Inflation Fears Grow With Tariff Uncertainty Looming

[Stay on top of transportation news: Get TTNews in your inbox.]

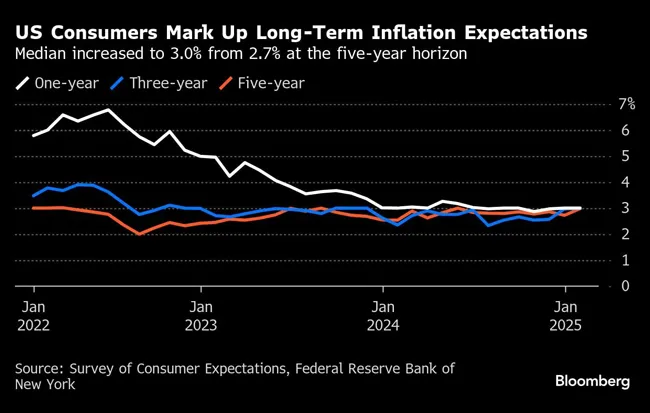

U.S. consumers’ long-term inflation expectations edged higher in January ahead of tariff announcements by the Trump administration, a monthly Federal Reserve Bank of New York survey showed.

Expected inflation five years ahead rose to 3% last month, the highest since May 2024, according to results of the New York Fed’s Survey of Consumer Expectations published Feb. 10. Expected inflation rates over the next year and three years ahead were both unchanged from December at 3%.

Inflation expectations have taken on newfound importance in the debate over next steps for monetary policy amid President Donald Trump’s moves to impose tariffs on the country’s biggest trading partners. On Feb. 1, Trump announced levies against goods imported from China, Mexico and Canada, though he subsequently delayed the Mexico and Canada decisions.

Several Fed officials have said in recent weeks that the central bank’s response to higher prices resulting from tariffs will depend on whether inflation expectations remain well anchored.

(Bloomberg)

Preliminary results of a monthly University of Michigan consumer survey published Friday also showed expectations ticking up. In that poll, expected inflation over the next year jumped to 4.3%, while anticipated inflation five to 10 years ahead rose to 3.3%.

The New York Fed survey showed a rise in inflation expectations for various items over the next year, including gas, food, medical care, college tuition and rent. It also revealed a growing divergence among respondents over estimated inflation in the year ahead, with the gap between the 25th- and 75th-percentile respondents widening to the largest since mid-2023.

(Bloomberg)

Other indicators in the New York Fed survey were more mixed. Expectations for growth in household spending fell in January to a four-year low and respondents reported more pessimism about their financial situations. Even so, the perceived probability that the unemployment rate would be higher a year from now also fell, to the lowest level since July 2021.

Results of a separate survey published Feb. 10 by the Cleveland Fed indicated chief executives and other business leaders polled in January said they expect the consumer price index to rise 3.2% over the next 12 months, down from 3.8% in October.

Want more news? Listen to today's daily briefing below or go here for more info: