China Puts US Soy Buying on Hold as Tariff War Escalates

China, the world’s largest soybean buyer, has put purchases of American supplies on hold after the trade war between Washington and Beijing escalated, according to people familiar with the matter.

State-grain buyers haven’t received any further orders to continue with the so-called goodwill buying and don’t expect that to happen given the lack of agreement in trade negotiations, said the people, who asked not to be identified because the information is private. Still, China has no plans to cancel previous purchases of American soybeans, the people said.

President Donald Trump escalated his trade war with China earlier this month, ramping up tariffs on about $200 billion of Chinese goods, prompting Beijing to retaliate with further duties of its own. Trump and his counterpart, Xi Jinping, are expected to meet again at the end of June for the G-20 summit, when some analysts predict a potential resolution.

Soybean futures in Chicago slumped to a 10-year low earlier this month as the tensions peaked. Since then, prices have rebounded as a deluge of rain roils U.S. plantings.

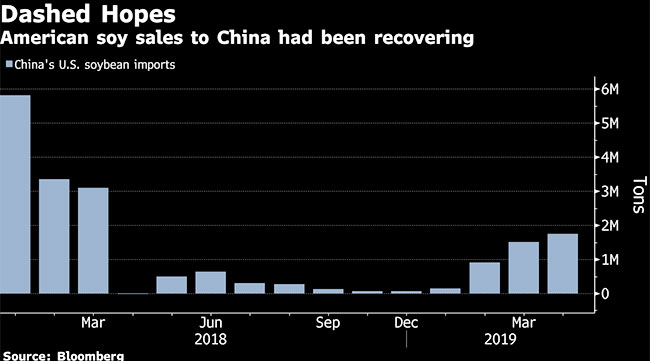

Government data indicate China bought about 13 million metric tons of American soybeans after the countries agreed to a truce in December, in a move that showed goodwill toward getting the trade dispute resolved. While U.S. Agriculture Secretary Sonny Perdue said in February that China had pledged to buy an additional 10 million tons of American soy, purchases now have stopped.

USDA data also showed that China is yet to take delivery of about 7 million tons of U.S. soybeans that it has committed to buy in the current marketing year.

Spokesmen for state-run buyers Cofco and Sinograin had no immediate comment.

Clamping down on U.S. soybean purchases is a direct strike at Trump’s political base. In the 2016 election, Trump carried eight of the 10 states with the largest soybean production, all of them in the Midwest. Iowa, the country’s second-largest soybean producer after Illinois, swung from Democrat to Republican in 2016 and could swing back again in 2020.

The trade war with China is compounding the strain of five years of falling commodity prices and losses from spring flooding across the Midwest. Overall, U.S. farm income dropped 16% last year to $63 billion, about half the level it was as recently as 2013.

China has reportedly halted purchases of American soybeans in another chess move in the escalated trade war with the U.S. https://t.co/h0nhYeleNK — CNBC (@CNBC) May 30, 2019

The president moved to shore up support in rural America immediately as he escalated the trade dispute earlier this month, announcing on the same day a new round of trade aid for farmers. The U.S. Agriculture Department said the aid package would total $16 billion.

There are signs China is replacing U.S. soybeans with Brazilian supplies. The premium paid for soybeans loading at Paranagua port more than doubled over the past month as the pace of exports has accelerated in the past weeks.

“Brazil will supply China almost exclusively from now on,” said Pedro Dejneka, a partner at Chicago-based MD Commodities.

China also is grappling to contain a deadly swine disease outbreak in its hog herd, curbing demand for livestock feed. Soybeans are a key component of the rations, and Rabobank estimates about 30% of the nation’s pork supply has been lost.