Senior Reporter

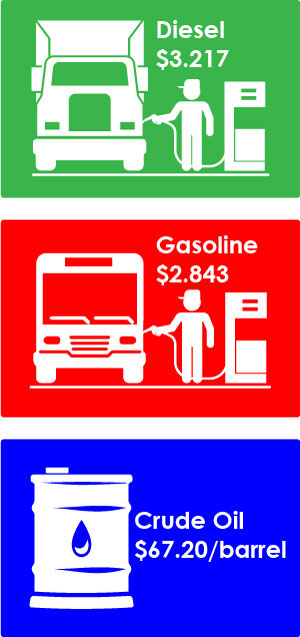

Diesel Slips 0.6¢ to $3.217

The U.S. average retail price of diesel inched down 0.6 cent to $3.217 a gallon while crude oil prices fell amid ongoing international currency and political issues that could sap demand.

Trucking’s main fuel costs 61.9 cents a gallon more than it did a year ago, when the price was $2.598, the Department of Energy said Aug. 13.

Averages fell in all regions.

The national average price for regular gasoline fell 0.9 cent to $2.843 a gallon, DOE’s Energy Information Administration said. The average is 45.9 cents higher than it was a year ago.

Average gasoline prices rose in the East Coast, Lower Atlantic and Rocky Mountain regions, but fell elsewhere.

The four-week average of finished motor gasoline product supplied — EIA’s proxy measure of U.S. consumption — typically hits the highest level of the year in August.

Data suggest this year’s peak in finished motor gasoline product supplied is likely to match that of 2016 and 2017, the two highest years on record, at 9.8 million barrels a day, EIA reported.

At the same time, “Diesel demand seems to be steady to strong. I know there are a lot of people out there who are really bullish on demand for distillate going forward, not just in the U.S. but globally. A lot of that still hinges on a strong global economy,” Denton Cinquegrana, chief oil analyst at Oil Price Information Service, told Transport Topics.

“I am still trying to figure out why [crude] markets are tumbling from the Turkey thing, how something so small [its falling Turkish lira currency] could potentially trigger something so big,’” Cinquegrana added.

Crude oil futures trading on the New York Mercantile Exchange closed Aug. 13 at $67.20 per barrel compared with $69.26 on Aug. 6.

On Aug. 15, oil plunged to $65.01 as investor concern increased that the U.S.-China trade war and Turkish crisis will undercut demand, and after U.S. stockpiles swelled by the most since March 2017, Bloomberg News reported.

U.S. crude inventories increased by 6.81 million barrels, contrary to analyst estimates for a 2.5 million-barrel decline in a Bloomberg survey.

And refineries have been humming at a peak level.

The four-week average of crude oil put into refinery processing units surpassed 18 million barrels per day for the first time on record for the week ending July 6 — the latest available data, according to EIA.

The last time the inputs approached 18 million barrels a day was the week of Aug. 25, 2017, ahead of Hurricane Harvey which made landfall the following week. The hurricane caused widespread refinery closures and shutdowns along the U.S. Gulf Coast.

Earlier this month, the National Oceanic and Atmospheric Administration increased its outlook for a below-normal Atlantic hurricane season to 60%, up from 25% in its initial forecast in May. The potentially disruptive hurricane season stretches from June through November.

“There are still more storms to come. The hurricane season is far from being over. We urge continued preparedness and vigilance,” Gerry Bell, lead seasonal hurricane forecaster at NOAA’s Climate Prediction Center, said in a statement.

The updated forecast also showed likelihood of a near-normal season is now at 30%, and the chance of an above-normal season has dropped to 10% from 35%.

NOAA’s latest outlook is for overall seasonal activity, and is not a landfall forecast.

In related news, the diesel engine turned 120 years old this month.

On Aug. 9, 1898, Rudolf Diesel received the first of several patents for what the advocacy group Diesel Technology Forum called an “efficient, slow-burning, compression ignition, internal combustion engine” that went on to disrupt large industries that at the time largely ran on steam power.

Diesel’s original engine was fueled on vegetable oil, a biofuel.

“In true back-to-the-roots fashion, one of the most exciting and growing opportunities for diesel today and in the future is the increasing use of renewable biofuels,” especially in California, according to the forum, as regulators push for near-zero emissions.

“We’re starting to see more and more state mandates for state vehicles [to use biodiesel],” Cinquegrana said. “All diesel has to have a 3% biodiesel component [now]. So it’s creeping up. Obviously, it stretches the diesel pool, so that’s a good thing.”