Special to Transport Topics

Fleets Turn to Remanned Parts to Reduce Operating Costs

[Stay on top of transportation news: Get TTNews in your inbox.]

The impact of a three-year freight recession, along with consistently rising costs, is providing both opportunity and challenge for truck parts remanufacturers in the dubbed “reman” market.

As prices for new trucks rise precipitously, owner-operators and fleets of all sizes are often running trucks longer. That’s requiring more maintenance and repair, and creating more demand for quality, refreshed replacement parts — a sweet spot for remanufacturers.

And with trucks remaining in service for longer periods of time, part obsolescence becomes a factor. As older units age and eventually are retired, OEMs, sensing a declining market, stop producing new replacement parts for them, which boosts demand for remanufacturers.

Also, the increasing focus on sustainability creates more interest in remanned parts, which conserves energy, repurposes scarce raw materials and prevents waste from going into landfills.

In all, it points to a rising groundswell of support for truck and trailer remanufactured parts for operators most concerned about total cost of ownership.

Maximum Uptime

“The key objective for any fleet is to find ways to manage the cost of ownership as low as possible, while keeping the fleet running with the highest uptime and consistently reliable operation,” said Jeff Stukenborg, head of remanufacturing engineering for ZF Group, which has one of the nation’s largest remanufacturing operations serving the heavy-truck market. He added that a remanufactured part should perform as reliably as new, and often comes with the same or better warranty as an original equipment part.

By definition, a remanned part is a used OEM part that has been stripped down, inspected, cleaned, repaired where needed, worn components replaced, and the unit reassembled and tested, bringing it back to factory specifications.

Jones

Wade Jones, senior director of operations for JLG Industries, noted that remanufactured parts are especially ideal for repairing older pieces of equipment. JLG Industries produces “access equipment,” such as forklifts, boom and scissor lifts.

“The process is like how the part was originally manufactured, but instead of all new parts, some of the components and materials that have been previously used are brought back to OEM standard,” he said. “Two common things equipment owners ask about when they need to purchase a part are its reliability and cost.”

Jones said that it’s important for fleets to know about the type of part they are putting in their equipment to determine if it will provide the desired efficiency and life span, as well as fit within their budget.

Starting With a Core

ZF’s Stukenborg believes the industry faces two key challenges: market perception that remanufactured parts are somehow inferior to new, and a lack of commitment on the part of customers to return used parts, the “cores” on which remanufacturing depends.

“Remanned parts provide advantages in terms of cost, quality, availability and speed to market. In some cases, if you have a truck-down situation, you can often obtain a remanned part more easily, with less risk of supply chain variations,” Stukenborg noted, adding that with reman parts, ZF is salvaging between 60% and 80% of the material.

(ZF Group via YouTube)

“There is less need for new virgin material. So, we just need new for the balance; that allows us to create the part faster,” he explained, adding that they are the same or better than new at a lower price, and with an equal or better warranty.

“It’s super important that a core comes back not damaged and in a timely manner,” Stukenborg said. “It is our basic raw material.”

In his experience, some companies “just throw their cores into a corner and only think to return them once a year,” or when their storage area fills up. “It’s people not treating [cores] with respect and understanding the value they represent. And getting them to us as quickly as possible,” Stukenborg explained.

David Schultz, director of aftermarket business development for Bendix CVS, echoed the core return challenge. To facilitate more components being returned, Bendix historically has put “core bounties” out in the market if there are certain parts the manufacturer wants to drive more cores back in.

Schultz

Another resource for core material is “core brokers,” typically someone who makes a business out of going around to dealers, repair shops and scrapyards looking for cores to buy and then resell. Schultz said most shops will just toss used parts in a bin, and if a core broker doesn’t take them, the shop sends them to scrapyards. “They know what core brokers are looking for and will set those parts aside,” he said.

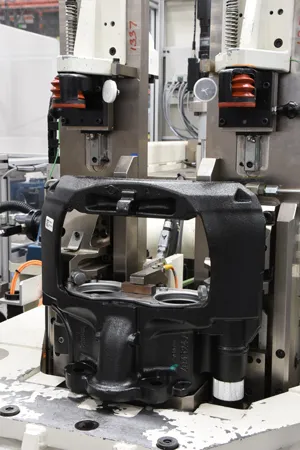

Brake calipers are among the components that offer the best opportunity for remanufacturing, Bendix's Schultz says. (Bendix)

Schultz says that for Bendix the biggest remanufacturing opportunities are with components such as air treatment, air dryers, compressors, valves and air disc brake calipers.

One other area of benefit from remanufactured parts that is gaining more attention is sustainability goals. “People recycle bottles and cans all the time. But to bring them back into use, you have to go through another process to recover and manufacture that new bottle or can. That uses more energy,” said ZF’s Stukenborg. In the case of a remanufactured part, which starts with a core component, ZF is reusing the embedded energy used to make the original part, he explained.

“You don’t have the same casting, forging or machining processes used to create the part originally, so we are essentially recapturing that energy by salvaging the raw material.” Stukenborg said, adding the reman process is less energy-intensive, ultimately saving on greenhouse gas emissions.

Truck Supply and Demand

Since the pandemic, two factors have been impacting supply and demand for remanned parts: fewer new trucks hitting the highways, and fleets running existing trucks over a longer life cycle. Both trends have had the effect of curtailing the flow of available core parts into the reman pipeline, noted Jordan Birch, director of product development for International Motors, which is a major supplier of both OEM new and remanufactured parts.

Birch

“There was a period of two-plus years where that was absolutely the case, fleets running trucks longer” and postponing new truck purchases, Birch said, explaining how that impacted the availability of parts to reman. “Some of those issues have improved over the past 18 months as more [new] vehicles are hitting the road,” and fleets return to more normal replacement cycles, he said.

Changing Perceptions

As president of the Automotive Parts Remanufacturing Association, Joe Kripli is front and center as an advocate for remanufactured parts. In addition to leading the association, Kripli, a 40-plus year industry veteran, also handles business development for D&W Diesel, a large remanufacturer and distributor of diesel engine components, and the largest turbocharger distributor in North America.

Kripli

“When the economy is soft, and trucking volumes flatten, people are not buying new [as much] and fixing up what they have,” he observed. “That’s good for the reman market and makes it somewhat recession-proof.”

Kripli agreed the industry remains challenged by perceptions of quality and reliability, which he stressed are inaccurate and unfair.

“Fleets often have to be convinced of what’s in it for them. It’s all about cost. You are getting the same quality part [as new] but at lower cost, and with the same quality,” he said, adding that availability and speed to market also argues in the remanufacturer’s favor.

Kripli noted that a decision on reman parts should be part of a larger, holistic approach to maintenance. He cited as an example a major parcel carrier that runs some 20,000 Class 8 trucks, “that only get turned off on Sunday.” Given the number of miles they run, “they are out of warranty in six months.”

Using historical data in their maintenance program tracking a huge variety of parts and components, Kripli explained, the carrier knows that a part historically has a certain life, so they schedule the part to be replaced before it fails. He said the carrier uses remanufactured parts extensively to keep costs down and keep uptime high, avoiding truck breakdowns from part failures.

Truck Parking Club's Evan Shelley discusses how innovative platforms are turning available space into opportunities for reserved parking. Tune in above or by going to RoadSigns.ttnews.com.

One area that Kripli cautioned relative to quality and reliability, is buying remanned parts from China due to their inconsistency.

“The part you checked initially ahead of time you confirmed it met the spec,” he said. “But then the next batch arrives, and it does not. That’s a problem.”

A critical challenge in meeting demand, Kripli said, is getting enough parts in the return pipeline consistently.

“There are still fleets out there that just throw the part away. A trailer ABS unit, for example, costs a fleet only $250, so they don’t return it,” he said. “On the other hand, a turbocharger might have a core value upwards of $1,000. That’s cash for the carrier if they return it.”

Other than cost, the top priority for fleets is uptime, and Kripli stressed that remanufactured parts can be a key part of the solution. His advice for truck operators is to respect the value of the part and get it back to the OEM as quickly as possible.

“Have a pre-maintenance plan and schedule. Don’t wait [for the truck] to fail,” he advised. “It’s more expensive to reman a part that’s failed, so know when failure is likely to occur, and replace the part ahead of that.” Kripli concluded that eliminating downtime and returning a quality core for reman keeps costs down and fleets running are the key advantages.

A Different Approach

Bruce Stockton, head of fleet operations for Wilson Logistics, has a somewhat contrarian view of remanufactured parts and how they fit into a maintenance and repair strategy. From his 40 years of experience, Stockton said his strategy for the 500-truck fleet is focused exclusively on maximizing use under warranty time and trading in trucks before the warranty is used up.

Stockton

“We buy a tractor with as much warranty as possible, keep it two years, sell it to the second buyer while still under warranty and never invest in new replacement or remanufactured parts,” he said, adding that the fleet completes preventive maintenance service for the truck four times, buys sets of steer and drive tires, then sells the truck.

“Residuals are better at that mileage or age point,” he noted, “and our downtime is nothing, which is huge in today’s world of waiting on trucks to be diagnosed and finally fixed.”

Want more news? Listen to today's daily briefing below or go here for more info: