Staff Reporter

January Truck Orders Fall Back Below Prior Year Results

[Stay on top of transportation news: Get TTNews in your inbox.]

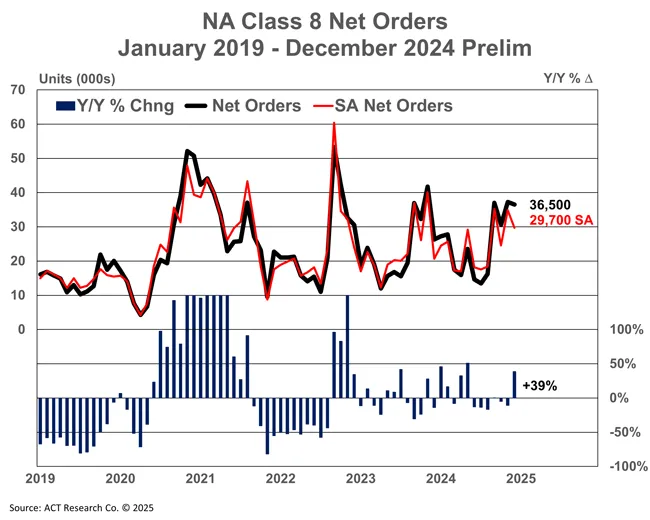

North American Class 8 truck orders in January remained below prior-year comparisons after a short-lived uptick the prior month, according to ACT Research.

Preliminary data showed orders declined 5.1% to 25,800 units and dropped 30% sequentially when compared with December. The back half of last year mostly trended below prior-year comparisons but ended on a predictable uptick. That has since settled back to another year-over-year decline.

“While January orders took a step down from the recent trend, strength continues to be the applicable descriptor of Class 8 order activity,” said Kenny Vieth, president and senior analyst at ACT Research. “While down narrowly from last January, orders were down 30% against a seasonally stronger December. Seasonally adjusted, Class 8 orders fell 22% from December to 23,300 units.”

ACT Research data also showed that orders have been booked at a 32,000-unit seasonally adjusted annual rate (SAAR) over the past six months. Vieth also briefly touched upon medium-duty, with orders continuing a slowly deflating trajectory into still historically elevated backlogs.

“While January orders reflect typical seasonal patterns, we’re seeing continued strength in vocational segments and growing fleet optimism about market recovery,” Mack Trucks North American President Jonathan Randall said. “Our customers remain focused on efficiency and productivity.”

(Act Research)

FTR Transportation Intelligence reported Class 8 preliminary net orders for January decreased 15% year over year to 24,000 units. There also was a sequential decline of 28%, with the report noting was below seasonal expectations. The positive momentum that held throughout the beginning of the current order season appears to be facing headwinds due to the looming threats of tariffs among trading partners in North America.

“A 25% U.S. tariff on imports from Canada and Mexico — currently paused for trade negotiations through early March — and a 10% tariff on Chinese imports as of Feb. 4 could significantly increase costs for North American Class 8 trucks and parts if fully implemented and enforced indefinitely,” said Dan Moyer, senior analyst, commercial vehicles at FTR. “Combined with upcoming U.S. EPA 2027 NOx regulations, tariffs could accelerate or delay fleet upgrades.”

Want more news? Listen to today's daily briefing below or go here for more info: