Diesel Drops 3.3¢ for First Decline in 21 Weeks

[Stay on top of transportation news: Get TTNews in your inbox.]

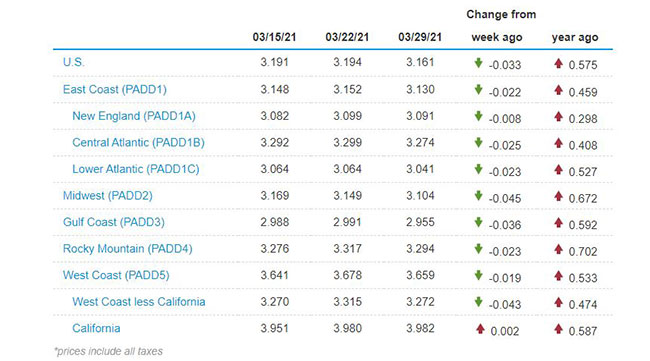

The national average price of a gallon of diesel dropped 3.3 cents to $3.161 a gallon, according to Energy Information Administration data released March 29.

Oil industry analysts Tom Kloza, the founder of the Oil Price Information Service, and Phil Flynn, author of the Energy Report, disagree on where prices may be going the rest of the year.

Kloza told Transport Topics that the recent run-up in gasoline and diesel prices since last fall might have reached its high point of the year. He expects prices will hold steady or possibly level off somewhat, even as the traditional vacation season starts and COVID-19 restrictions continue to be loosened.

Highlights

- The decline is the first for diesel in 21 weeks, with the most recent decline being Nov. 2, when it slipped 1.3 cents from the week before.

- Since Nov. 2, a gallon of diesel had climbed 82.2 cents until this week’s drop.

- Diesel still costs 57.5 cents more a gallon than it did at this time last year.

- Trucking’s main fuel fell in nine of the 10 regions in EIA’s weekly survey, with the largest being 4.5 cents in the Midwest. Only California, at two-tenths of a cent, showed an increase.

- Gasoline dropped by 1.3 cents per gallon to reach $2.852.

“Diesel has been very weak, and gasoline has been kind of steady, and probably wobbling just a bit on the retail side, and that’s going to run its course here in the next few weeks or so,” Kloza said. “The weakest demand period of the year globally for diesel tends to be May, and April is not so hot.”

Flynn told TT that he anticipates higher fuel prices as Texas oil refineries come back to full capacity after the severe February freeze shut many of them down. Annual production requirements that those facilities produce so-called summer-blend gas, which causes less evaporation, also are a factor. Summer-blend gas also contains less butane, a relatively cheap additive that makes it easier for cars to start in cold weather.

Flynn sees gas and diesel prices remaining at least where they are and possibly going up as demand increases and the economy improves.

“Gasoline demand is coming back. It’s not where it was pre-COVID. But, it’s been fairly solid,” he said. “Last week, gasoline demand hit 8.61 million barrels per day. A year ago, we were at 8.83 million barrels per day. Even though we’re not driving to work, the consumption numbers have been pretty impressive. And, our expectation is as more people become vaccinated, those numbers are going to go up.”

U.S. On-Highway Diesel Prices

EIA.gov

Flynn anticipates what he calls “healthy demand” as motorists take to the road for vacations after Memorial Day.

The latest Baker Hughes rig count shows domestic oil production continues to increase slowly. A March 26 report showed the number of operating rigs increased by six to 417 from the previous week. A year ago, 728 rigs were operational. Texas, the nation’s leading oil-producing state, saw its rig count increase by three to 205.

Baker Hughes ranks No. 66 on the Transport Topics Top 100 list of the largest private carriers in North America.

The price of West Texas Intermediate crude, the industry’s benchmark, again is trading in the $60-a-barrel range after reaching $66.08 on March 5. The 8% drop in price comes as the latest Dallas Federal Reserve Energy Survey, released March 27, showed the so-called break-even price for WTI is $52 a barrel, up from $49 at this time last year.

The Fed’s Business Activity Index was up 18.5% to 53.6 in the fourth quarter of 2020, reaching its highest level in the survey’s five-year history.

Plante

“Our latest survey results show the oil and gas industry starting 2021 on a positive note,” Dallas Fed Senior Research Economist Michael Plante said. “Business activity grew strongly, and survey respondents reported a dramatic improvement in their outlook. For the first time in two years, there were more firms reporting increased employment than job cuts.”

EIA’s March 31 report shows just how much the cold weather in Texas and other parts of the Southwest in February impacted energy production

“Fuel ethanol production fell to the lowest levels since the onset of responses to COVID-19 in spring 2020,” the report said. “U.S. weekly fuel ethanol production fell to an average of 658,000 barrels per day during the week of Feb. 21, 2021, which was the lowest weekly production level since May 11, 2020, and 38% lower than at the same time last year.”

The report also said U.S. refining capability is moving up, now at 83.9% of capacity last week. That compares with 68.6% of capacity in mid-February.

Gas production increased last week, averaging 9.3 million barrels per day. Distillate fuel production increased last week, averaging 4.7 million barrels per day.

Want more news? Listen to today's daily briefing below or go here for more info: