Charging Infrastructure Limitations Challenge OEMs

[Stay on top of transportation news: Get TTNews in your inbox.]

HANOVER, Germany — Charging limitations are placing an unfair burden on equipment manufacturers that have developed the technology to comply with government regulations, OEMs and fuel providers said at IAA Transportation 2024.

“We have invested billions in the products, and we have draconian penalties, but the infrastructure is not picking up at the right pace,” said Andreas Gorbach, head of truck technology at Daimler Truck AG. “It’s not in our hands.”

Daimler has customers who are doing their part in the decarbonization game, but they can’t always add vehicles.

RELATED: Daimler broadens global platform of EVs, services

“They are willing to invest even though the economics are so-so,” he said. “Then comes the challenge when they tell us they want to buy more, but the electricity provider can’t provide more power.”

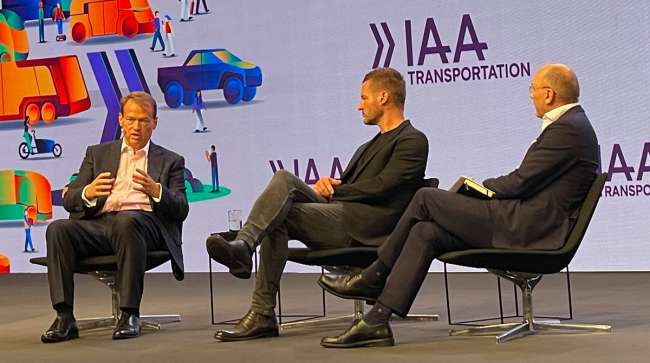

“We have the truck. We have the hardware, but there is nowhere to charge," says Anne-Lise Deraedte of Enride. (Mindy Long for Transport Topics)

Anne-Lise Deraedte, vice president of charging EMEA for Enride, a Swedish transport company specializing in electric and self-driving vehicles, has seen the same situation.

“We have the truck. We have the hardware, but there is nowhere to charge, and that is a big, big issue,” she said.

In an interview with Transport Topics, Volvo Trucks President Roger Alm said there needs to be a cost associated with CO2.

“Then it is equal to everybody,” he said, “and then we are taking the environmental situation very seriously.”

Incentives can help with the energy transition, but Alm said they aren’t fair.

“There are different incentives you can apply, and there are different incentives in different markets,” he said, “but many customers don’t know if they will get the incentives. It is better to put the price on CO2.”

Gorbach also sees value in making CO2 more expensive.

“Government is willing to put regulations on CO2 but not put a price on CO2,” he said, adding that a price on carbon would force the markets to find the ideal solutions. “Then without all these regulations, our B2B market would automatically steer into the economic optimum without CO2.”

Alm

If Gorbach had one wish, he said it would be for governments to couple the regulations on manufacturers with regulations for infrastructure.

While addressing equipment providers, Thomas Fabian, chief commercial vehicles officer at the European Automobile Manufacturer’s Association, said OEMs cannot unlock the issues going on with the grids.

“This is a call to policymakers to unlock this transition,” he said.

Even when power is available, it can take too long to get it to charging stations, making it unattractive to customers, Gorbach said.

Enride’s Deraedte said there may be opportunities to optimize charging times to increase utilization.

“The grid is an infinite resource, but we can use it in a much smarter way. Avoiding the overload will take us a long way without having to upgrade it,” she said.

Alexander Jung, general manager, central Europe, for fueling station provider Aral AG, said providers need clarity from politicians in all the national capitals as they move forward with new solutions.

“I would say, ‘Big kudos to the vehicle manufacturers.’ They are all going in the right direction. They are all offering attractive vehicles,” he said. “What is missing is a clear signal from politicians.”

One solution is not to limit OEMs and fleets to specific technology.

“I think everything that can decarbonize trucking is welcome,” Gorbach said. “We need hydrogen. We need biofuels, like [hydrogenated vegetable oil]. We need battery-electric vehicles in longhaul trucking. We need openness to various technologies, and that is what I’m missing from politicians at the moment.”

Manufacturers are making significant investments to develop a wide range of technologies — battery-electric vehicles, hydrogen fuel cells, hydrogen combustion engines and advanced diesel technology — to meet customers’ needs.

“We have been investing more than ever,” Alm said. “We have to do that to support all of the projects.”

TT's Seth Clevenger and Mike Senatore dive into the details behind the 2024 Top 100 Private Carriers list. Tune in above or by going to RoadSigns.ttnews.com.

Developing new powertrains is expensive, and factors driving increased costs are sometimes obscure. Alm said Volvo is conducting even more crash testing on its electric trucks compared with diesel combustion engines.

“We need to do more safety testing so we can learn,” he explained.

New powertrains also create new parts and distribution needs.

“Today we have to put diesel parts in our warehouses, and now we also have to include parts for batteries and other components,” Alm said. “It has an impact on the whole value chain, from the engineers and suppliers to how we are manufacturing them, to how we are selling them.”

Alm said it will take battery-electric, hydrogen fuel cell and hydrogen internal combustion engines to meet the trucking industry’s needs.

Given the capital and time needed to upgrade the electrical grid, Gorbach expects hydrogen to play a critical role in trucking.

“In a decarbonized world, we need green hydrogen,” he said.

Hydrogen fueling infrastructure is facing the “hen or the egg” dilemma, and Gorbach said it is hard for fueling providers to invest in hydrogen until they are sure the demand will exist.

“To make that work,” he said, “we need clear support from the government on the regulatory side and the economic side.”

Want more news? Listen to today's daily briefing below or go here for more info: