Bloomberg News

Oil Refiners in US Slow Down, Stoking Global Glut Worries

[Stay on top of transportation news: Get TTNews in your inbox.]

Some of the top U.S. oil refiners are throttling back operations at their facilities this quarter, adding to concerns that a global glut of crude is forming.

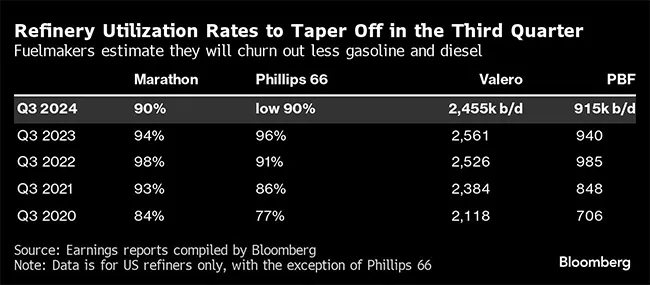

Marathon Petroleum Corp. — owner of the largest U.S. refinery — plans to operate its 13 plants at an average of 90% of capacity this quarter, the lowest for the period since 2020. Similarly, PBF Energy Inc. announced it’s preparing to process the least crude in three years, Phillips 66 will run its refineries near a two-year low and Valero Energy Corp. expects to trim oil processing.

Together, those four refiners account for about 40% of America’s capacity to churn out gasoline and diesel.

The U.S. fuelmaking complex — a key factor in global supply-demand balances — is faltering as consumption stalls and profit margins shrink. The slowdown bolsters the possibility that an oversupply of crude is looming, a threat that has limited oil prices to a roughly 7% gain this year despite OPEC+’s production cuts and rising geopolitical tensions. The trend also bucks the International Energy Agency’s estimate that global fuelmakers will process almost 900,000 barrels a day more this year.

“Compressed refining margins are setting up the stage for another round of heavy refinery maintenance in the U.S. during the fall season,” Vikas Dwivedi, Macquarie’s global oil and gas strategist, said in an interview in Houston. “That’s going to weigh on balances and may add to crude builds in the U.S. for the rest of the year.”

Margins to convert crude into fuels are shrinking amid mismatches in the timing of refinery closures, conversions and new capacity additions at the same time as electric vehicles and heavy trucks fueled by LNG are growing in popularity in China, the world’s top oil importer.

At the same time, global supplies of crude are expected to rise through the end of the year, even as new refineries ramp up. The U.S. has been able to ship some its surplus to Nigeria’s Dangote mega refinery — which has been feasting on oil from the Permian formation — and Mexico’s Dos Bocas refinery is slated to start production this year. In total, between 2023 and 2030, the world is expected to add about 4.9 million barrels a day of net capacity, roughly what India processes now, according to Bloomberg NEF.

But that relief may be short-lived as Guyana ramps up production while OPEC+ plans to bring back about 540,000 barrels of daily output in the fourth quarter.

While the plan is subject to change, those barrels are slated to hit the market as shale producers bring on output from wells that were drilled earlier in the year. The U.S. is expected to finish the year pumping a record 13.8 million barrels a day, about 600,000 barrels more than the same period last year, Dwivedi said.

Want more news? Listen to today's daily briefing above or go here for more info

The potential for supplies to outstrip demand is reducing the premium geopolitical risks have added to crude prices, he said.

“The market is no longer willing to pay a huge premium for that because the tensions haven’t so far resulted in a loss of barrels,” said Dwivedi, who sees benchmark Brent oil averaging $75 a barrel in the fourth quarter and dipping to $64 in the second quarter.

Phillips 66, the biggest U.S. fuelmaker by market value, cited those softer margins as the rationale for its reduced output projections. The Houston-based company plans to carry out preventive maintenance as refining margins are “weaker that we’ve seen in a little while,” Chief Financial Officer Kevin Mitchell said during the company’s second-quarter earnings call.

Marathon “will run economically in 90%” capacity this quarter, which is a multiyear low for the period, Chief Commercial Officer Rick Hessling said. The company also said the Chinese economy remains a concern and the return of OPEC barrels could inject some volatility in the short term.