Senior Reporter

June Trailer Orders Hit 13,441

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. trailer orders in June improved by more than 100% from a year earlier as they pushed past 13,000 to reach the second-highest level for the year, ACT Research reported.

Net orders were 13,441, according to ACT. That compared with 6,278 a year earlier when heavy cancellations reflected concerns over expected declines in the 2020 freight environment.

Year-to-date orders stood at 52,629 compared with 96,081 in 2019.

“It’s better, but spotty,” Frank Maly, ACT director of commercial vehicle analysis, said about the June number. “The bigger fleets are putting in orders, but the small to medium fleets are still sitting off to the sidelines. So when you have the bigger fleets placing orders it comes in spurts, and it’s not even across all the players. Some have good order months, some have disappointing months.”

Transport Topics introduces its newest digital interview series, Newsmakers, aimed at helping leaders in trucking and freight transportation navigate turbulent times. Audience members will gain access to the industry's leading expert in their particular field and the thoughtful moderation of a Transport Topics journalist. Our second episode — "The Evolution of Electric Trucks" — featuring Nikola founder and executive chairman Trevor Milton, will air live on July 28 at noon EDT. Registration is free but advance signup is required. Sign up today.

Despite the gain in overall orders, it was still less than what the trailer makers built in June, so the backlog continued to shrink, he said. “Although the pace of the decline is easing.”

The industry backlog now stretches to not quite Thanksgiving at the most recent build rates, Maly told Transport Topics on July 21.

He noted the refrigerator trailer backlog increased sequentially. “That’s pretty much one of the only trailer categories that posted [such] a gain,” Maly said.

Trailer makers confirmed signs of recent improvement but forecast there would be no quick turnaround.

Utility Trailer Manufacturing Co. saw orders rise in June, leading it to hope “the worst is behind us,” said Craig Bennett, senior vice president of sales.

The company still is operating at about half of its 2019 levels of business, he said. “But we are fighting an invisible enemy, unlike anything in my almost 50-year career. Shutting down most all business activity is crazy. Trailers are essential, and the only question is how many will be needed to support the economy.”

At Stoughton Trailers, June was considered a good month due to a couple of large orders.

“But many fleets are just waiting for significant signs of sustained improvement. We are in for a long period of cautiousness,” Vice President of Sales David Giesen said.

He said industry cancellations in the past four months were significant at 17,250.

“This can be blamed on COVID-19,” he said.

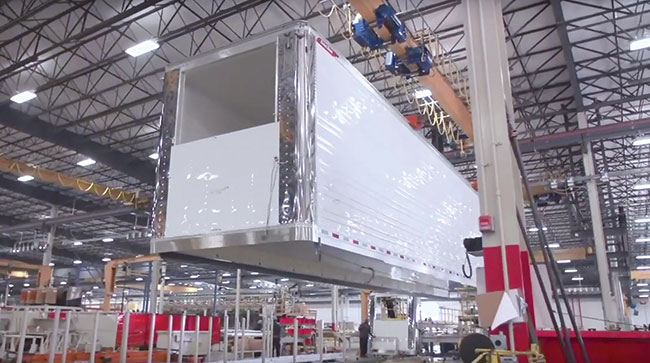

A trailer body in production at a Great Dane manufacturing plant. (Great Dane via YouTube)

Great Dane is seeing normal activity, “albeit at lower overall volumes as fleets ramp up for the fall shipping season,” said Chris Hammond, executive vice president of sales.

“I do think we hit bottom a few months ago and will continue to see positive trailer order intake for the next few months,” he said.

At Hyundai Translead, Chief Sales Officer Sean Kenney said, “[June was] a stronger month than the few previous ones, for sure. Customers were definitely more engaged and hopeful the worst of things has passed, which still remains to be seen.”

In related news, some Democrats in Congress asked for a provision in the next coronavirus stimulus bill that would suspend the 12% federal excise tax on heavy-duty trucks and trailers until the end of 2021.

The move has the support of the Modernize the Truck Fleet coalition of 196 industry groups and the United Auto Workers.

Meanwhile, an executive with a provider of data solutions for the less-than-truckload segment said today’s trailers are offered with tremendous technological features.

These include trailer-mounted sensors that detect changes in tire pressure, trailer tilt and blind-spot elimination, and constantly feed data up to the cab and on to the corporate office, Brian Thompson, chief commercial officer for SMC3, told TT.

“Obviously, the future prospects of the economy as well as a company’s financial strength is foremost on the minds of carriers,” Thompson said, “but I do expect technology advancements delivering added safety, fuel efficiency, security, connectivity and visibility to be a long-term driver of trailer demand.”

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More