Ships Diverted From Red Sea Send Ripple Effects Across Globe

[Stay on top of transportation news: Get TTNews in your inbox.]

Never has it been so cheap to inflict a world of economic pain.

That stark point was underscored last week by Maximilian Hess, a principal at London-based Enmetena Advisory, a political risk consultancy. Speaking to a webinar of supply chain managers, he showed a slide of a canoe-size naval drone and said such jury-rigged weapons have the ability to redirect world trade.

“Nowhere is this more clear than in the conflict in the Red Sea,” Hess said, referring to attacks launched from Yemen toward commercial ships trying to use the Suez Canal.

Nearly six months into the Houthis’ relentless campaign to protest Israel’s war in Gaza, the economic fallout is widening. As ships sail around Africa’s Cape of Good Hope, their unpredictable schedules are clogging major Asian ports, creating shortages of empty containers in some places and pileups in others. Delivery times to the U.S. and Europe are getting longer, and freight rates are surging.

The blame rests on several factors, including solid demand for goods in the U.S. But the latest bout of trade turmoil largely stems from the Red Sea diversions. Sea-Intelligence, a Copenhagen-based maritime data and advisory firm, recently calculated that rerouting increased the average minimum transit time by almost 40% to the Mediterranean from Asia, and by 15% to northern Europe.

The ricochet effect of ships circling back to Asia — now knocked off their timetables — is contributing to bottlenecks in ports like China’s Shanghai-Ningbo and Singapore. Jebel Ali in the United Arab Emirates is having congestion issues, too, because of its proximity to the Red Sea and because it’s a major transshipment hub for freight moving through Dubai on both ocean and air carriers.

Singapore, home to the world’s second-biggest container port, issued a statement last week explaining how it has experienced a significant increase in arrivals since the start of 2024, leading to an 8.8% rise in container volumes in January through April from a year earlier. Waits for some vessels are two to three days, the port authority said.

“The situation is expected to worsen due to the increase in off-schedule vessel arrivals and very high yard utilization,” Tan Hua Joo, a container market analyst at Linerlytica, said in an email on May 31.

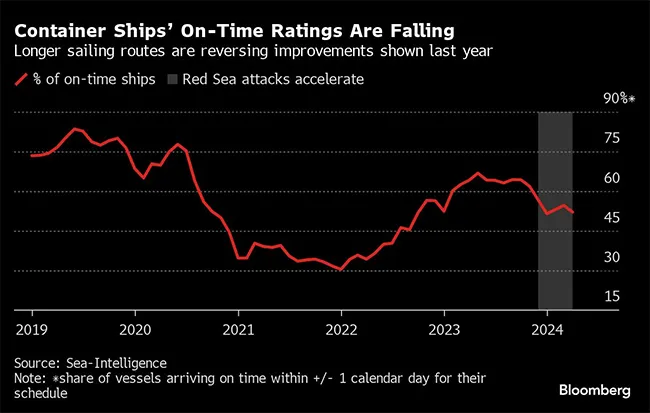

As ships spend more time at anchor and face extended journeys, supply chain managers paying for those services feel compelled to place orders further in advance, worrying some into buying more than they might need. The share of container ships arriving on time has slumped to about 52%, retracing much of last year’s improvement from pandemic-era lows of about 30% from early 2022, according to Sea-Intelligence.

Delivery times are particularly slow for goods traveling to Europe and the U.S. East Coast from China — because most of the ships on these routes are avoiding the shortcut through the Suez Canal.

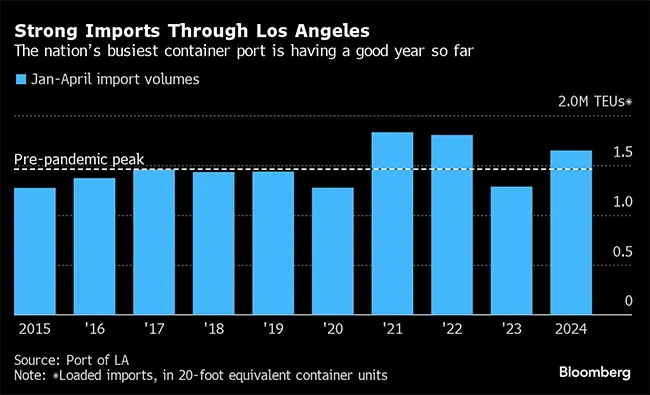

On the demand side, the U.S. economy is adding a strong pull, as import volumes through the Port of Los Angeles showed during the first four months of the year. An early read on May volumes through the nation’s busiest port shows the momentum is continuing — with three of the past four weeks coming in higher than year-earlier levels.

The supply-demand imbalance is happening at least a month before peak shipping season from July to September. That’s when retailers stock shelves for back-to-school sales and year-end holidays, placing large orders from their Asian suppliers. It’s not quite pandemic-level panic level yet, but some analysts say a situation like this can feed on itself when geopolitical risks and tariff threats are so pervasive.

“As more shippers start a peak season early, they create a capacity shortage and rates go up, causing other shippers to join the early stampede,” said Lars Jensen, a shipping analyst and founder of Copenhagen-based Vespucci Maritime. In process, they’re “creating the crunch they hope to avoid,” he said.

Spot shipping rates have responded by going up sharply.

Want more news? Listen to today's daily briefing above or go here for more info

A much costlier mode of transportation — air cargo — is also seeing the effects on specific routes as demand increases. Trine Nielsen, senior director and head of ocean EMEA at the logistics tech company Flexport Inc., said that suggests some cargo owners “expect the peak to sustain longer.”

Rogier Blocq, director of product development at Amsterdam-based WorldACD, said air cargo rates from the Persian Gulf and South Asia into Europe were up almost 80% in May versus a year earlier. That stood out from the average global rate increase of about 3% over the same period.

Just how long it will take for the interconnected system to return to balance is anyone’s guess, according to Rolf Habben Jansen, chief executive of Hamburg, Germany-based Hapag-Lloyd AG, which ranks No. 13 on the Transport Topics list of the largest global freight companies.

“It could still last for another couple of months if the Red Sea situation doesn’t improve,” he said in an interview last week on Bloomberg Television.