Deere Expected to Report Weakest Q4 Since 2020

[Stay on top of transportation news: Get TTNews in your inbox.]

Deere & Co., the world’s largest farm machinery maker, is set to report what could be its worst fourth quarter since 2020, wrapping up a challenging period for the sector hit by a slumping farm economy.

The industry has been suffering from two years of sales dropping from peak levels of 2022, when Russia’s invasion of Ukraine sent crop prices soaring and gave farmers more to spend on gear. While some traders and executives are looking for improvement from falling crop prices, there is widespread uncertainty over the impact of President-elect Donald Trump’s policies.

The maker of the iconic green and yellow tractors on Nov. 21 is expected to report adjusted earnings of $3.87 per share for the quarter, the lowest in four years, according to analyst estimates. Net income for the following fiscal year could drop to $5.83 billion from about $7 billion this year.

Deere’s results come after rival manufacturers CNH Industrial NV and AGCO Corp. reduced their sales outlooks earlier this month as quarterly results missed estimates. CNH said it plans to cut production further as dealer inventories remain too high.

(Bloomberg)

Sales of agricultural tractors continued their decline in October, with U.S. sales falling about 14% from the previous year, the Association of Equipment Manufacturers said in a report.

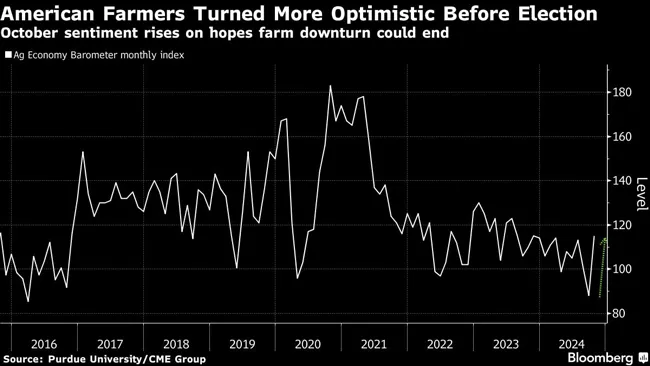

Still, CNH said it expects 2025 to be the bottom of the cycle. Farmer sentiment also bounced in October, according to Purdue University and CME Group’s Ag Economy Barometer. Producers “expressed some optimism that economic conditions will improve and not precipitate an extended downturn in the farm economy,” the barometer stated.

Deere shares recently turned higher for the year on hopes for a rebound in the sector.

Trump’s election remains a wild card, though, and investors will be watching for clues on how his second term may change the agricultural landscape. He has threatened tariffs on any products Deere starts making in Mexico, while intensified trade wars could also disrupt agricultural markets.

Want more news? Listen to today's daily briefing below or go here for more info: