Staff Reporter

Nikola Leads Field in Hydrogen Fuel Cell EV Deployment

[Stay on top of transportation news: Get TTNews in your inbox.]

Hydrogen fuel cell electric vehicles may be envisioned as the future workhorse of a decarbonized North American longhaul freight sector, but the development and adoption of these zero-emission trucks has proceeded at a measured pace.

Designing and building trucks with a new vehicle architecture and powered by a fuel that requires a completely new fueling infrastructure was bound to be complex and therefore unlikely to happen overnight, and that’s proving to be the case.

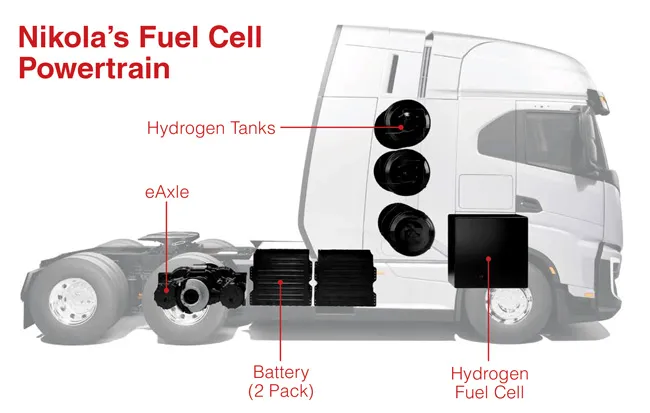

Unlike the battery-electric trucks that have entered the market in recent years, hydrogen FCEVs are equipped with a hydrogen fuel cell stack — which generates electricity to run the vehicle’s electric powertrain — along with a hydrogen storage system.

Roeth

“It’s really complex, even without adding cooling systems,” said Mike Roeth, executive director at the North American Council for Freight Efficiency. “If you had a diesel truck, a battery-electric truck and a hydrogen FCEV truck next to each other, you’d [say], ‘My, hasn’t that gotten complex.’ ”

The ecosystem is creeping forward as a consequence, with established truck makers not putting all their eggs in one basket while industry disruptors set the pace as they try to stay afloat — as is often the case across many corners of the automotive and other industries.

Phoenix-based Nikola is one of the few hydrogen fuel cell truck makers to reach serial production in North America — after a number of tumultuous years — but CEO Steve Girsky wants to see competition in a business that he described as lonely right now.

Girsky

“We’re happy that other people are coming — big companies, small companies. More the merrier because we’re trying to build out an ecosystem here,” Girsky told analysts Oct. 31 during the company’s third-quarter earnings call. Nikola, which shifted its full attention to hydrogen fuel cell trucks from battery-electric trucks in May 2023 because of battery supplier problems, is open about the complexity of the task it and others face.

“This isn’t just about doing what everybody else is doing and trying to do it better. We’re doing something that nobody else has done yet. And it’s not easy,” Girsky said during the call. “We grind through it every day, but that’s why people show up to work here.”

And infrastructure concerns (read more on page 14) are inhibiting even some of the biggest players in the truck making world.

Daimler Truck told Transport Topics that it planned to start series production of hydrogen-powered vehicles at the end of this decade, noting it was a “conscious decision because the ramp-up of the infrastructure is slower than with battery-electric drive technologies.”

(Nikola Corp.)

Industry observers are also keen on hydrogen fuel cell trucks, but they say their time is not here yet.

“We see the opportunity for this technology, but it is not going to happen for some time,” S&P Global Mobility Principal Research Analyst Greg Genette told TT, adding that he expected an acceleration of the segment in the late 2020s, although that acceleration would be the launch of more models rather than high production volumes.

The foremost fundamental challenge is presenting a solid business case to customers, said Ray Minjares, heavy-duty vehicles program director for the International Council on Clean Transportation.

Hydrogen fuel tractors are more fuel efficient than a diesel counterpart at 7.6 miles per gallon versus 6 miles per gallon, but a battery-electric semi is near 13.5 miles per gallon, according to ICCT.

Nikola shipped 90 hydrogen fuel cell electric trucks in the most recent quarter, compared with three in the year-ago period, while many other players continue to test their products. Nikola’s record sales in the quarter include the purchase of 20 FCEVs by J.B. Hunt Transport Services as well as adding a customer outside California or Canada, DHL Supply Chain.

J.B. Hunt, which ranks No. 3 on the Transport Topics Top 100 list of the largest for-hire carriers in North America and the TT Top 100 logistics companies list, will use some of the trucks to support its drayage and intermodal operations in California.

DHL, which ranks No. 5 on the TT Top 50 global freight carriers list and No. 14 on the logistics TT 100, is deploying two Tre FCEVs at Diageo North America’s Plainfield, Ill., campus.

“It required a lot of research,” DHL Supply Chain Vice President for GoGreen North America Stephan Schablinski said in October. “Everything about diesel trucks is plug and play,” whereas with a hydrogen fuel cell truck, the buyer has to understand truck, the fuel, where to source it, sourcing technicians and the infrastructure.

“All the pieces make a puzzle. And if one of the pieces is missing, then it is not going to work,” he added.

Fishwick

Diageo wants to see the performance of the truck in extreme conditions, said Vice President of Logistics Lucy Fishwick. The trucks are Diageo’s first FCEVs. It is not just the reliability of the truck, but the reliability of the hydrogen supply, she said.

“There’s a lot of open questions,” Fishwick noted, adding that Diageo chose hydrogen FCEVs because they can run 24/7 and want to minimize downtime.

There are some challenges ahead for Nikola. The company reported a loss of $200 million in Q3 on Oct. 31, compared with $425.5 million in red ink in the same period a year earlier. The continued losses mean the company’s cash reserves are likely to last only partway through the first quarter of 2025 without successful fundraising efforts or additional partnerships.

“We estimate that our existing cash is sufficient to fund our forecast operating costs and meet our obligations into but not beyond Q1 2025,” Chief Financial Officer Tom Okray told analysts during the earnings call.

Okray

“We are examining every opportunity to optimize cash,” said Okray, adding: “We continue to seek to maintain sufficient capital to support our business.”

That may include partnerships, according to Girsky. “We are actively talking to lots of potential different partners who value what we do and value what we’ve built. It’s because we’ve been doing the hard work out front building the framework, and we have proof points. We’re on the road today with customers,” he told analysts.

Okray added: “We are looking for these like-minded partners who have stated corporatewide decarbonization goals for the next decade, hydrogen producers who view hydrogen as a viable energy growth vector, and automotive OEMs who bring either light-duty or heavy-duty fuel cells to the market. Together, we form a hydrogen economy that we believe can thrive.”

Nikola was joined at the serial production stage by Bolingbrook, Ill.-based Hyzon late in Q3. Hyzon began series production of its Class 8 hydrogen fuel cell truck Sept. 16.

Hyzon completed eight trials through the start of November. More than 20 large fleet trials are planned through February. (Hyzon)

Production initially will take place at Charlotte, N.C.-based Fontaine Modification. Hyzon intends to provide the facility with kits for the fuel cell system, battery packs and hydrogen storage systems. Fontaine adds these onto vehicle chassis. The current base chassis for Hyzon’s truck is a Freightliner Cascadia in two day cab variants.

On Nov. 4, Hyzon said drayage specialist IMC Logistics completed a two-week trial of the Class 8 truck in the Houston area, driving more than 1,000 miles in the test period. IMC ranks No. 33 on the for-hire TT 100.

Hyzon completed eight trials through the start of November. More than 20 large fleet trials are planned through February. The auto manufacturer has also encountered financial hurdles. The company raised additional funds in Q3 after shuttering its operations in the Netherlands and Australia in July.

Another recent entrant to the Class 8 market, global automaker Hyundai has 50 Xcient hydrogen fuel cell trucks in operation in North America, according to a company spokesman. Hyundai’s tractors are navigating the roads around the South Korean company’s Metaplant in Georgia and California. The trucks are currently built at the company’s Jeonju plant in South Korea.

Xcient variants are available with Allison transmissions, as too will be another heavy-duty trucking disruptor’s hydrogen FCEV.

Host Seth Clevenger and Features Coordinator Mike Senatore take you behind the scenes to unveil the 2024 Top 50 Global Freight Companies. Tune in above or by going to RoadSigns.ttnews.com.

In September, German startup Quantron debuted its QHM FCEV heavy-duty truck, which it claims has an operating range of 700 kilometers. The truck includes Ballard Power Systems’ FCmove-XD 120-kilowatt fuel cells and an integrated eGen Power 130D e-axle from Allison.

Most leading North American legacy truck makers, meanwhile, are keeping their alternative fuel options open, with plans for FCEV, natural gas and hydrogen internal combustion engine-powered trucks.

Legacy builder Peterbilt offers a hydrogen fuel cell version of its 579 Model day cab, while fellow Paccar unit Kenworth offers a FCEV option for its flagship T680 semi. Serial production of both was expected to begin in 2025, but neither Peterbilt nor Kenworth would confirm a date.

Fellow Class 8 majors Volvo Trucks North America and Daimler Truck North America have yet to announce hydrogen fuel cell truck plans for North America.

VTNA’s redesigned Class 8 flagship VNL semi, launched in January, will be the base for any future hydrogen fuel cell truck the company launches, a spokesman said, and it is targeting North American commercial deployment of FCEVs by the end of the decade.

The first Volvo Group hydrogen fuel cell trucks will be launched in Europe.

DTNA sibling Mercedes-Benz Trucks, meanwhile, plans to launch serial production of its GenH2 Truck at the end of the 2020s, but only in Europe. (TT file photo)

DTNA, parent company of Freightliner and Western Star, has no plans to deploy fuel cell electric vehicles in North America at present, a spokeswoman said.

In Europe, DTNA sibling Mercedes-Benz Trucks, meanwhile, plans to launch serial production of its GenH2 Truck at the end of the 2020s. The truck began customer trials earlier this year, including with e-commerce giant Amazon. Prototypes began testing in 2021. Amazon ranks No. 1 on the global freight TT 50 and the logistics TT 100 and No. 12 on the TT Top 100 private carriers list.

Meanwhile, Germany’s other truck making powerhouse, Traton, and its International Motors unit in North America plan to concentrate on battery-electric trucks rather than enter the hydrogen fuel cell arena, a spokeswoman confirmed in October.

The legacy players’ deliberate progress is in part because they can take a considered approach while continuing to sell diesel trucks and finance their long-held zero-emissions ambitions. But the hurdles are obvious, said Maral Idehav, Volvo Trucks director of total offer electric vehicle and services.

Idehav

“First, we must have hydrogen fueling infrastructure in place for commercial operations to be able to deploy FCEVs at scale, particularly in the longhaul segment, where they are not returning to a home base daily,” Idehav said.

“Hydrogen is still too expensive today, with prices in the range of $30-$40 per kilogram, to achieve widespread adoption we must see the price of hydrogen in the range of $4 per kilogram to have a feasible operation cost,” she said.

The cost of fuel will continue to be an issue, even by 2030, according to ICCT, hampering price competitiveness.

In California, where most of the U.S. hydrogen fuel cell truck fleet is operating as a result of state incentives, FCEVs are likely to be more expensive to operate even in 2030 at $2.40 per mile, compared with $1.90 per mile for a battery-electric semi or $1.91 per mile for a diesel truck, according to ICCT forecasts. ICCT’s price assumptions are based on a hydrogen price of $9-$11 per kilogram.

As a result, ICCT’s Minjares is not optimistic about a scaling up of demand. Hydrogen FCEVs may become a niche segment, catering to jobs that battery-electric trucks find too difficult, be that in the agricultural arena or with extreme payloads, he said.

Want more news? Listen to today's daily briefing below or go here for more info: