Managing Editor, Features and Multimedia

Cummins Maintains Engine Share Lead, But Continues to Lose Ground to OEMs

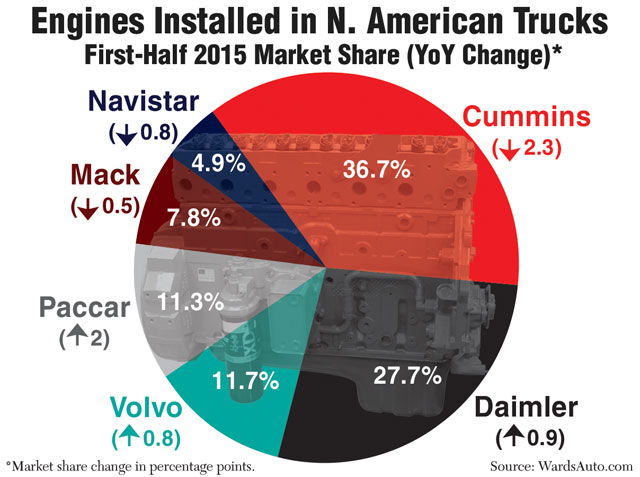

Truck makers sold more of their own engines in the first half of 2015 as they continue to encroach on Cummins Inc.’s industry-leading market share.

In-house engines accounted for 63.3% of the 165,810 diesel engines installed in new Class 8 trucks built in North American factories through June, according to WardsAuto.com.

The rest were supplied by Cummins, the industry’s only third-party engine manufacturer. The company’s first-half market share slipped to 36.7%, compared with 39% in the first six months of 2014 and 41.1% in the same timeframe in 2013.

Original equipment manufacturers Daimler Trucks North America, Volvo Group and Paccar Inc. each expanded their share of the engine market.

Larry De Maria, an industry analyst at William Blair & Co., said Cummins is performing “in line with expectations,” but predicted that its heavy-duty market share will continue to drift lower, especially as OEMs ramp up production of their own engines.

“We’ll find some equilibrium once some of the supply constraints and capacity constraints are alleviated for the vertically integrated manufacturers,” he said, predicting that Cummins’ market share would likely settle somewhere in the low- to mid-30% range.

De Maria also cited increasing interest in vertically integrated 13-liter engines, although the choice is highly dependent on the customer’s duty cycle.

All engine makers posted higher unit volumes than a year ago as total shipments climbed 19% in the first half of 2015.

Cummins sold 60,783 engines for heavy-duty trucks, up 12% from 54,155 a year ago.

While some truck makers continue to tout the benefits of vertically integrated powertrains, Cummins sees a continued need for different engine options, said Amy Boerger, vice president of Cummins’ North American engine business.

“Choice is critical for the industry as applications, duty cycles and job functions are so diverse that the ability to properly spec the engine and chassis to best meet the specific needs of a customer’s business is necessary,” Boerger said.

Nonetheless, Cummins also is focusing more on powertrain integration, as evidenced by its collaboration with transmission maker Eaton Corp. on the SmartAdvantage powertrain, she said.

Cummins is not seeing any significant shift in preference for big-bore versus medium-bore engines, Boerger said. In addition to its flagship 15-liter ISX15, the company also offers 12-liter engines powered by either diesel or natural gas.

Daimler Trucks captured 27.7% of the North American engine market in the first half, up from 26.8% a year earlier. The company’s Detroit subsidiary supplied 43,787 engines for Freightliner and Western Star trucks, a 24% increase from a year ago. Daimler also installed 2,090 Mercedes-Benz engines, up 3% year-over-year.

Paccar Inc. posted the industry’s largest gain. The company’s share grew to 11.3% from 9.3% as sales of its MX-13 engines surged 45% to 18,757 units.

Paccar installed its engines in 39.8% of the company’s Kenworth and Peterbilt trucks, a gain of

6.2 percentage points from a year ago. The remaining 60.2% were equipped with Cummins engines.

Ken Hastings, head of investor relations at Paccar, said the heavy-duty market is split about evenly between 15-liter and 13-liter engines, implying a current market opportunity of about 50% penetration for the MX-13 in Kenworth and Peterbilt models.

“We expect that mix to shift more toward 13-liters in the future as part of a long-term customer trend toward lower-displacement engines,” he said.

Volvo Trucks’ engine market share rose to 11.7%, from 10.9% a year ago, as its engine sales climbed 28% to 19,356 units.

“We see customers increasingly spec’ing the 13-liter Volvo D13 and 11-liter Volvo D11 engines as they continue to focus on fuel efficiency and weight,” said John Moore, Volvo Trucks’ powertrain product marketing manager.

Mack Trucks captured 7.8% of the total market, down from 8.3%. The company sold 12,987 of its MP engines, up 13% from a year earlier.

Stu Russoli, Mack’s highway and powertrain products marketing manager, predicted that the industry’s movement toward vertical integration will continue.

“We remain committed to integration because we believe it is key to meeting our customers’ needs through increased fuel efficiency, higher performance and lower maintenance costs,” he said. “Because we’re designing and building all of the powertrain components and the vehicle, we’re able to share 100% of the data, 100% of the time between the many electronic control modules found in today’s heavy-duty trucks.”

Navistar Inc.’s engine market share slipped to 4.9%, from 5.7%, but its sales volume edged up 2% to 8,050 units.

The company installed its own engines in 37.9% of its International trucks, up from 36.9% a year ago, with the remainder featuring Cummins engines.

While some OEMs focus on proprietary equipment, Navistar has taken a different approach, choosing instead to emphasize its collaboration with third-party suppliers such as Cummins. Navistar renewed its partnership with Cummins in 2012 as it transitioned to selective catalytic reduction technology to meet emissions standards.

Since then, Navistar has quietly rebranded its own 9-, 10- and 13-liter engines under the “N-Series” moniker, moving away from its previous MaxxForce brand.

Navistar spokesman Steve Schrier said the company is focused on selling International trucks, regardless of engine choice.

“We believe we have the best 15-liter option available for customers [in the Cummins ISX15] and the best 13-liter option [in the N13],” he said.