Bloomberg News

US Jobless Claims Hit Eight-Month Low to End 2024

[Stay on top of transportation news: Get TTNews in your inbox.]

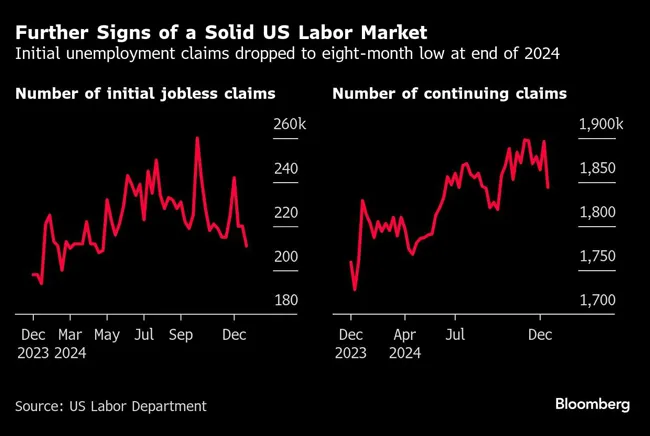

Initial applications for U.S. unemployment capped 2024 at an eight-month low, reflecting the relatively muted levels of job cuts in a labor market that has remained surprisingly resilient.

New claims fell by 9,000 to 211,000 in the week ended Dec. 28, lower than all but one estimate in a Bloomberg survey. Meanwhile continuing applications, a proxy for the number of people receiving benefits, also fell, to a three-month low of 1.84 million in the week ended Dec. 21, according to Labor Department data released Jan. 2.

The current levels for initial claims are subdued — in line with their pre-pandemic levels — and consistent with a job market where companies are generally holding onto their workers.

The U.S. labor market is ending the year in what Federal Reserve Chair Jerome Powell described this month as a “solid shape.” A spike in the unemployment rate over the summer had raised alarms, prompting policymakers to cut interest rates by a half-percentage point in September to help support employment.

(Bloomberg)

More recent data have pointed to a labor market that is moderating but remains broadly solid. It is cooling, but not in a way that would raise concerns, Powell said at a press briefing mid-December following policymakers’ decision to lower rates for the third time in three months.

Weekly data tend to be choppy, and even more so around holidays. The four-week moving average of new applications for unemployment insurance, a measure that helps smooth out volatility, fell to 223,250 — the lowest since the end of November.

Before adjusting for seasonal factors, initial claims rose. Michigan, New Jersey and Pennsylvania registered the steepest increases, while Texas and California posted the largest declines.

Want more news? Listen to today's daily briefing above or go here for more info

Despite the drop in continuing claims, recurring applications for U.S. unemployment benefits are set to post a second straight year of increases, which is historically rare outside of recessions and reflects the cooldown in hiring.

The latest numbers bring the increase in 2024 to 4.8%, following a 10.6% jump in 2023.

Over the past 50 years, back-to-back annual gains in continuing claims have only occurred during recessions and times of massive layoffs. The past couple of years, however, have seen a different labor market: Employers are mostly holding onto their workers, but they’re not hiring as much as they used to. That means it takes longer for people who are out of a job to find work.