Senior Reporter

Medium-Duty Sales in November Point to Ongoing Strength

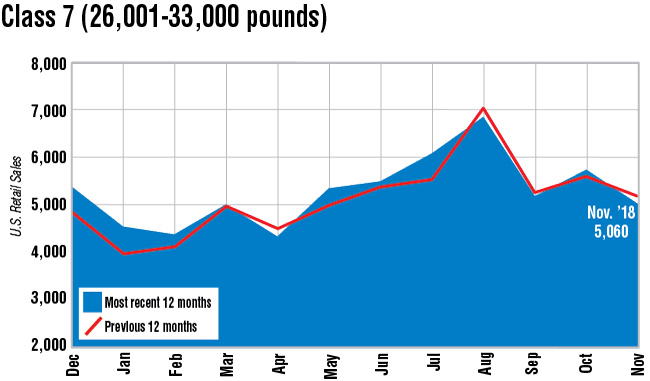

Sales of medium-duty trucks in November barely budged from a year earlier, rising just 1.4% and boosted primarily by a modest gain in the lighter classes, WardsAuto.com reported.

Sales of Class 4-7 trucks inched up to 18,101 compared with 17,844 a year earlier.

One analyst said the typical pattern is for orders to go from 5-6% below average in September to 7-8% above average in October, then back down to 5-6% below average in November.

“The fact they were pretty much flat is kind of a testament to the ongoing strength in this space. We would have expected to see even as much as a 15% sequential drop,” said Steve Tam, ACT Research Co. vice president.

Sales in October were 20,631, according to Ward’s.

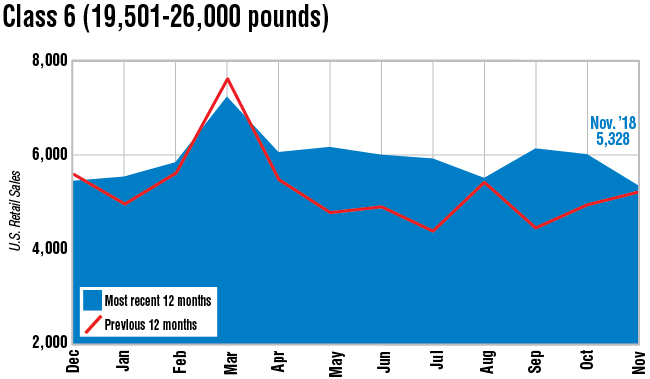

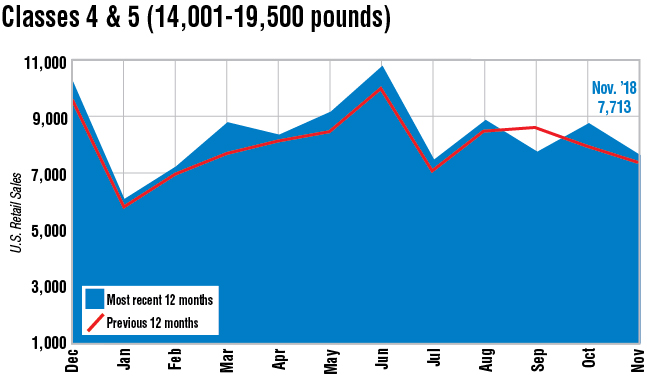

In November, Class 7 sales dipped 1.8% to 5,060, Class 6 sales increased 1.7% to 5,328 and Class 4-5 sales increased 3.5% to 7,713.

For the 11-month period, total sales rose 6.7% to 215,098 compared with a year earlier as all segments were in positive territory.

At the same time, over the course of the past six and 12 months, medium-duty orders averaged 24,000 and 24,900, respectively, according to ACT.

One dealership executive predicted ongoing strength in this sector.

With all the different dynamics, such as last-mile delivery, that are coming into distribution, “I expect medium-duty to remain strong for the next three, four or five years,” W.M. “Rusty” Rush, Chairman and CEO of Rush Enterprises said during a recent media roundtable.

And when the market dip comes, it will not be as steep in the medium-duty sector compared with Class 8, he added.

Asked if the company had a plan for selling last-mile vehicles, Rush said, “We will evolve with the OEMs. I feel good that the brands we represent will be on top of all of that and we will, hopefully, benefit from all of that.”

Rush is the nation’s only publicly traded truck dealership and has 110 locations in 21 states. It sells medium-duty trucks from Ford Motor Co., Hino Trucks and International Truck and Isuzu Commercial Truck of America Inc., in addition to Class 8 trucks. Hino is a unit of Toyota Co. International is a unit of Navistar Inc.

In its third-quarter earnings statement, Rush reported its Class 4-7 sales increased 18% compared with a year earlier and accounted for 5.1% of the total U.S. market.