Associated Press

Economic Growth Slowed Sharply Last Quarter to 1.6% Pace

[Stay on top of transportation news: Get TTNews in your inbox.]

WASHINGTON — The nation’s economy slowed last quarter, growing at an annual rate of 1.6% in a sign that the high interest rates may be taking a toll on borrowing and spending.

The April 25 report from the Commerce Department said the gross domestic product — the economy’s total output of goods and services — decelerated from its brisk 3.4% growth rate in the final three months of 2023. Consumers continued to drive growth in the January-March quarter but slowed their spending. Growth was also held back by businesses reducing their inventories.

The state of the U.S. economy has seized Americans’ attention as the election season has intensified. Although inflation has slowed sharply, to 3.5% from 9.1% in 2022, prices remain well above their pre-pandemic levels.

Republican critics of President Joe Biden have sought to pin responsibility for high prices on Biden and use it as a cudgel to derail his re-election bid. And polls show that despite the healthy job market, a near-record-high stock market and the sharp pullback in inflation, many Americans blame Biden for high prices.

IMF Growth Forecast: 2024

🇺🇸 US: 2.7%

🇩🇪 Germany: 0.2%

🇫🇷 France: 0.7%

🇮🇹 Italy: 0.7%

🇪🇸 Spain: 1.9%

🇬🇧 UK: 0.5%

🇯🇵 Japan: 0.9%

🇨🇳 China: 4.6%

🇮🇳 India: 6.8%

🇷🇺 Russia: 3.2%

🇧🇷 Brazil: 2.2%

🇲🇽 Mexico: 2.4%

🇸🇦 KSA: 2.6%

🇳🇬 Nigeria: 3.3%

🇿🇦 S. Africa: 0.9%https://t.co/tPL4fgygu4 pic.twitter.com/Y99bDg17oJ — IMF (@IMFNews) April 16, 2024

The economy’s gradual slowdown reflects, in large part, the much higher borrowing rates for home and auto loans, credit cards and many business loans that have resulted from the 11 interest rate hikes the Federal Reserve imposed in its drive to tame inflation.

Even so, the United States has continued to outpace the rest of the world’s advanced economies. The International Monetary Fund has projected that the world’s largest economy will grow 2.7% for all of 2024, up from 2.5% last year and more than double the growth the IMF expects this year for Germany, France, Italy, Japan, the United Kingdom and Canada.

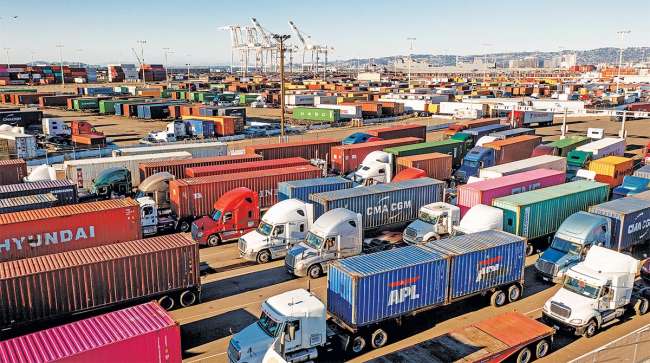

Businesses have been pouring money into factories, warehouses and other buildings, encouraged by federal incentives to manufacture computer chips and green technology in the United States. On the other hand, their spending on equipment has been weak. And as imports outpace exports, international trade is also thought to have been a drag on the economy’s first-quarter growth.

Kristalina Georgieva, the IMF’s managing director, cautioned last week that the “flip side” of strong U.S. economic growth was that it was “taking longer than expected” for inflation to reach the Fed’s 2% target, although price pressures have sharply slowed from their mid-2022 peak.

Inflation flared up in the spring of 2021 as the economy rebounded with unexpected speed from the COVID-19 recession, causing severe supply shortages. Russia’s invasion of Ukraine in February 2022 made things significantly worse by inflating prices for the energy and grains the world depends on.

Want more news? Listen to today's daily briefing above or go here for more info

The Fed responded by aggressively raising its benchmark rate between March 2022 and July 2023. Despite widespread predictions of a recession, the economy has proved unexpectedly durable. Hiring so far this year is even stronger than it was in 2023. And unemployment has remained below 4% for 26 straight months, the longest such streak since the 1960s.

Inflation, the main source of Americans’ discontent about the economy, has slowed from 9.1% in June 2022 to 3.5%. But progress has stalled lately.

Though the Fed’s policymakers signaled last month that they expect to cut rates three times this year, they have lately signaled that they’re in no hurry to reduce rates in the face of continued inflationary pressure. Now, a majority of Wall Street traders don’t expect them to start until the Fed’s September meeting, according to the CME FedWatch tool.