Staff Reporter

Class 8 Truck Orders Decline 5% in October

[Stay on top of transportation news: Get TTNews in your inbox.]

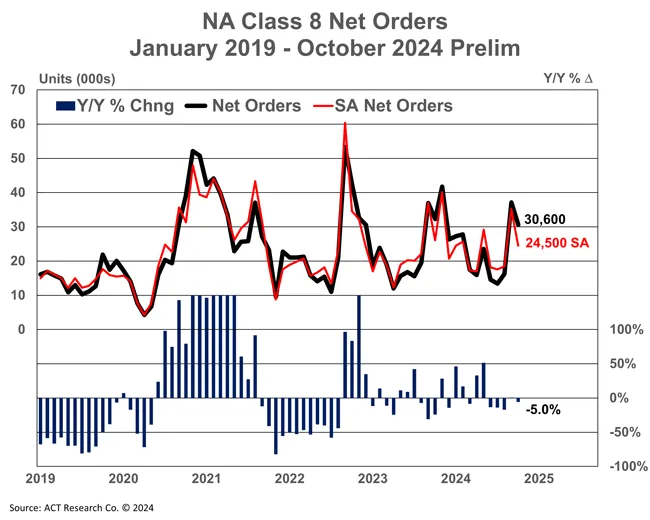

North American Class 8 truck orders took another year-over-year tumble in October, the latest drop in an up-and-down year, according to ACT Research.

Preliminary data showed orders declined 5.2% to 30,600 units, marking the fifth month in 2024 where orders fell on an annual basis. Orders have risen on an annual basis an equal number of months this year. For October, orders fell 17.5% sequentially compared with September.

“After a strong start to the opening of 2025 order books in September, medium-duty and heavy-duty orders took a step back in October,” said Kenny Vieth, president and senior analyst at ACT. “On a seasonally adjusted basis, Class 8 orders fell 30% from September to 24,500 units, a 294,000 [seasonally adjusted annual rate].”

Medium-duty orders also posted an annual decline, falling 27% compared with October 2023. The drop was notable since the sector has been on a steady but slowly deflating trajectory over the past several years. Still, ACT stressed that one month doesn’t necessarily indicate an overall trend.

(ACT Research)

Mack Trucks North America President Jonathan Randall noted that the vocational market is holding firm despite market shifts.

“While we’re seeing some expected adjustments in overall order levels, the strength in the straight truck segment reflects the robust construction sector, particularly in government infrastructure projects and construction spending,” he said. “This diversification in demand, coupled with Mack’s strong position in the vocational market, continues to provide opportunities even as the freight sector works through its current cycle.”

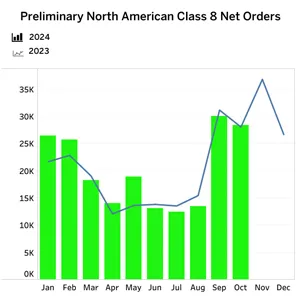

(FTR Transportation Intelligence)

FTR Transportation Intelligence reported that Class 8 preliminary net orders for October increased 2% year over year to 28,300 units, but posted a sequential decline of 14%. The figure fell somewhat short of seasonal expectations, with the average October order level over the last seven years being 33,940 units.

“This month, OEMs saw a drop [month-to-month] in total market demand, but there was inconsistency, as some experienced increases in orders and others saw declines,” said Dan Moyer, senior analyst of commercial vehicles at FTR. “The on-highway market showcased a notable jump in demand, softening the blow from the declines observed in the overall vocational sector.”

FTR concluded that the October figure can be considered healthy given continued stagnation in the truck freight market, but noted it suggests that some fleets are being cautious as they look toward ordering new trucks for 2025.

“Despite a sluggish freight market, fleets have sustained their investments in new equipment, albeit primarily at replacement demand levels thus far in 2024,” Moyer said. “We anticipate a slight uptick in October backlogs once the final Class 8 market data is released later this month. With inventory levels remaining close to record highs, we also foresee continued downward pressure on production rates through the remainder of 2024.”

Want more news? Listen to today's daily briefing below or go here for more info: