Staff Reporter

Minnesota Fuel Taxes to Jump 12% in 2025 Due to New Law

[Stay on top of transportation news: Get TTNews in your inbox.]

Minnesota’s motor fuel taxes will jump by nearly 12% starting Jan. 1 for diesel, gasoline, biodiesel and other fuels because of a state law passed last year tying increases to higher highway construction costs.

In accordance with a 2023 law, the Minnesota Department of Revenue has calculated the tax rate index by an Aug. 1 deadline for motor fuel tax rate adjustments for the coming year.

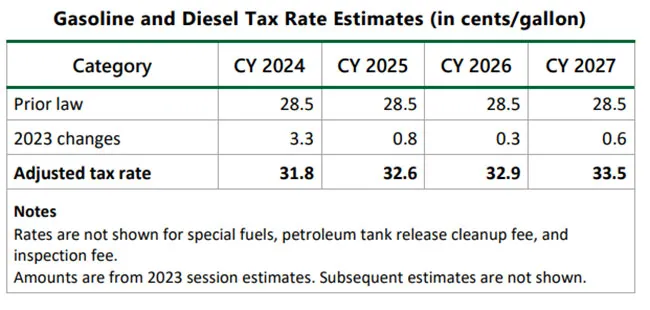

Starting Jan. 1, per-gallon motor fuel taxes will rise to 31.8 cents for diesel, biodiesel and gasoline from today’s tax rate of 28.5 cents. Ethanol will jump to 22.59 cents per gallon from the current 20.25-cent tax rate, up 11.6%.

“The new combined rate will be $0.318, consisting of the $0.283 excise tax rate for gasoline and special fuel products, plus the $0.035 per gallon debt service surcharge. Alternative fuels rates will also be increased,” the state revenue department noted.

(Minnesota House Research Department)

The motor fuel tax hike stems from a required yearly adjustment to each type of fuel that is linked to increases in the Minnesota Highway Construction Cost Index.

RELATED: California Drivers Face Nation’s Steepest Fuel Tax Mountain

“The adjusted rate must be calculated each Aug. 1 and goes into effect the following Jan. 1 for the next 12 months. Starting in 2025, the annual percentage change in tax rate is capped at 3%,” noted a state legislative report from January explaining the changes.

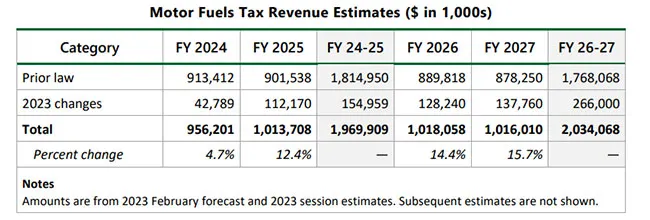

The coming motor fuel tax increase is expected to generate $1 million in revenue by the end of fiscal 2025. The money will be used to pay for state transportation projects.

(Minnesota House Research Department)

Nationally, highway construction costs have soared and eroded the spending power of bipartisan infrastructure funds awarded to state transportation departments. The Bureau of Transportation Statistics, under the U.S. Department of Transportation, defines the National Highway Construction Cost Index by analyzing successful bids on state highway projects using price quotes on specific items, such as materials and labor.

“The average price charged is calculated for each item in each state, and these price changes are then combined into a national index based on a market basket of items,” noted BTS.

In a review of 2023, the BTS stated that the cost index for national highway construction “reached a new all-time high in the second quarter of 2023; increasing 3.8% from the previous quarter but by less than in the second quarter of 2022. In the second quarter of 2022, the NHCCI grew faster (11.9%) than any other quarter on record (with records beginning in 2003).”

Want more news? Listen to today's daily briefing below or go here for more info: