IEA Warns Attacks on Russia Plants May Disrupt Diesel Market

[Stay on top of transportation news: Get TTNews in your inbox.]

The flurry of Ukrainian drone attacks on Russia’s oil refineries risks disrupting global markets for petroleum products, the International Energy Agency said.

Ukrainian drones have ramped up attacks on Russia’s oil industry this year in an attempt to disrupt fuel supplies to the military and curb the Kremlin’s revenue. About 500,000 to 600,000 barrels a day of the country’s crude processing capacity could be offline this quarter on a gross basis, before offsets, according to the IEA’s monthly report.

The shutdown of damaged refineries or units of between four to eight weeks for repairs “could mean a significant loss” of Russian oil-product exports, the Paris-based agency said on April 12. International markets “rely on Russian exports of diesel, naphtha and jet fuel, while refining systems in Asia absorb substantial quantities of the country’s straight-run and cracked residue to boost upgrading unit feedstocks.”

The IEA was echoing an earlier statement from the U.S. Defense Secretary Lloyd Austin, who warned that Ukrainian attacks “could have a knock-on effect” on the global energy market.

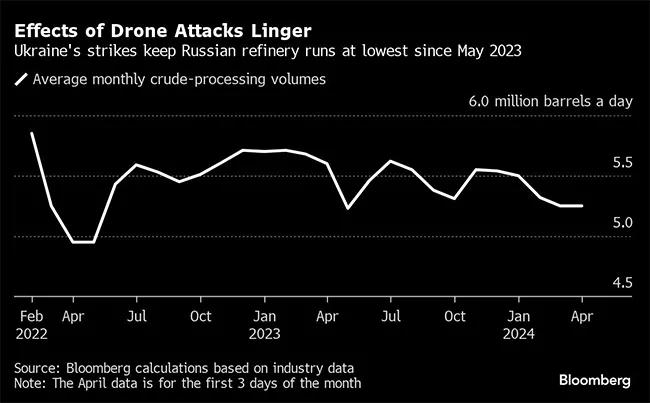

So far the actual drop in refinery runs was much lower. Russia’s official weekly refinery output data through late March is consistent with crude runs at 5 million to 5.2 million barrels a day, rather than the 4.6 million barrels a day that a bottom-up assessment of the refinery outages would indicate, according to the IEA.

Some of the nation’s facilities have been relatively quick to repair the damaged equipment. Only Rosneft PJSC’s Tuapse refinery near the Black Sea — attacked in late January — remains offline, but it isn’t clear whether that’s due to the drone strike or initial planned maintenance. It’s likely to resume operations in mid-May, the IEA said, citing reports.

Russia’s refiners have also deployed spare or underused crude-processing units to mitigate the impact of drone attacks before the uptick in seasonal demand. “It seems reasonable that the Russian refining system is large enough that some outages could be offset by the deferral of planned maintenance or increased runs elsewhere in the system,” the IEA said.

In the first three days of April, Russian refiners churned through an average of 5.25 million barrels a day, Bloomberg reported last week. While recovering since the middle of March, daily refinery runs remain significantly below 5.78 million barrels of crude processed in first days of April a year ago, according to Bloomberg calculations based on historic data.

Russia’s crude oil production averaged 9.42 million barrels a day in March, or some 30,000 barrels lower than the nation’s target, according to the IEA. In 2023, the nation pledged to cut daily output by 500,000 barrels to 9.45 million barrels until the end of 2024. It also promised to curb exports of crude and petroleum products by 500,000 barrels a day in the first quarter.

Want more news? Listen to today's daily briefing above or go here for more info

Starting this month, Russia will roll back some of those exports reductions while also deepening its production cuts, as part of an agreement with some nations in the Organization of Petroleum Exporting Countries.

In April, Russia will curb crude output by an additional 350,000 barrels a day, but withhold just 121,000 barrels a day from exports. In May, the split will be 400,000 barrels a day of production and 71,000 of exports. In June the curbs will come from production only.

The IEA estimates that Russia’s crude production will average about 9.1 million barrels a day in the second quarter, down 300,000 barrels a day from previous three months.