Staff Reporter

Efficient Use of Space Is Key in Weak Freight Market: Study

[Stay on top of transportation news: Get TTNews in your inbox.]

Over-the-road carriers waiting for an upturn in the freight cycle must concentrate on making the most efficient use of their trucks’ space to best ride out ongoing market weakness, according to the Council of Supply Chain Management Professionals.

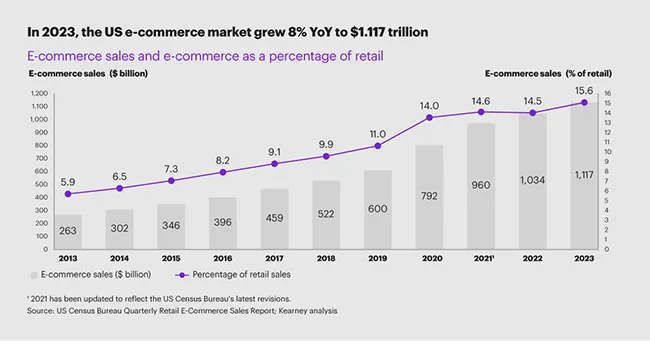

In the trade group’s 35th annual State of Logistics Report, CSCMP said persistently sluggish demand and excess capacity remain, even as the freight sector is showing some green shoots of recovery. One of those green shoots is the e-commerce sector; the U.S. e-commerce market grew 8% year-over-year in 2023 to $1.117 trillion, achieving 15.6% of retail sales compared with 14.5% a year earlier, the report found.

Factors the report cited for holding back a more broad-based recovery include simultaneous geopolitical conflicts around the globe; high inflation; high interest rates; climate change and, apart from the U.S., sluggish demand. As a result, CSCMP said the most successful carriers will be those that can mitigate these factors by focusing on capacity optimization rather than rates, including collaborating with shippers and third-party logistics providers to minimize empty miles.

The report noted that digital freight-matching tools can help fleet operators supplement their own volume with that of third-party shippers, enabling higher levels of utilization and filling of deadhead miles. Options include route optimization software that minimizes such empty miles; advanced bidding tools to swiftly mobilize deals and secure favorable rates; and integrated transportation management systems, it added.

E-commerce sales continue to rise. (Council of Supply Chain Management Professionals)

According to a Bloomberg-Truckstop survey released in May, sentiment among North American carriers operating in the spot truckload market improved in the first quarter of 2024. For the time being, though, shippers retain an advantage over carriers, CSCMP said, with lingering opportunity to retain lower rates, diversify and reset their carrier portfolios, and boost the resilience of their logistics. Freight rates are unlikely to rise until the second half of 2024 at the earliest, the CSCMP added.

Spending by shippers slumped 27.9% year-over-year in the first quarter of 2024, according to the U.S. Bank Q1 2024 Freight Payment Index. Spending also fell 16.8% compared with the fourth quarter of 2023. Shipments declined 21.6% year-on-year, the U.S. Bank report showed.

When a turn in the market does arrive, CSCMP projected that carriers best positioned to take advantage will be those with an established record for consistent service and that have continued investing in making efficient use of available capacity.

Moses

“Our customers, as well as the industry, continue to face significant challenges in maintaining both a consistent and cost-effective supply chain,” said Andy Moses, senior vice president of sales and solutions for Penske Logistics, which sponsored the report. “Investing in technologies to help improve agility and resilience will better position organizations and the industry as a whole to seamlessly navigate future disruptions.”

More than 1,500 freight brokers and 25,000 asset-based carriers exited the market in 2023, a trend that has continued into 2024, CSCMP said.

What may also make a longer-term recovery tougher for carriers is a trend among larger shippers to monetize their own logistical capabilities, CSCMP said. Such moves tend to blur the traditional distinction between shippers and 3PLs and brokers, some of whom are also adapting by offering asset-heavy services such as truck fleet management or drop trailers, it said.

🚛 The 2024 State of Logistics Report® is here! Discover the trends and insights shaping the logistics sector. Produced by CSCMP and Kearney, presented by Penske Logistics. 🌍📈 Download today: https://t.co/oxmG4NYo1b pic.twitter.com/USWBnniv3g — cscmp (@cscmp) June 18, 2024

Among the trailblazers, the theory is to look at logistical functions as a whole and redesign them with an eye not only toward cost reduction, but also the unleashing of capacity, according to CSCMP. Few companies have reached this level of innovation, but more are getting there, it said. This “4PL” ideal of end-to-end supply chain management is within the grasp of some of the largest players, the study’s authors said, with Amazon closest to the goal.

Amazon ranks No. 1 on the Transport Topics Top 100 list of the largest logistics companies in North America and No. 9 on the TT Top 100 private carriers list.

For the rest of the segment, a fuller capitalization of technology able to improve coordination is necessary, the study found. Route optimization, rate shopping, automated dispatch, inventory calibration, cargo tracking and other essential network functions all are necessary, it said.

Want more news? Listen to today's daily briefing below or go here for more info: