Staff Reporter

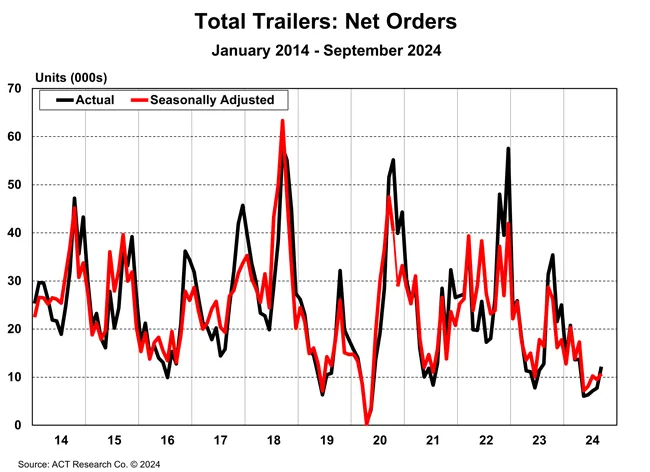

US Trailer Orders Drop 61% in September

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. trailer orders continued to trend well below the previous year by dropping 61% in September, ACT Research reported.

Preliminary net data shows 12,100 trailer orders for the month, up 57.1% from about 7,700 in August. Seasonally adjusted results lowered the total to 10,700 units, still 13% above the previous month.

“Despite the sequential order improvement, September data continues to bear witness to our expectations of weaker demand,” said Jennifer McNealy, director of commercial vehicle market research at ACT. “An order uptick showcasing demand, or the lack thereof, depends not just on one month, but on the next few months as OEMs more fully open their 2025 books.”

McNealy noted many in the trailer industry are concerned about next year’s outlook. She views the timing and size of order bookings as the wild card. But she is also monitoring additional indicators that might suggest a lack of optimism.

(Act Research Co.)

“While we are seeing increased activity and optimism among our dealers and leasing customers, most carriers remain rather tentative on committing to 2025 at this point, citing both the election and current rate environment as reasons,” Hyundai Translead CEO Sean Kenney said. “Hyundai Translead capacity is right-sized for 2025 and remains flexible to pivot to market changes.”

ACT Research data showed a 34% year-to-date contraction, with total orders reaching 101,600 units. Third-quarter orders dropped 51% to 27,000 units. The only year-over-year increase in 2024 was a 37% rise in April.

Lairsen

“We’re not seeing growth-based demand in the marketplace,” said Brandon Lairsen, vice president of trailer leasing at Transport Enterprise Leasing. “It’s still all replacements, and that’s just being driven by companies that have reached the end of their lease agreements on trailers, that they did post-COVID, and are looking to get into something a little more reasonable from a cost perspective.”

Lairsen said good deals are available for fleets needing trailers, creating opportunities to attract new customers while overall market growth remains stagnant. He doesn’t expect a turnaround until at least the second half of next year, given current excess trailer capacity.

“We’re seeing and realizing, or taking advantage, of some of those opportunities to get business from companies that we haven’t done business with before, and try to get some trailers out there and increase utilization,” Lairsen said. “So, it’s not all bad. It’s certainly not where anybody would like for it to be and hopes that it’ll get better soon.”

Lairsen expects the replacement trend to settle soon as companies finish refreshing their fleets. He hopes market conditions improve before that lull becomes an issue but says if timing works out, he can transition easily from replacements to trailer market growth.

McLeod Software CEO Tom McLeod explores the potential for artificial intelligence to boost efficiency and build resilience. Tune in above or by going to RoadSigns.ttnews.com.

“September to me is a pivotal month,” said Jeremy Sanders, chief commercial officer at Stoughton Trailers. “If you think about the seasonality and the cycle, the typical buying behavior that follows, it’s not surprising to us that we saw, I’ll say historically-based, a muted September. It also doesn’t surprise me that we did see a bit of a pickup from August to September, just based on the seasonality and cycle timing.”

Sanders added that customers remain very cautious. He noted that capital has been constrained and profitability isn’t healthy enough for business reinvestment. This has created a market where people are buying at a much lower rate, a trend he expects to continue.

“It definitely casts a bit of a cautious outlook in the short term,” Sanders said. “And as we look at 2025, what will that mean from an industry perspective. Projections continue to fall based on prior guidance. I wish I could say I was surprised by September’s results, but I wasn’t. And frankly, I’m a little bit concerned about what the short-term order horizon looks like.”

Sanders suspects some pent-up demand exists because fleets are holding onto their trailers longer than they should, contributing to market slowness and likely higher maintenance costs for customers.

“With 2025 order books now open for a couple of months we are finally seeing some orders flowing albeit at a lower rate than past order seasons,” said Chris Hammond, executive vice president of sales at Great Dane. “Our fleets are working through a tough rate environment which I suspect will continue through the end of this year. Fleets are dealing with a lot of additional variables that will keep order flow modest through the end of 2025.”

Want more news? Listen to today's daily briefing below or go here for more info: