Public-Private Partnerships Propel Hydrogen Infrastructure

[Stay on top of transportation news: Get TTNews in your inbox.]

With help from the U.S. Department of Energy, the hydrogen industry and truck makers are working to develop a hydrogen refueling infrastructure that can support cost-effective, environmentally viable fleet operations.

A major part of the effort is a DOE program called Regional Clean Hydrogen Hubs, created through the bipartisan infrastructure law, which may provide up to $7 billion to form what the DOE calls “the foundation of a national clean hydrogen network” and help decarbonize sectors of the economy including heavy-duty transportation.

The hubs are, by region or state: Appalachia, California, Gulf Coast, Heartland, Mid-Atlantic, Midwest and Pacific Northwest. Each hub, consisting of private and public partnerships, applies to and negotiates with the DOE for funding of specific projects.

In the Gulf Coast regional hub, Linde this year was awarded $10 million by the DOE to demonstrate “cost-effective, standardized and replicable hydrogen fueling infrastructure” for heavy-duty trucks in La Porte, Texas. Richard Minter, president of Linde Services and Hydrogen Mobility, said the completed project is expected to offer high throughput with convenient fueling options to businesses and transportation fleets in the region, as well as tube trailer filling to enable supply chain development in the Gulf Coast region. The station will be located within Linde’s hydrogen pipeline complex for access to low-cost feedstock, Minter said.

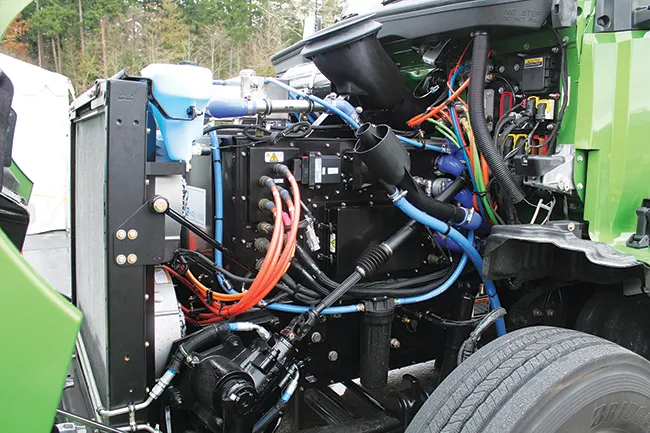

A DOE report contends that as demand for FCEVs grows, the business case for building more stations with higher capacities improves. (TruckPR/Flickr)

California’s hydrogen hub is a public-private partnership called the Alliance for Renewable Clean Hydrogen Energy Systems (ARCHES). In July, the DOE and ARCHES announced a $12.6 billion agreement to build a hydrogen hub in California, including up to $1.2 billion in federal funding. The alliance said it plans to put 5,000 fuel cell electric trucks on the road and to develop infrastructure for hydrogen transport, including 60 heavy-duty fueling stations and 165 miles of open-access pipelines.

“That goes a long way to getting you close to what would be a viable statewide network,” said Mikhael Skvarla, regulatory lobbyist for California Hydrogen Business Coalition, a group that includes hydrogen supplier Air Liquide, Chevron, FirstElement Fuel, Hyundai, Linde, Shell and Toyota. The coalition is working to expand availability of hydrogen fueling. Skvarla noted that “big players … are coming into the fray.”

Chevron last year announced that it invested in OneH2, a hydrogen distribution and fueling business based in Longview, N.C. Other investors are Trafigura and The Papé Group.

Skvarla also pointed out that on Nov. 8, the California Air Resources Board was expected to adopt an update to the Low-Carbon Fuel Standard. The coalition worked with CARB to create a heavy-duty hydrogen refueling infrastructure credit, which Skvarla said is expected to be included in the updated standard.

Federal and state government policies are critical to the development of refueling infrastructure for HFC heavy-duty trucks, hydrogen experts said. Government plays a vital role, creating grants, tax rebates or other incentives, said Linde’s Minter. “As governments focus on decarbonization and promoting the hydrogen economy, there also needs to be a focus on energy reform to ensure the cost-efficient supply and distribution of electricity,” he noted.

Linde applies its technology, engineering and construction capabilities to design and build modular hydrogen refueling stations that can be scaled up. “Our sale-of-gas model allows Linde to install the storage system at the customer’s site and deliver the hydrogen as needed, based on the customer’s demand,” Minter said.

FirstElement Fuel, Nikola, Pilot and Trillium Energy Solutions

The logistics industry has also engaged in building, planning or considering building refueling stations for HFC electric heavy trucks.

FirstElement Fuel opened a hydrogen fueling station in Oakland, Calif., earlier this year featuring four light/medium-duty dispensers and two heavy-duty truck pumps. Using proprietary high-flow technology, the station can fuel a truck in under 10 minutes.

Host Seth Clevenger and Features Coordinator Mike Senatore take you behind the scenes to unveil the 2024 Top 50 Global Freight Companies. Tune in above or by going to RoadSigns.ttnews.com.

FirstElement has a 10-year agreement to refuel Nikola’s hydrogen fuel cell electric trucks at the station. In August, Nikola opened a new hydrogen refueling station at Tom’s Truck Center in Sante Fe Springs in Southern California. Tom’s Truck Center is part of Nikola’s sales and service dealer network. Nikola said it plans multiple fueling locations by the end of the year, a combination of modular and permanent stations. Patrick Fiedler, president and owner of Fiedler Group, said the main difference between modular and permanent stations is how quickly they can be deployed. Fiedler Group did the engineering and permitting on the modular station at Tom’s. “From start to finish, permitting to deployment, was maybe five months,” Fiedler said. “A permanent station would be more like two years.”

The investment in the Oakland hydrogen fueling station like the one built by FirstElement Fuel in Oakland is a factor.

“One of the things we achieved in Oakland was to have a commercial scale, so we can refuel up to 200 trucks a day here,” said Shane Stephens, the co-founder, chief development officer and board member of FirstElement Fuel. Industrial gas company Air Liquide, an investor in and supplier to FirstElement, also delivers the fuel, which is stored at the Oakland station in its liquid state.

“Our station uses a cryopump to convert that liquid hydrogen into compressed gaseous hydrogen, which ultimately goes into the truck,” Stephens said.

For HFC infrastructure to develop, government is expected to play a vital role in creating grants, tax rebates or other incentives. (Daimler Truck AG)

Asked the cost of building the station, Stephens put the investment, including state support from the California Energy Commission under the NorCal Zero Project, at more than $10 million, adding that similar “first-generation” projects could range between $10 million and $15 million.

“That cost, of course, will be and needs to be driven down,” he said. By the early 2030s, Stephens continued, “We’d like to [have built] between 15 and 20 stations in California.”

To enable HFC electric heavy truck transport across the U.S., Stephens estimated, “You only need about 40 stations to accomplish that.”

He said it could be achieved by locating hydrogen refueling stations along the nation’s major cross-country trucking routes. “Later, once a commercial market develops, then you need more fueling points” to serve a larger number of trucks, he said. Across the U.S., approximately 200 stations will be needed “to support the truck fleet” in the 2030s, Stephens estimated.

The hydrogen supply chain must grow apace with the number of stations, Stephens and others said.

Truck OEMs such as Nikola are working on that. Nikola said last year that it planned a network of up to 60 stations.

In 2023, there were 59 retail stations available to the public nationwide, mostly concentrated in California, according to the DOE’s Alternative Fuels Data Center. There are some private stations supporting fleets and others used primarily for demonstration and/or research, the AFDC said. “As the demand for FCEVs grows, the business case for building more stations with higher capacities improves and the volume in production of station components will bring station costs down,” the AFDC predicted, adding that “rollout of heavy-duty hydrogen trucks, such as linehaul trucks, will necessitate very large stations compared to light-duty needs.”

Fiedler said, “No fleet is going to sign up for trucks if there’s no infrastructure to fuel. And the station developers are not even going to open stations unless there are fleets available.”

Zobel

Hydrogen refueling sites for HFC electric heavy-duty trucks are scarce today, hydrogen executives said. “As of now, there are just a few heavy-duty hydrogen locations operating near the San Francisco and Los Angeles areas in California,” said Bill Zobel, senior director of hydrogen and infrastructure for truck stop operator Pilot Co.

Zobel said Pilot is in the development stages of its hydrogen refueling efforts and is working to identify the best-suited regions and specific locations.

Trillium Energy Solutions, part of the Love’s truck stop business, has built a number of hydrogen fueling stations for transit fleets, and is looking to apply that experience to the heavy-duty trucking sector.

“Our network is already well-positioned along the major corridors, so the customers don’t have to really change their routes,” said Ashish Bhakta, business development manager for Trillium’s Zero Emission Solutions. “Now that the hydrogen hubs have been announced — agreements are still being negotiated — we can see the landscape of the supply of hydrogen changing.”

Bhakta added that it may take 10-15 years for hydrogen fueling to be truly commercialized. He noted “the demand side”— HFC electric trucks on the road — “still needs more assistance, or is challenged,” because subsidies and other forms of support haven’t reached an impactful level.

“Today, if I asked a customer to buy 50 trucks so we can put a hydrogen fueling site [somewhere], it would be a challenge for us to make that work,” Bhakta said, “just because of the cost of infrastructure and the cost of the vehicles.”

Frank Wolak, president and CEO of the Fuel Cell and Hydrogen Energy Association, said that the barriers ultimately come down to how many vehicles can be expected to be resident within a certain zone or area.

“If you have a concentration of vehicles and predictable volumes of hydrogen, then natural capitalism takes over and people will in fact deploy fueling stations,” he explained.

Looking Ahead

Expansion of hydrogen production faces a few challenges and uncertainties, according to industry executives and trade associations, noting a proposed federal tax credit from the U.S. Treasury Department. Hydrogen suppliers and industry groups have said that the credit, provided in the bipartisan infrastructure act, is critical in comments to the Treasury Department in February. The California Hydrogen Business Council said that end-user projects in the California hub “including bus fleets, heavy-duty freight trucks, port cargo handling equipment, and distributed fuel cell and central gas turbine power generation, depend upon receiving the $3/kg production tax credit to enable projects to proceed.”

Katrina Fritz, president and CEO of the CHBC, warned, “Depending on how the guidance is finalized, some of those projects might not be viable.”

The CHBC also cautioned that the total cost of ownership of the bus fleets, heavy-duty freight trucks, and port cargo handling equipment will not support the adoption of hydrogen and fuel cell technology without the lower cost hydrogen that will be enabled by the $3/kg production tax credit.

The Treasury Department responded Oct. 1 with a letter noting that the clean hydrogen industry needs certainty, and intends to finalize rules for the section 45V Clean Hydrogen Production Credit “by the end of the year.”

United States Hydrogen Alliance Executive Director Roxana Bekemohammadi said key challenges include “high production costs, limited renewable energy capacity for electrolysis, and infrastructure gaps.” Electrolysis is a process used to produce hydrogen gas. The process uses electricity to split water molecules into oxygen and hydrogen. “The lack of supportive policies and clear market signals for long-term investment also hinders scalability,” Bekemohammadi explained.

Minter of Linde pointed to stability of the electric grid as a priority, particularly in California.

Want more news? Listen to today's daily briefing above or go here for more info

“While electrolyzer technology is not yet mature enough on a large scale, we expect, in the midterm, to see small and medium-size [i.e. 20-40 MW] electrolyzer complexes being built to serve the merchant demand, which includes the hydrogen mobility market,” Minter wrote by email.

He added that hydrogen needs more support from state government agencies. “Policies in place for zero-emission vehicles, which are supposed to be technology neutral, rarely give hydrogen the beneficial regulatory and incentive support compared to electric charging,” Minter noted.

Minter said Linde supports development of a California Hydrogen Market Development Strategy, viewing it as a vital step to kick-start the hydrogen industry in the heavy-duty mobility sector. But they warned that without proper focus on energy reform, California will struggle to attract investments in hydrogen due to the high cost of electricity.