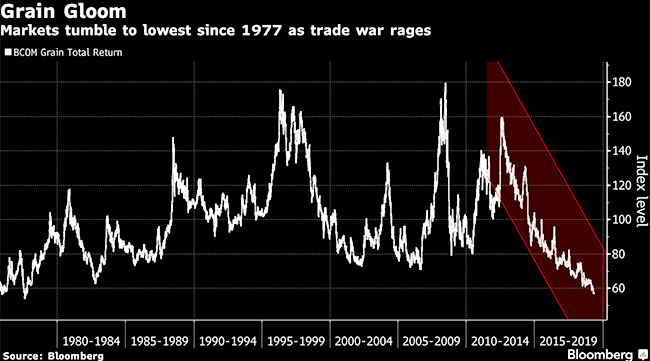

Grain Markets Dive to 42-Year Low After Trump’s Trade Tweets

Soybean and corn futures slumped after tweets from Donald Trump that threaten an escalation of the U.S.-China trade war, frustrating battered American producers hoping for a quick resolution.

The Bloomberg Grains Subindex Total Return tumbled to the lowest since 1977. The prospect of an end to the crippling tariffs that Beijing imposed on U.S. soy, corn and wheat exports was one of the few positives for American agriculture markets. China’s foreign ministry said that officials still were planning to travel to the United States for the next round of trade talks — but was unable to confirm when amid signs that a delay is being considered.

July soybean futures capped a seventh straight loss as the contract slumped to a record. Soy has been one of the hardest hit commodities by the trade war as China, the world’s top consumer, snubbed American imports.

Swollen stockpiles and the spread of African swine fever also are hanging over the U.S. grain and soy markets, as soggy weather across the Midwest impedes planting and means some farmers may switch to plant more of the oilseed, which can be sown later than corn.

The bad weather that farmers are facing is a double blow, according to Scott Irwin, an agricultural economist at the University of Illinois in Urbana-Champaign. Not only are they unable to plant, he said, but this leaves them more time to stew on the current conditions from trade to the overall downturn, Irwin said.

Recent news reports on the U.S.-China trade talks had led many farmers to believe a resolution might be near. “The sense in farm country was ‘my gosh we’re finally going to get out of this nightmare,’ ” he said. “And then boom.”

“{It’s] like a bad version of the movie ‘Groundhog Day’ for the U.S. farmer,” Irwin said.

Dale Livingston, a fifth-generation farmer from Illinois, said that while he understands why Trump launched the trade war, he’s eager for it to end. Livingston, who grows soybeans, corn and wheat on 1,500 acres, said he has never seen so many negative things happening at the same time. “Let’s quit playing these games and get it over with.”

Aaron Zimmerman, who grows corn, soybeans, alfalfa and wheat, alongside his brother on 2,300 acres in Pierce, Neb., says the trade war now has to be worth the pain. “I know … this hurts and I’m getting tired of it,” but it’s too late to turn back now, the third-generation farmer said.

Even before Trump’s latest missive, investors were ready to throw in the towel on crop prices. The pig-disease outbreak has forced China to cull more than 1 million hogs, denting the outlook for grain use in livestock feed. A measure of combined hedge fund net-short positions across corn, soybeans and wheat is at its most bearish since the data began in 2006, a U.S. Commodity Futures Trading Commission report May 3 showed.

“A single Trump tweet erases any optimism of a trade deal this week,” Jacob Christy, a trader at The Andersons Inc., said in a video posted online. “We expect volatility to remain quite elevated until we see some type of clarity on the situation.”