Special to Transport Topics

Electric TRUs, Diesel Hybrids Pave Path for Reefer Transport

Trailer manufacturers like Carrier Transicold are moving toward improvements that meet sustainability and performance goals. (Carrier Transicold)

[Stay on top of transportation news: Get TTNews in your inbox.]

As its technology advances, the omnipresent transport refrigeration unit remains the workhorse of the refrigerated transportation market with room to grow. However, the TRU market is likely to see a measured evolution; in the meantime, manufacturers continue to refine and improve the capacity, performance, efficiency and low-emission profile of diesel-powered units.

The development of electric TRUs is influenced by several factors, including battery weight, shore power capacity and infrastructure. But arguably, the operating environment and use case may be the most important factor.

Paul Kroes, trailer innovation leader at TRU maker Thermo King, sees the market going through a phased transition. “Phase 1 is hybrid TRUs that still retain the full diesel backup and are optimized for shore power,” he explained. “Phase 2 is a hybrid, but where the TRU is electrically powered with an onboard battery, and a small diesel unit kicks in when the battery needs recharging.”

Kroes

The final phase, Kroes projected, is an all-electric TRU “with no diesel backup and possibly having range extension like ‘e-axles’ on the trailer that can charge the TRU battery while moving.”

Those innovations are not without challenges, he notes. “Given the current range of battery tech, you need to be able to produce power and charge the battery while it is away from home,” Kroes said, adding it’s not yet entirely feasible (because of battery weight and limited range) to provide enough power, and there aren’t enough places to recharge.

All-Electric Solutions Growing

Despite the technical challenges, manufacturers Thermo King and Carrier Transicold have moved forward to develop advanced diesel-powered TRUs as well as initial versions of all-electric TRUs.

“The most significant innovations involve helping customers comply with regulations and achieve their sustainability goals while delivering the performance they expect from their refrigeration systems,” said Bill Maddox, senior manager of product development for Carrier Transicold. He cites Carrier’s diesel-powered X4 and Vector series, “which [use] an advanced version of the smart engine [on] our existing trailer platforms.” The engine optimizes fuel delivery to reduce fuel consumption by 5 to 10 percent, he noted, adding it produces significantly lower emissions without exhaust gas recirculation. The units are California Air Resources Board compliant and deliver “96 percent reduction compared to prior offerings,” he said.

On the all-electric side, Carrier has three offerings under its “eCool” brand covering a range of vehicle applications and classes:

- the Neos 200e, which is designed for lighter-duty delivery

- the medium duty-fitted, Supra eCool series

- the all-electric TRU Vector eCool, through which power is generated from an in-wheel electric motor within the hub assembly

Truck leasing firm Penske in partnership with Daimler have introduced a Carrier Transicold-equipped all-electric Class 7 refrigerated truck for leasing.

Penske Logistics ranks No. 13 on the Transport Topics Top 100 list of the largest for-hire carriers in North America and No. 16 on the TT Top 100 logistics list.

Thermo King, along with other producers, have moved forward to develop advanced diesel powered as well as initial versions of all-electric TRUs. (Thermo King)

Thermo King also offers a mix of high-efficiency, low-emissions diesel TRUs and all-electric TRUs and auxiliary powered units. Its Precedent S750i product provides a hybrid diesel-electric TRU solution for trailers. Within its “evolve” family of all-electric models, the e200 unit is designed for Classes 1-4 trucks and vans. The e300 unit applies to Classes 2-4 trucks. The e1000 unit is applicable for Classes 5-7 trucks.

The company also is testing single- and multi-temperature hybrid electric refrigerated trailers. Preliminary testing trials over 2,000 hours, 40,000 miles and 400 deliveries “demonstrate significant progress in reducing carbon emissions and fuel emissions,” the company said, estimating that over the trial period, some 1,300 gallons of fuel were saved while over 34,000 pounds of carbon dioxide emissions were eliminated.

Challenges Ahead

In his several decades in the business, Utility Trailer Manufacturing Co. President and Chief Operating Officer Steve Bennett has seen the market change and evolve in many ways.

Bennett

One constant, he said, is meeting primary customer priorities, such as TRUs that are quieter and more energy-efficient, use less fuel, require less maintenance, and have increased cooling capacity and lower profile units to prevent in-service damage. Also, Bennett noted emissions compliance, performance reliability and overall lowest cost to operate also are main concerns.

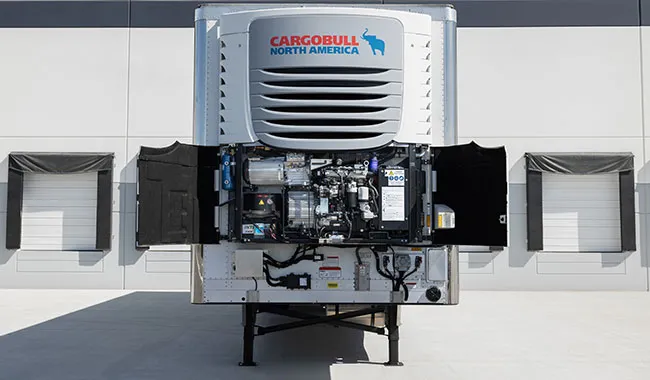

Last year, Utility Trailer launched its Schmitz Cargobull line of TRUs, initially with two models: the 625 Hybrid, which is a single-temp unit for longhaul operations; and the 655MT Hybrid, which is a multi-temp unit generally for food service and grocery delivery. Both are built on Utility’s 3000R trailer.

Both are CARB-certified, ultra-low-emission TRUs and require no diesel particulate filter or exhaust gas recirculation aftertreatment systems.

The company said it also is developing all-electric TRUs with Schmitz Cargobull and expects that it will soon have available all-electric versions of the 625 single-temp TRU and the 655 MT multi-temp unit.

Bennett believes the hybrid approach will gain the earliest traction in the market, especially where those units can be plugged into “shore power” at the dock or staging area of a warehouse or terminal. “That completely eliminates local diesel emissions and is less than half the cost of running on diesel,” he said.

However, while local shore power has demonstrated advantages, Bennett says adoption so far is light, likely due to the expense of upgrading local electric service, adding wiring and charging plugs at docks and staging areas, and the cultural process challenge of getting drivers to plug in the units once docked. Regulatory mandates may force the issue, he says.

Last year, Utility Trailer launched its Schmitz Cargobull line of TRUs, with models serving longhaul operations and food service deliveries. (Utility Trailer Manufacturing Co.)

The holy grail for the industry, Bennett believes, is TRUs with cost-effective, long-lasting, powerful battery packs and fully electric-powered and rechargeable trailers that can charge on the go and at local docks. “But [with] the relatively small volumes of electric TRUs today, coupled with the availability of battery packs and the pricing economics ... it’s going to be a long road map to [wider adoption of] this technology,” he said.

Innovations also are driving improvements in the trailer box itself. Trailer design and construction has evolved as fleets seek lower operating costs, less maintenance and increased payload. “Customers want more interior cube, lighter weight and more efficiency,” said Great Dane’s Tim Schmeits, director of reefer product engineering. Great Dane built the first refrigerated trailers in the 1940s.

Among those demands is improving trailer insulation to reduce water absorption and minimize “outgassing,” which results from polyurethane insulation typically degrading over time. “Outgassing over five years can cause you to lose 25 percent of the insulation’s value,” Schmeits noted. “And the material absorbs water, so after many years of washing out the trailer, it actually gains weight.”

To alleviate the problem, Great Dane installs a product it calls ThermoGuard in its trailers. “It’s a lining that keeps the outgassing from happening and prevents moisture accumulation. It’s virtually impermeable and keeps moisture from getting into the insulation,” he said.

Great Dane is agnostic when it comes to which TRU goes on its trailers, including future all-electric units. “The solutions we are working on would be compatible with either Thermo King or Carrier,” Schmeits said. “The TRU is an independent choice by the customer.”

Getting Started

Fleet operators are cautiously tracking the development of hybrid diesel-electric as well as all-electric TRUs, but for many, given a fleet’s use profile, capital investment and the cost of change, a wholesale transition to all-electric TRUs won’t happen anytime soon. Faster adoption will be seen first with hybrid diesel-electric TRUs, these sources say. Yet innovations in other areas are helping fleets better manage operations, ensure product integrity and respond faster to emergencies.

Melton

David Melton, technical program manager for R.E. Garrison Trucking, which has a fleet of 1,400 reefer trailers, cites advanced telematics and the ability to capture and react to TRU events in real time as a major benefit.

“We are getting much more visibility into the trailer and the TRU, where it is in real time, how it’s performing, and if there are any issues that need immediate attention,” he said. “We have the ability to adjust temperature on the fly.”

Melton noted that capability has an added benefit, saying it “takes another task off the driver so they can focus on driving and getting there safely.” One feature Melton would like to see added is remote cameras inside the reefer to give him a visual every 15 to 30 minutes.

At Target stores, its 2,000-trailer reefer fleet is mostly Utility trailers with Thermo King diesel-powered TRUs, says Ryan Magyar, Target’s lead equipment engineer. A trend he’s seeing is retrofitting diesel units to hybrid by adding a battery pack. “It’s a bit less infrastructure-dependent; we can try this, learn from it, then jump into full EV hybrid later,” he explained, adding that he is considering Utility’s trailer with the Cargobull TRUs.

The makers of Transport Topics' updated Top 100 For-Hire Carriers list examine how the freight market slump has altered the competitive landscape in trucking. Tune in above or by going to RoadSigns.ttnews.com.

One issue he foresees is getting good telematics data from all the different TRUs, trailers and tractors into the same management platform. “We use Orbcomm,” he noted. “How do I get all this cool equipment we want, get the data synced up behind the scenes, aligned and talking together with accuracy,’” he said. “That’s going to be an issue.”

Not all fleets are jumping on the electrification train. Springfield, Mo.-based Prime Inc. is the nation’s largest longhaul reefer carrier, with a fleet of 8,500 reefer trailers, primarily Utility trailers with mostly Carrier TRUs.

Paul Higgins, Prime’s director of purchasing, sees a disconnect between people’s expectations of all-electric TRUs in longhaul “and what the product temperature really demands. It’s got to be kept frozen for days at a time in the trailer. He added, “We may have an ice cream load at minus 20 degrees, and another load of frozen vegetables at zero.” Prime ranks No. 20 on the for-hire TT100.

A complicating issue is there are virtually no truck stops that have available “shore power” to recharge a TRU battery when drivers take mandatory rest stops. To meet Prime’s operating requirements, “we spec the biggest, baddest reefer unit we can get.” And that means diesel because of the longevity of the operating environment and critical need for reliability and consistency.

And while Higgins sees some opportunity for hybrid and all-electric units, particularly in the grocery and shorthaul regional food service segments, “as a practical matter, it’s impossible at this time for longhaul, over-the-road reefer operations.”

Want more news? Listen to today's daily briefing below or go here for more info: