Bloomberg News

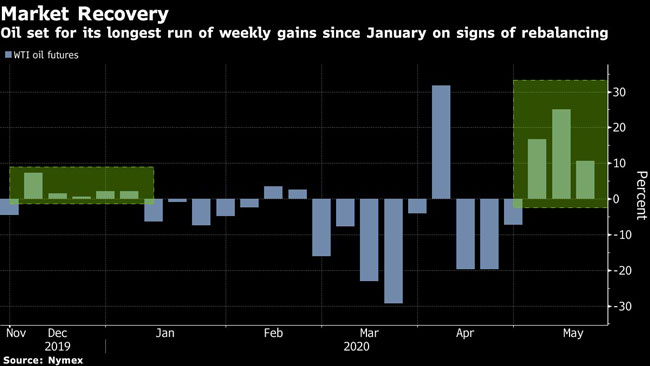

Oil Trades Near Six-Week High on Supply Cuts, Demand Recovery

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

Oil was near the highest in six weeks as major producers slash supply, and there are increasing signs that demand is recovering.

Futures in New York are up about 16% this week. China’s industrial output increased in April for the first time since the coronavirus outbreak, signaling economic recovery aided by government stimulus efforts. Meanwhile, Saudi Arabia will slash supply to its global customers in June as part of OPEC and its allies’ record production cuts.

Oil prices still are down more than 50% this year. Demand still is far below pre-virus levels, but BP sees evidence of consumption rising and the International Energy Agency said the market’s outlook has improved. Governments from Europe to India are easing lockdown measures in an attempt to kick-start their economies again.

As more regions across the U.S. “are beginning the process of returning to work, we are already seeing an increase in product demand,” Tom Nimbley, CEO of refiner PBF Energy Inc. said in an earnings report.

Other market indicators also are showing that the huge oversupply is draining. Timespreads — the difference in prices between near-term oil contracts and those for later delivery — are the narrowest in about two months in Europe, the U.S. and the Middle East. Options markets also have turned their least bearish since March. The number of supertankers signaling China is the highest in three years, signaling higher demand.

Industrial output in Asia’s biggest economy rose 3.9% from a year earlier, reversing a drop of 1.1% in March, data showed May 15. In spite of the improvement, the Chinese economy “hasn’t returned to normal level,” said Liu Aihua, a spokeswoman for the National Bureau of Statistics.

However, the oil market’s recovery remains fragile. While Saudi Arabia plans to reduce supply further from June, more than 30 tankers laden with the kingdom’s crude are set to reach the U.S. this month and the next, according to ship-tracking data compiled by Bloomberg. That could put fresh pressure on storage just as a glut shows signs of easing.

Want more news? Listen to today's daily briefing: