Bloomberg News

Cargill Revenue Down as Trader Struggles With Profit Targets

[Stay on top of transportation news: Get TTNews in your inbox.]

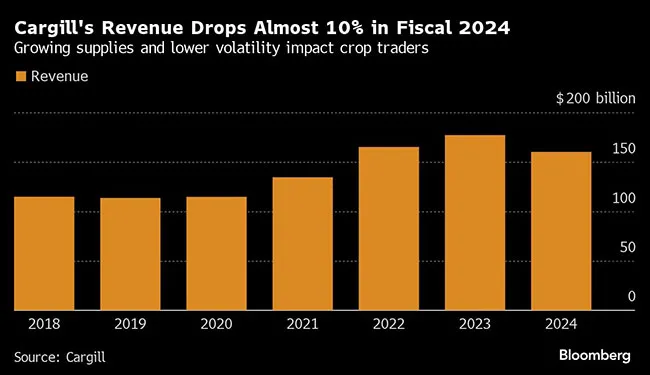

Cargill Inc. took a revenue hit of almost 10% in its most recent fiscal year, a decline that comes amid signs of profit struggles at the world’s biggest crop trader.

Revenue for the 12 months that ended in May fell to $160 billion, compared with about $177 billion in the prior period, the closely held Minneapolis-based company said Aug. 13 in its annual report. The drop came after two straight years of record sales.

While lower revenue isn’t always a sign of concern for commodity traders, which can make money even as markets decline, the figure comes as CEO Brian Sikes is streamlining operations after missing profit targets — his first big shakeup since taking the helm at what has been long considered America’s largest private company.

Cargill ranks No. 18 on the Transport Topics agriculture and food processing carriers list.

Cargill is reducing the number of business units to three from five as a part of its 2030 strategy, and less than a third of Cargill’s businesses reached their earnings goal in fiscal 2024, Bloomberg reported last week. The company, which stopped releasing its full results publicly during the pandemic, is also paying smaller bonuses as a result of the missed targets.

Bumper global harvests have squeezed profits for agricultural commodities traders such as Cargill. Rivals Archer-Daniels-Midland Co. (No. 74 on the TT Top 100 private carriers list and No. 9 on the ag and food processing list) and Bunge Global SA — which make up the so-called ABCDs of global agriculture commodity trading alongside Louis Dreyfus Co. — recently reported shrinking earnings.

Grain traders are under pressure from ample supplies, reversing the windfalls from previous years, when crop losses and Russia’s invasion of Ukraine sent prices surging. Margins from processing soybeans into meal and oil — a key earnings driver — have also eroded.

For Cargill, the squeeze in margins was also compounded by the smallest American cattle herd in seven decades. The trading giant had spent much of the past decade turning itself into the country’s third-largest beef processor — a bet that paid off during the leadership of former CEO David MacLennan but that was just starting to sour when Sikes took over in January 2023.

Want more news? Listen to today's daily briefing below or go here for more info: