Bloomberg News

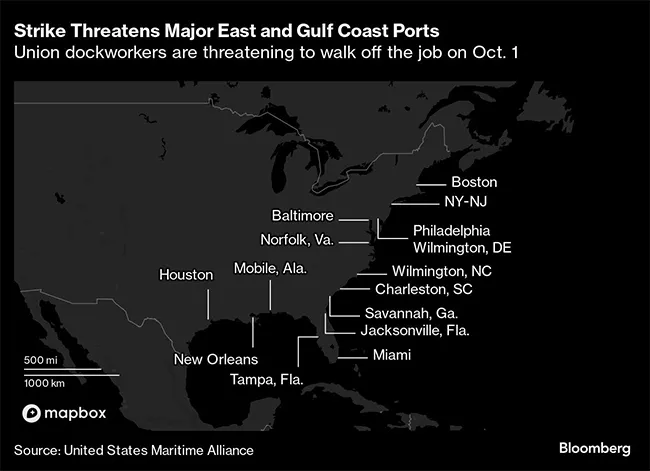

East and Gulf Coast Ports Prepare to Close

[Stay on top of transportation news: Get TTNews in your inbox.]

Key industry and government officials are urging U.S. dockworkers and their employers to avoid a strike at East and Gulf Coast ports this week, though many facilities are already bracing for a shutdown.

“We are coordinating with partners across the supply chain to prepare for any potential impacts,” said Steve Burns, a spokesman for the Port Authority of New York and New Jersey, the nation’s busiest Atlantic gateway for containers. “We urge both sides to find common ground and keep the cargo flowing for the good of the national economy.”

The U.S. Maritime Alliance, a group representing ocean carriers and port terminal operators, and the International Longshoremen’s Association have no talks planned before their contract expires at the end of Sept. 30.

President Joe Biden said Sept. 29 he wouldn’t intervene in any dockworkers strike. Resolving the dispute is a matter for collective bargaining, he told reporters in Delaware.

In a statement released Sunday, ILA Chief of Staff James McNamara said the union is “joined in solidarity by tens of thousands of dockworkers and maritime workers around the world,” adding that it will update the public with any new developments by Sept. 30 at 11 a.m. New York time.

The stalemate sets the stage for a strike to start the following day, forcing ports with the combined capacity to handle as much as half of all U.S. trade volumes to halt container cargo and auto shipments. Energy supplies and bulk cargo like municipal waste and road salt won’t be affected, and some exceptions will be made to allow for the movement of military goods and cruise ships.

To help break the impasse, the Biden administration summoned USMX, as the employer group is known, to the White House on Sept. 27 for a meeting with senior officials to urge a return to negotiations, and said they’d been in touch with the union to deliver the same message.

Those efforts continued through the weekend, White House spokeswoman Robyn Patterson said Sept. 29. She said senior officials had “been in touch with USMX representatives urging them to come to a fair agreement fairly and quickly — one that reflects the success of the companies.” The officials conveyed the same message to the ILA, Patterson said.

Speaking on condition of anonymity, a White House official said the administration will also be watching freight rates and surcharges imposed by ocean carriers, and doesn’t want to see anticompetitive price moves. The two largest container lines have already announced plans to impose extra fees tied to work stoppages.

Could a massive U.S. #dockworkers strike derail #holidayshopping? #Retailers are rushing to get ahead of potential port disruptions before potential chaos erupts, with 45,000 dockworkers threatening a walkout just weeks before the holiday season. #laborhttps://t.co/IOpvu3IG80 — The Food Institute (@FoodInstitute) September 27, 2024

If a strike goes ahead, it’ll be the first major labor disruption at U.S. maritime hubs since a nine-month standoff in 2014-15 led to work slowdowns and reduced productivity at ports on the West Coast. The last ILA strike on the East Coast was in 1977.

USMX is now alleging the union has refused to bargain since calling off talks back in June, and asked the National Labor Relations Board to force the dockworkers to negotiate. The ILA wants assurances against job-reducing automation, and counters that its members are owed a bigger cut of the “billions of dollars in revenues and profits” shipping lines have made in recent years.

Biden brands himself as the most pro-union president in history, and his administration has maintained it won’t interfere if ports shut down. “We’ve never invoked Taft-Hartley to break a strike and are not considering doing so now,” the White House’s Patterson said Sept. 26.

The economic pressure for federal intervention will only build if important gateways are paralyzed for more than a few days. Oxford Economics estimated that a strike would cost the U.S. economy $4.5 billion to $7.5 billion a week — a hit to gross domestic product that would be reversed after it’s over and shipments resume.

Still, analysts said the fallout of even a short strike would be costly for many retailers, manufacturers and other importers heading into the fourth quarter. Even with supply chains running relatively smoothly, every week that cargo is stalled and backlogs are created will take a month to clear, in part because ports like Los Angeles and Long Beach, Calif., are already operating near capacity.

“Contingency routes could become overwhelmed very quickly,” C.H. Robinson Worldwide Inc., one of the largest U.S. freight brokerages, said in an alert last week. “A significant volume shift to the U.S. West Coast would not only challenge the ports but also rail services, which may require more use of truck and transload services.”

A strike that lasts several weeks would force businesses to pay shippers for the delays, and some goods could arrive too late for the peak of the holiday shopping season. https://t.co/y3Gfy7XpkY — ABC 7 Chicago (@ABC7Chicago) September 30, 2024

C.H. Robinson ranks No. 2 on the Transport Topics Top 100 list of the largest logistics companies in North America.

According to Oxford Economics, East and Gulf Coast ports are major players in handling exports and imports of raw materials including copper, cotton, tin and wood, as well as base metals used in manufacturing.

In the autos sector, although only 32% of overall vehicles and parts are imported through the ports threatened by strikes, Oxford Economics said “it would spell trouble for European auto producers” given the trade route across the Atlantic and few viable alternatives.

Ports, meanwhile, were preparing to scale down operations Sept. 30, with some — like New York-New Jersey — offering extended hours to pick up freight. Near Norfolk, the Port of Virginia said marine operations will cease at 1 p.m. local time Sept. 30, and Port Houston in Texas plans to shut at 7 p.m. In Boston, the last vessel operation is scheduled to end at 8 p.m. if no labor agreement is reached.

Port of Montreal dockworkers begin three-day strike at two terminals https://t.co/b42cv2snIC pic.twitter.com/y2v17ym9xU — National Post (@nationalpost) September 30, 2024

For shippers and carriers, idled ships, delivery delays and higher costs were among the contingencies because alternative routes are limited. In Canada, two major terminals at Montreal Port operated by Terminal Termont Inc. will close this week as union dockworkers prepare for a three-day strike starting Sept. 30.

MSC Mediterranean Shipping Co. SA said in an advisory that “booking adjustments including rolls to other vessels or cancellations may be needed” if ports are shut.

MSC also floated an “emergency operation surcharge” of $3,000 per 40-foot container effective Oct. 27 on shipments from Asia to the East and Gulf coasts. That was similar to a surcharge, which would become effective Oct. 21, that Denmark’s A.P. Moller-Maersk A/S announced earlier this month.

Hapag-Lloyd AG also cautioned that industrial action would will raise freight rates.

MSC ranks No. 11 on the Transport Topics list of the largest global freight companies Maersk ranks No. 5 and Hapag Lloyd ranks No. 13.

“Shipping costs, including freight, warehousing and drayage rates, are expected to rise due to increased demand for alternative routes and port services,” the Hamburg-based carrier said in a note posted on its website. “Emergency surcharges may also be applied to account for additional handling and congestion.”

Want more news? Listen to today's daily briefing above or go here for more info

Still, Wells Fargo economists Tim Quinlan, Shannon Seery Grein and Nicole Cervi said concern about the fallout from a strike may be overstated, partly because inventory levels have been replenished, and also because the political resistance to government intervention will fade as a strike unfolds.

“The doomsday reporting about shortages and major disruption overstates the scope of potential disruption,” they wrote in a research note on Sept. 27. “Disruption and controlled chaos have been the norm in the global shipping business throughout the current expansion, and we see reasons to believe that businesses will be able to weather this storm.”