Senior Reporter

Medium-Duty Sales Reflect Stable Demand; All Classes Rise

U.S. retail sales of medium-duty trucks in April posted double-digit gains across all classes, WardsAuto.com reported.

Sales of Classes 4-7 trucks rose 17.2% in April to 22,080 compared with 18,847 a year earlier, according to Ward’s. Year-to-date sales climbed 5.9% to 78,246.

ACT Research Vice President Steve Tam suggested the normal rebound from typically slower sales in January and February had taken longer than March to register. “I think it was some slack in the catch-up,” Tam said about the April gains.

In related news, consumer spending in March increased $87.4 billion for the best gain in almost a decade, according to Bloomberg News.

“The consumer side is where so much of the medium-duty space is supported from,” Tam said.

At the same time, ACT is looking for about 3% growth in the medium-duty market. “Things will get a little tougher as we roll through the year. That is very much the situation we see going on,” he added.

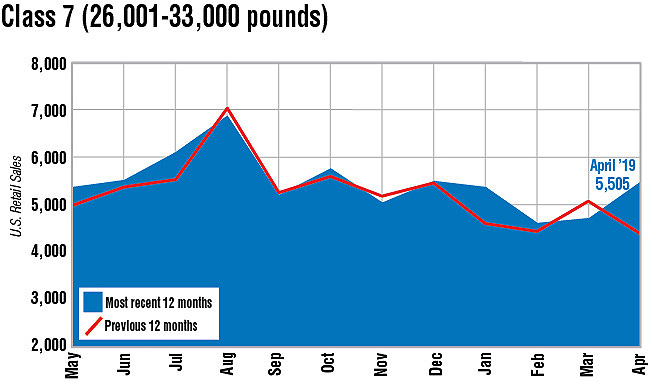

In April, Class 7 trucks posted the largest jump compared with a year earlier, rising 26.1% to 5,505. Freightliner, a brand of Daimler Trucks North America, sold the most, 2,769 — good for a 50% market share. International, a unit of Navistar Inc., sold the second-highest amount for a single brand, 1,220, earning a 22% share.

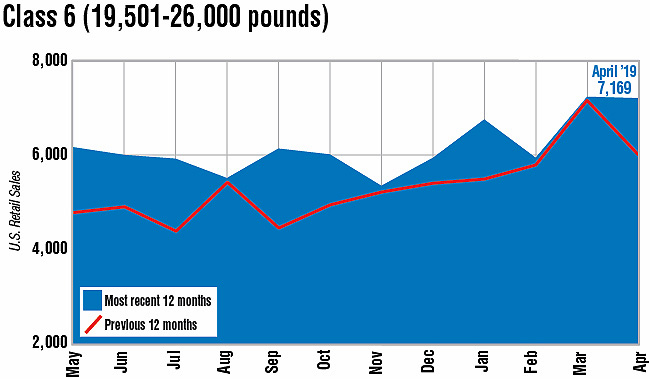

Class 6 sales were 7,169, an 18.8% increase from a year earlier. Ford Motor Co. led the way with 2,929, followed by International at 1,862, and Freightliner at 1,256.

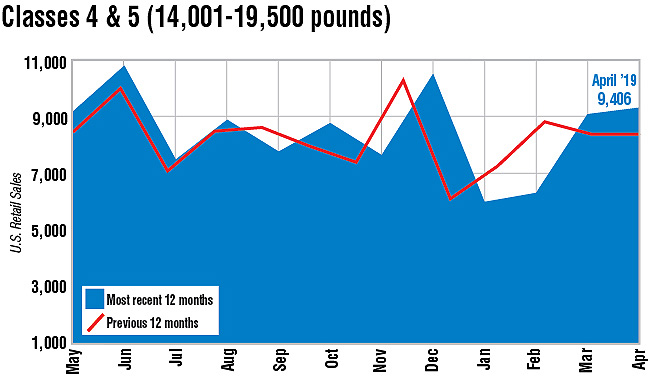

In Classes 4-5, sales climbed 11.3% to 9,406. Ford and Isuzu dominated their respective segments. Ford sold 4,596 Class 5 trucks earning a 62% share in that class. Isuzu sold 1,463 Class 4 trucks, while the next highest was Ford’s 267.

Meanwhile, independent engine maker Cummins Inc. forecast its share of the medium-duty market to be 74-76%, unchanged from its prior guidance.

“We’ve got eight quarters in a row with year-over-year growth in production, and this has just been a very resilient market and such a diversified market,” Cummins Chairman and CEO Tom Linebarger said in a first-quarter earnings call.

“We have a nice backlog, something like 60,000 units, which is in a market we generally don’t see big backlogs, looking at from that side,” he said. “I’m pretty bullish that this one looks stable, at a good level, and remaining pretty stable going forward.”