Senior Reporter

Cummins Is Top Overall Supplier of Class 8 Engines in First Half of 2019

[Stay on top of transportation news: Get TTNews in your inbox.]

Independent engine maker Cummins Inc. supplied a leading 35.8% of the diesel engines used in the first half of 2019, amid an expanding market, WardsAuto.com reported, based on data that differed from the prior year.

The report breaks Class 8 engines into two segments, 10 liters and over, and under 10 liters. Cummins’ dominance with its smaller L9 engine ensured it posted the overall lead.

Detroit Diesel Corp. posted a narrow lead in the number of engines 10 liters and over.

“We are seeing growing customer acceptance of our integrated solutions including with numbers as high as 95% with Detroit engines in the new Cascadia. Customers value the integration we can provide,” said Kelly Gedert, director of product marketing for Freightliner trucks and Detroit components.

“We also know our customers value choice in offering the right products to meet their specific application and our portfolio includes the solutions from our partners such as Cummins, Allison and Eaton,” she added.

The Ward’s data this period reflected reporting changes involving Mexico, which included only trucks to U.S. and Canada. “The Mexico domestic and export to other [countries] data is no longer available. Due to these reporting changes, data for total North America is not comparable to prior years,” according to the report.

The industry’s clear choice, however, between truck makers’ proprietary powertrains and Cummins’ engines remained in play, and shows no signs of changing, a Cummins executive said.

"I think it has been that way for a while and will continue to be for the foreseeable future,” said Rob Neitzke, Cummins’ executive director for North American truck OEM business, told Transport Topics.

“But the main headline for us is that the Mexico domestic and export to other countries’ data — like to Colombia, Ecuador and Peru — that data is no longer available from Ward’s. The Mexico market is a 15,000-unit market. It is not insignificant,” Neitzke said. “Cummins does really well down there. We are anywhere from 60% to 80% depending on the reporting period. So to take that volume out of the number is basically to underreport and represent Cummins’ share. That’s why we haven’t been looking at it as closely as we have in previous years.”

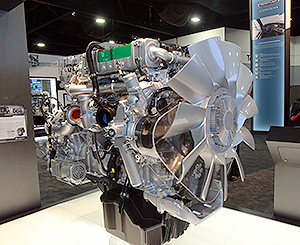

A Detroit DD8 engine on display at an industry show. (John Sommers II for Transport Topics)

Ward’s noted Freightliner data was incomplete for North America, too. Freightliner is the largest user of engines from Detroit Diesel Corp., and both are units of Daimler Trucks North America.

Ward’s explained that the provider of the data it uses stopped giving it the full export destinations from Mexico.

Meanwhile, Ward’s found the total number of Class 8 diesel engines installed in the first half of 2019 reached 171,292, up from 141,474 a year earlier.

Cummins supplied 61,358. Detroit Diesel provided 51,023, or 29.8%.

The figures come from a Ward’s report on North American factory sales of heavy-duty trucks, including their engines, released July 31. Factory sales are the transactions between the factory and the dealers.

In the segment for engines 10 liters and over, Detroit Diesel pulled down a leading 31.9% share with 50,320 engines. Trucks from Freightliner and Western Star, also a DTNA brand, used the engines.

Cummins was right behind, with a 31.2% share with 49,260 engines, which were used by all truck makers.

Volvo engines — used exclusively in trucks from Volvo Trucks North America — were third with a 12.3% share, or 19,419 engines.

Paccar Inc. was next with 18,660 engines, or an 11.8% share, for its Peterbilt Motors Co. and Kenworth Freight Co. truck brands.

When you equip your truck with a #DT12, you also get Intelligent Powertrain Management 6 (IPM6). IPM6 standard feature, which becomes available September 9th, integrates pre-loaded terrain maps and GPS into engine and transmission functions to help you predict the route ahead. pic.twitter.com/jZ8Z5YjL4O — Detroit (@DemandDetroit) August 14, 2019

Paccar is adding machining and assembly equipment in the Columbus, Miss., engine plant to increase capacity 10% to 20%. “The MX engine, MX-11 and 13 engines are doing really well,” Paccar CEO Preston Feight said during a recent earnings conference call.

Paccar’s truck brands combined also were the largest users of the heavier Cummins engines, accounting for 59.3% of the total, or 29,215.

Mack Trucks used 14,807 engines 10 liters and over, good for a 9% share.

International used 5,166 of its own engines, good for a 3% share. International also used the second-most number of heavier Cummins engines, 14,530, or 29.4%.

“Cummins X15 engine is the main product we have in that 10-liter-and-over segment,” Neitzke said.

The company introduced the X15 engine in July 2016. The X12 became available in 2018. The L9 was introduced in 2017.

“The X12 is really the springboard from where we are now to grow even more,” Neitzke said. “We feel it’s a really nice complement to the X15, which is going into the heavy-haul and longhaul segments — that’s about half of this Class 8 market, and it is really well-positioned there.”

At the same time, in Class 8 engines under 10 liters, Cummins’ L9 earned an 88% share with 12,908 engines out of 13,654.

Freightliner used the most from Cummins in the lighter category, 7,406.