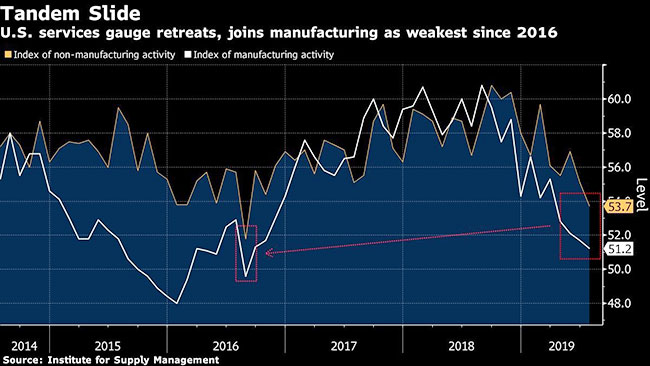

Services Join Factories With Slowest Growth Since 2016

[Stay on top of transportation news: Get TTNews in your inbox.]

A gauge of service industries declined in July to an almost three-year low as orders continued to cool, indicating a sluggish start to the third quarter for the biggest part of the economy.

The non-manufacturing index fell to 53.7, the weakest since August 2016 and well below the median forecast of economists, data from the Institute for Supply Management showed Aug. 5. While still expanding, the purchasing managers’ group’s measures of orders and business activity were also the lowest since mid-2016. Readings above 50 indicate growth.

The July decline follows the ISM’s report last week that showed a fourth straight month of slower growth in manufacturing. Together, the figures point to the growing economic risks that Federal Reserve officials highlighted when they reduced interest rates last week for the first time in a decade.

While sluggish global economies and trade friction between the United States and China have been more pronounced in manufacturing, the concern at the Fed is that the weakness will extend to services, which account for about 90% of the economy and include industries such as retail, health care, and construction.

Among other categories in the ISM’s non-manufacturing report, a measure of inventories suffered the biggest decline since December.

An index of export orders also retreated as overseas customers cut back on demand for U.S. services and merchandise. President Donald Trump escalated the trade conflict last week, announcing a 10% tariff on an additional $300 billion in Chinese goods which include consumer items like laptops and clothing that will have a more direct impact on U.S. retailers.