Bloomberg News

DSV Secures $5.4 Billion in Bonds for DB Schenker Deal

[Stay on top of transportation news: Get TTNews in your inbox.]

DSV A/S has raised €5 billion ($5.4 billion) in funding for its acquisition of DB Schenker in a multi-tranche bond transaction, matching the largest corporate deal in Europe this year.

The Danish transport company sold a six-part bond deal with maturities ranging from two to 10 years, according to a person familiar with the matter. The deal attracted investor orders exceeding €29 billion ($31.3 billion), said the person, who asked not to be identified because they weren’t authorized to speak publicly about the matter.

Chief Financial Officer Michael Ebbe told Bloomberg last week that the company would finance the €14.3 billion ($15.4 billion) purchase of DB Schenker through a combination of shares, bonds and bank debt. DSV raised about €5 billion ($5.4 billion) in equity earlier this month, leaving about €6 billion to €9 billion ($6.5 billion to $9.7 billion) needed from bonds and loans, he said.

The company tightened pricing for all tranches, setting spreads at 55 basis points over mid swaps for one of the shortest tranches and a premium of 105 basis points for the longest maturity, the person said. The notes are expected to receive an A3/A- rating.

DSV’s deal matches Siemens AG’s €5 billion ($5.4 billion) four-part bond sale in February. In another major European issuance earlier this year, Danish obesity drug maker Novo Nordisk A/S priced €4.65 billion ($5 billion) in a four-part transaction in May.

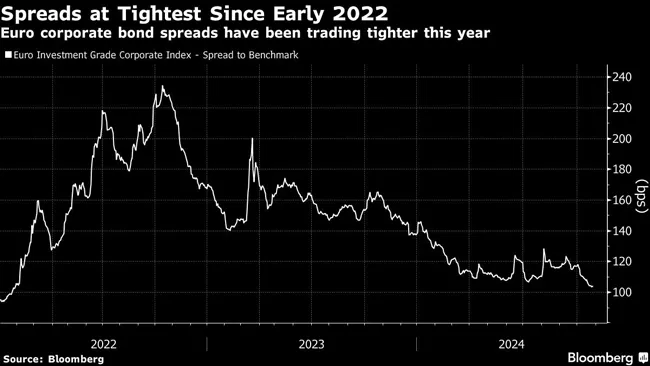

Conditions in Europe’s bond market have remained strong through most of 2024, with investment-grade companies raising about €336 billion ($362.7 billion) year-to-date, 35% ahead of the same point in 2023, according to data compiled by Bloomberg.

Deals have met strong investor demand, partly driven by inflows into the asset class. Companies have rushed to market ahead of potential volatility from U.S. labor data later this week and U.S. elections next week.

BNP Paribas SA, Danske Bank A/S, HSBC Holdings Plc and Nordea Bank Abp led the transaction.

DSV ranks No. 10 on the Transport Topics Top 100 list of the largest logistics companies in North America, and No. 14 on the TT 50 list of the largest global freight carriers.

Want more news? Listen to today's daily briefing below or go here for more info: