tipped management in favor of an all-cash deal.

“The thing which has helped get us over the line is that in the last four months, prices have firmed,” Chief Financial Officer Brian Gilvary said. “We do see oil prices staying pretty firm around $70.”

BP shares soared the most in two years earlier Oct. 30 as investors saw the sense in a cash deal. The company is committed to buying the package of U.S. shale assets from BHP Billiton Ltd. anyway, and there are fewer logistical costs from using cash than from issuing shares. Nevertheless, the move does include some risks.

In early 2019, with the cash spent, BP’s ratio of debt to equity —or gearing — could rise above its targeted limit of 30%. The company will dispose of as much as $6 billion of assets to reduce that figure, but a separate divestment program has seen slow progress this year.

BP has ticked off about $400 million in asset sales out of a $3 billion target for 2018. Gilvary said the company is certain it will meet that goal and that it will complete the separate $5 billion to $6 billion program, which mostly consists of aging onshore fields in the U.S. Lower 48 states.

“We know we already have multiple bidders on all of those assets, and we are looking in terms of breaking it up into a significant number of parcels,” he said in a Bloomberg television interview. “So we’re pretty confident we’ll have no issue with that.”

He also expects tightening global oil supplies to keep prices strong, meaning a good valuation for the assets. Investors will hope he’s right, since a fresh market slump could leave BP highly leveraged with no clear exit ramp. The kind of downturn seen in 2014-16, before the Organization of Petroleum Exporting Countries and its allies cut production, could upend the company’s calculations.

“BP needs current OPEC-led management of oil markets to prevail,” Alastair Syme, an analyst at Citigroup Inc. in London, said in a note to clients.

For the U.K. energy giant, which finally is emerging from the 2010 Deepwater Horizon disaster — a catastrophe that cost it more than $65 billion — a small dip in the oil price can be managed, according to Gilvary. He said it would take a major correction to really trouble him, and that’s unlikely.

“We’re confident that we have all the tools and equipment to be able to manage any sort of liquidity crisis going forward,” he said. “I think we’ve demonstrated that.”