Staff Reporter

Diesel Prices Dip to Average of $3.794

[Stay on top of transportation news: Get TTNews in your inbox.]

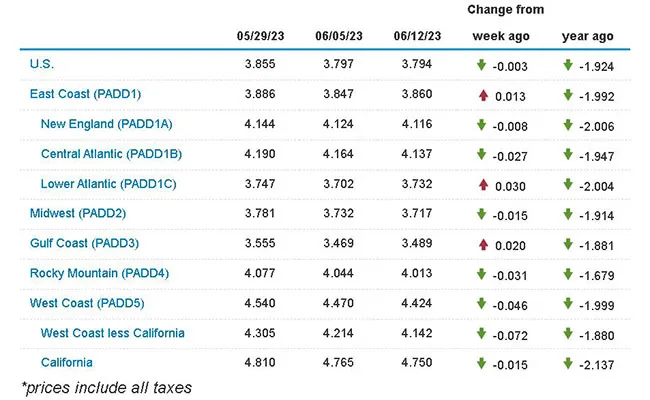

Diesel prices nudged slightly lower, dipping three-tenths of a cent to a national average of $3.794 a gallon, according to Energy Information Administration data released June 12.

With the modest decline, diesel prices have fallen every week since Jan. 30, except for a 1.8-cent rise April 17. The pace of the weekly decline was the slowest in eight weeks.

Average diesel prices have fallen 82.8 cents a gallon since Jan. 30.

Diesel prices on average have declined $1.924 a gallon from this time in 2022.

Diesel prices decreased in seven of the 10 regions in EIA’s weekly survey and increased in three. The largest drop was 7.2 cents a gallon in the West Coast less California; the largest gain was 3 cents in the Lower Atlantic.

Gasoline experienced a national average rise of 5.4 cents a gallon, and at $3.595, is just 19.9 cents a gallon cheaper than diesel.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Analysts say retail diesel prices could be close to finding a bottom after their long trek lower, somewhat mirroring wholesale markets, where a run of a couple of days higher or lower is being followed by the reverse.

Thompson

Front-month wholesale prices have traded in a range between $2.20 a gallon and $2.40 a gallon since the start of May. David Thompson, an executive vice president at Powerhouse, a brokerage based in Washington, said June 13 there has been buying of dips in the futures market, but it has not been sustained enough to break free of the top of the recent range.

Another reason supporting expectations of a steadying of on-highway prices is demand figures. EIA data shows a four-week moving average for distillate fuel oil demand of 3.848 million barrels a day at the end of the first week of June, compared with 3.825 million barrels a day in the same period a year earlier.

Refinery production has responded to this and demand from overseas, Rystad Energy Senior Downstream Analyst Janiv Shah said in an email. Demand from Europe, where Shah said output is being slowed by maintenance and outages, is meeting that production strength amid what the EIA said were the lowest distillate crack spreads since Russia invaded Ukraine.

Any upside may be limited though by ongoing weakness in freight markets and weakening bullishness about crude markets, even after Saudi Arabia promised a 1 million barrels a day cut in the OPEC kingpin’s oil output in July.

Hayden Cardiff, co-founder and chief innovation officer of Idelic, discusses predictive analytics software and scoring driver practices. Tune in above or by going to RoadSigns.ttnews.com.

This week saw renowned crude bull Goldman Sachs cut its December 2023 target for Brent, the global oil benchmark, by $9 a barrel to $86 a barrel, as well as dropping its West Texas Intermediate target by a similar amount to $81 a barrel. The bank cited extra supplies in the market from sanctioned nations such as Russia, Iran and Venezuela for its move.

And a weak domestic economy continues to sap away at demand from shippers. Arkansas-based carrier ArcBest said June 9 the slowdown in the general economy hurt customer order quantities and resulting shipment sizes in May compared with May 2022. In the weaker economic environment, ArcBest saw something of a boost from its less-than-truckload business, but demand was lower from its “core accounts,” the company said in a regulatory filing.

ArcBest’s assessment of the economy matched that of North Carolina-based carrier Old Dominion Freight Line Inc. a week earlier. Old Dominion and ArcBest rank No. 9 and No. 14, respectively, on the Transport Topics Top 100 list of the largest for-hire carriers in North America.

Want more news? Listen to today's daily briefing below or go here for more info: